Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

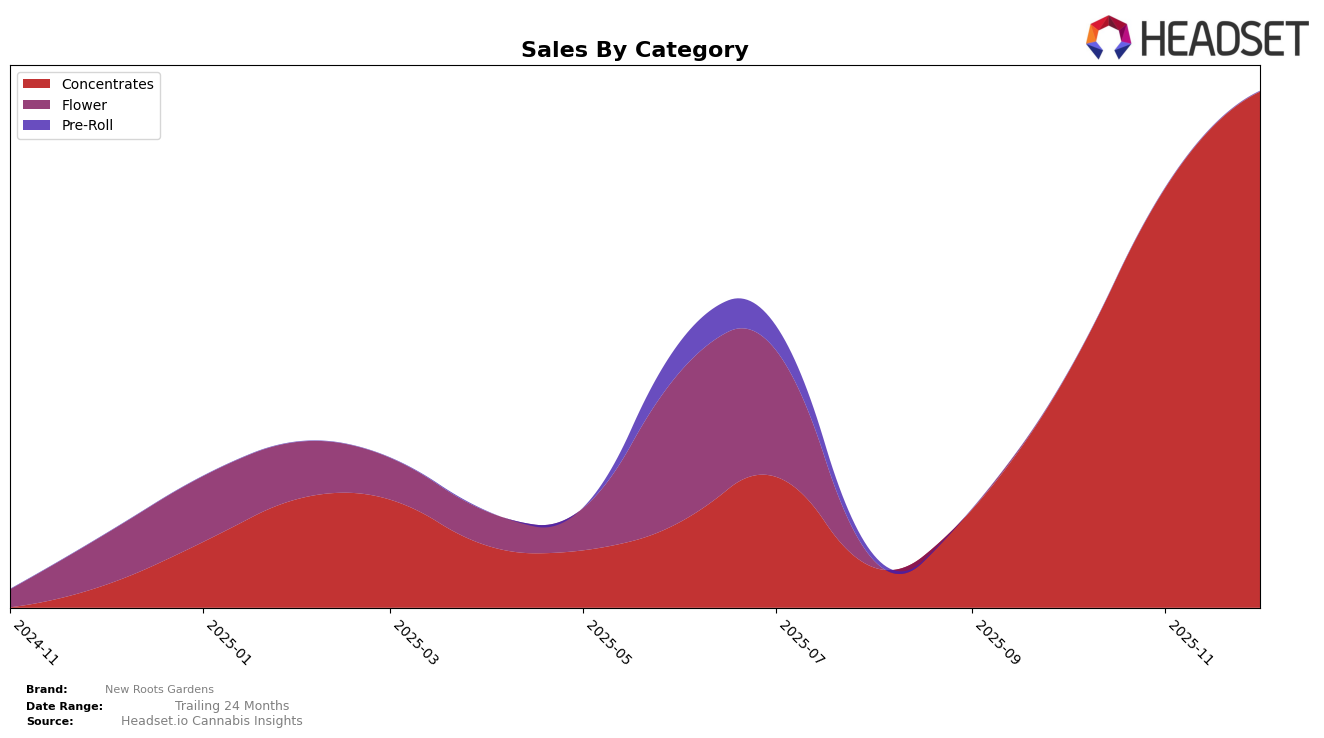

New Roots Gardens has shown a promising upward trajectory in the concentrates category within New York. In September 2025, the brand was not listed among the top 30 brands, but by October, it had climbed to the 33rd position, and further improved to the 30th and 27th positions in November and December, respectively. This steady ascent suggests a growing acceptance and popularity of their products in the market. The brand's ability to break into the top 30 by November indicates a positive reception and increased consumer interest in their offerings.

The absence of New Roots Gardens in the top 30 rankings in September 2025 could initially be seen as a disadvantage, but their subsequent rise in the ranks demonstrates a significant turnaround. This performance could be indicative of strategic changes or successful marketing efforts that have resonated well with consumers. The increase in sales from October to December also supports this notion of growing momentum. However, it remains to be seen how they will sustain this growth and whether they can continue to climb higher in the rankings, or if this trend will plateau in the coming months.

Competitive Landscape

In the competitive landscape of New York's concentrates market, New Roots Gardens has shown a promising upward trajectory in the latter months of 2025. After not ranking in the top 20 in September, New Roots Gardens climbed to 33rd in October, 30th in November, and further improved to 27th by December. This positive trend suggests a growing consumer preference and effective market strategies. Comparatively, Pines/ A Walk In The Pines demonstrated a significant leap from 32nd in September to 17th in November, although it slightly declined to 23rd in December, indicating a volatile yet strong presence. Meanwhile, Veterans Choice Creations (VCC) maintained a relatively stable position, fluctuating between 27th and 34th. Ithaca Organics Cannabis Co. started strong at 21st in September and October but saw a decline to 29th by December. These dynamics highlight New Roots Gardens' potential to capitalize on its upward momentum and gain further market share against its competitors.

Notable Products

In December 2025, Bickett OG Live Rosin (1g) from New Roots Gardens maintained its position as the top-performing product in the Concentrates category, with sales reaching $166. Combat Candy Live Rosin (1g) held steady at the second position, indicating consistent performance across the months. Lylah's Rose Live Rosin (1g) secured the third spot, showing stability since November. Bread Winner Cold Cure Live Rosin (1g) remained in fourth place, marking a slight increase in sales compared to previous months. Notably, Bread Winner Solventless Live Rosin (1g), which previously ranked in the top three, did not rank in December, suggesting a shift in consumer preferences or inventory availability.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.