Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

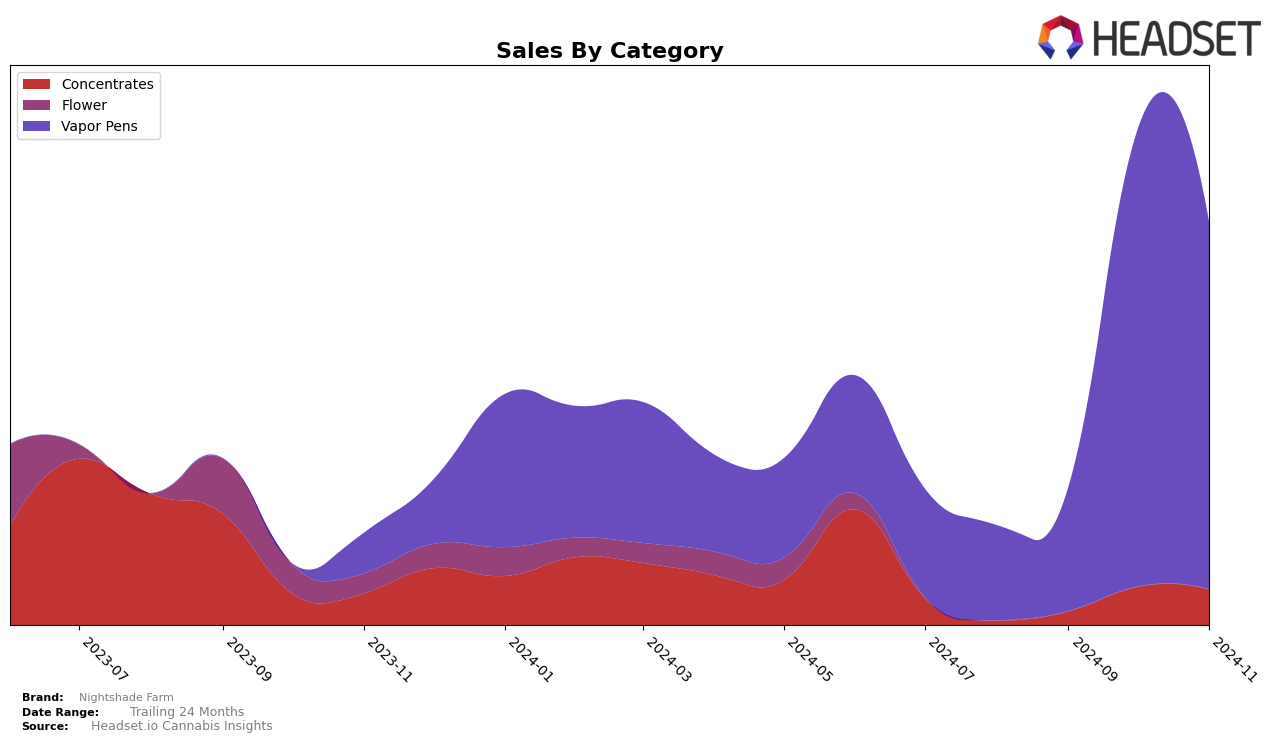

Nightshade Farm has shown fluctuating performance across various categories and states, with notable movements in the vapor pens category within New York. In this category, the brand's ranking improved significantly from 72nd in August 2024 to 46th in October before slightly declining to 52nd in November. This rise in ranking during October coincided with a substantial increase in sales, indicating a successful strategy during that period. However, the drop in November suggests potential challenges or increased competition that affected their market position. The absence of Nightshade Farm in the top 30 brands during these months highlights the competitive nature of the market and the need for strategic adjustments to maintain upward momentum.

Despite the challenges in maintaining a top-tier ranking, Nightshade Farm's ability to climb the ranks in September and October demonstrates potential for growth and adaptation. The brand's presence just outside the top 30 in New York's vapor pens category suggests that while they are not yet a dominant player, they are making strides towards increased market penetration. This performance could be indicative of targeted marketing efforts or product innovations that resonated well with consumers during these months. Observing how Nightshade Farm continues to navigate these competitive waters will provide further insights into their strategic direction and potential for future success.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Nightshade Farm has shown significant fluctuations in its market position over the past few months. Initially ranked at 72nd in August 2024, Nightshade Farm made a remarkable leap to 46th in October, before slightly declining to 52nd in November. This volatility in ranking is mirrored by its sales trajectory, which peaked in October, suggesting a temporary surge in consumer interest or effective marketing strategies during that period. In comparison, Beboe has demonstrated consistent upward movement, climbing from 57th to 47th, indicating a steady gain in market share. Meanwhile, MyHi also improved its position from 63rd to 54th, albeit with a more gradual sales increase. On the other hand, Luci experienced a decline in November, dropping to 51st, which could be an opportunity for Nightshade Farm to capitalize on. Notably, Kingsroad saw a dramatic fall from 24th to 53rd, presenting a potential opening for Nightshade Farm to capture some of its lost market share. These dynamics highlight the competitive pressures and opportunities within the New York vapor pen market, emphasizing the need for Nightshade Farm to maintain strategic agility to improve its standing and sales performance.

Notable Products

In November 2024, the top-performing product from Nightshade Farm was Super Lemon Haze Cured Resin Disposable (1g) in the Vapor Pens category, climbing from the second position in October to first place with sales of 318 units. Rainbow Zelato Cured Resin Disposable (1g) dropped to second place after leading in October, with a notable decrease in sales. OG Kush Cured Resin Disposable (1g) maintained its third-place ranking consistently from October to November. Jack Cured Resin Disposable (1g) remained steady in fourth place across both months. Hella Jelly Batter (1g) in the Concentrates category held the fifth position, showing a slight decline in rank from earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.