Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

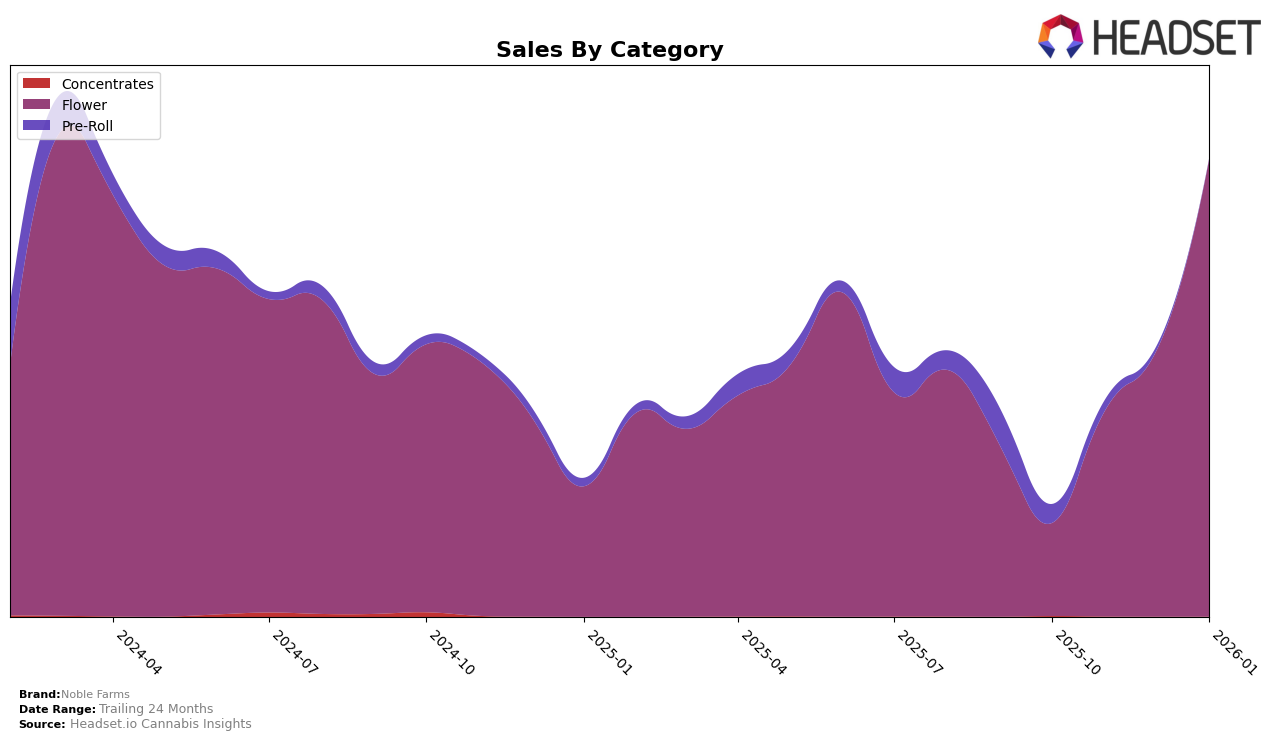

In the Oregon market, Noble Farms has shown a significant upward trajectory in the Flower category over recent months. Starting from a rank of 99 in October 2025, the brand has made remarkable progress, climbing to the 19th position by January 2026. This impressive movement indicates a strong market presence and an increasing consumer preference for their products. The substantial leap in ranking suggests that Noble Farms has successfully leveraged strategies to enhance its visibility and appeal within the competitive Oregon cannabis market.

While Noble Farms has demonstrated a robust performance in Oregon, it's notable that they did not appear in the top 30 brands in any other state or category during the same period. This absence could be seen as a missed opportunity for expansion or an indication of their focused strategy on the Oregon market. The brand's concentrated efforts in Oregon might be paying off, as evidenced by their sales growth, but it also highlights potential areas for growth in other regions and categories. Understanding how Noble Farms can replicate its Oregon success elsewhere could be key to its future growth.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Noble Farms has shown remarkable growth, climbing from a rank of 99 in October 2025 to an impressive 19 by January 2026. This upward trajectory in rankings is accompanied by a significant increase in sales, suggesting a strong market presence and consumer preference. In contrast, Emerald Fields Cannabis maintained a relatively stable position, starting at rank 12 in October 2025 and slightly dropping to 21 by January 2026, with a noticeable decline in sales over the same period. Meanwhile, BJ's A-Grade experienced fluctuations, initially ranking 57 in October 2025, dropping to 71 in November, but then recovering to 20 by January 2026, indicating a volatile yet resilient market strategy. Millerville Farms entered the top 20 in January 2026, suggesting a late but strong market entry. Herbal Dynamics showed consistent performance, improving from rank 51 in October 2025 to 18 by January 2026, closely mirroring Noble Farms' trajectory. These dynamics highlight Noble Farms' strategic advancements in the Oregon flower market, positioning it as a formidable competitor amidst fluctuating performances from other brands.

Notable Products

In January 2026, the top-performing product for Noble Farms was Blueberry (1g) in the Flower category, which achieved the number one rank with sales reaching 1013 units. Cap Junky (1g) maintained a strong position, ranking second, consistent with its performance in November 2025. O.M.G. (1g) also performed well, securing the second position, showing an improvement from the third place in December 2025. Blue Royale (1g) made its entry into the rankings at the third position, indicating a strong debut. Garlic Skunk #22 (Bulk) was ranked fourth, marking its first appearance in the rankings for this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.