Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

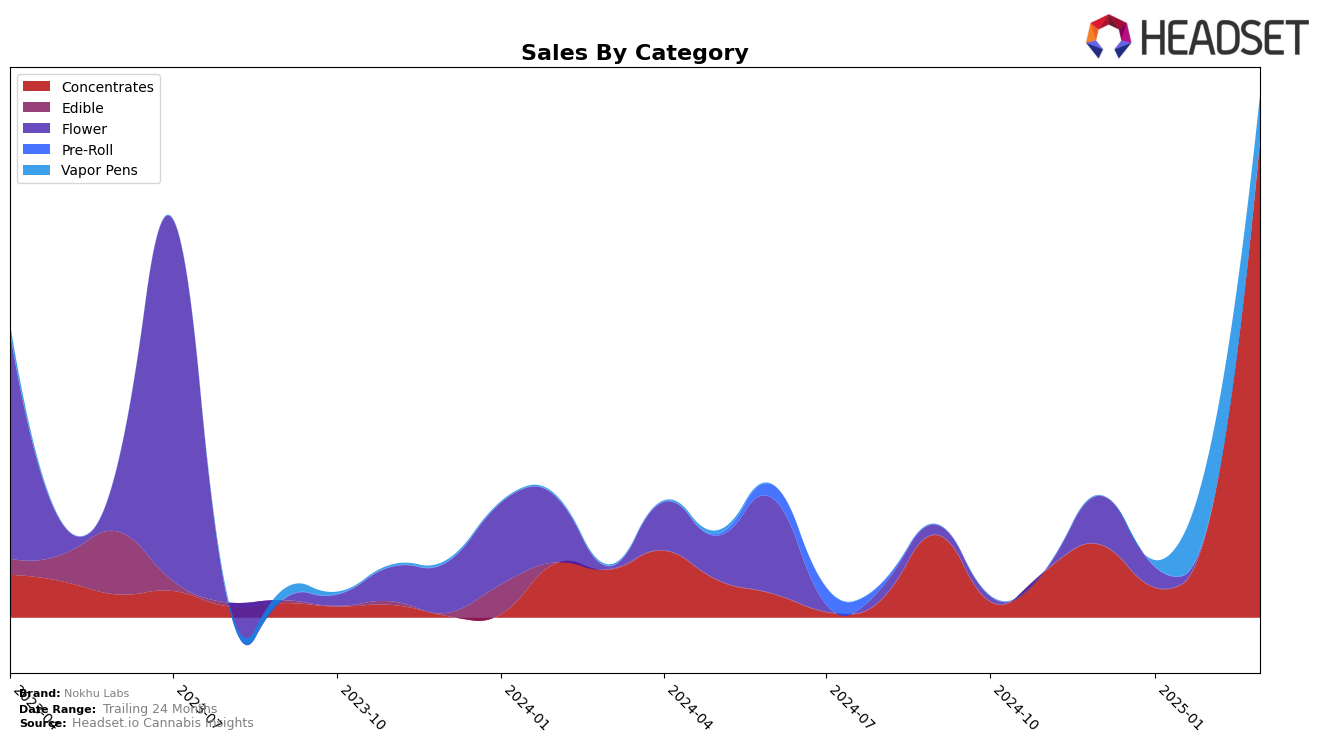

Nokhu Labs has shown a notable improvement in its performance in the Colorado concentrates category over the first quarter of 2025. After not being ranked in the top 30 in December 2024 and January 2025, Nokhu Labs made a significant leap to 29th place by March 2025. This upward trajectory indicates a strong market presence and growing consumer acceptance in the concentrates category. The sales figures corroborate this trend, with a marked increase from February to March, suggesting that Nokhu Labs is effectively capturing market share in this competitive segment.

The absence of Nokhu Labs in the top 30 rankings for December and January highlights challenges they faced in gaining traction initially. However, their subsequent entry into the rankings by March suggests successful strategies or product launches that resonated well with consumers. While specific sales numbers for January are withheld, the overall trend points towards a positive reception and growing brand recognition in the Colorado market. This performance in concentrates could serve as a springboard for Nokhu Labs to explore other categories or expand into new states, though further data would be required to assess such potential moves fully.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, Nokhu Labs has shown a remarkable upward trajectory in recent months. After not ranking in the top 20 at the start of the year, Nokhu Labs surged to the 58th position in February 2025 and further climbed to the 29th position by March 2025. This impressive rise in rank suggests a significant increase in market presence and consumer preference. In contrast, competitors like Harmony Extracts and The Greenery Hash Factory have experienced declines in sales, with Harmony Extracts dropping from 28th to 35th and The Greenery Hash Factory maintaining a relatively stable position but with decreasing sales figures. Meanwhile, Rare Dankness and TFC (The Flower Collective LTD) have shown fluctuating ranks, indicating potential instability in their market positions. Nokhu Labs' ascent in rank and sales highlights its growing influence and could be indicative of a strategic advantage in the concentrates market in Colorado.

Notable Products

In March 2025, Nokhu Labs' top-performing product was Cookie Cake Live Rosin (1g) from the Concentrates category, achieving the number one rank with significant sales of 3039 units. Grease Monkey Live Rosin (1g), also from the Concentrates category, followed closely in second place, having dropped from its top position in February. Tropicana Banana Live Rosin (1g) made a notable entry into the rankings, securing the third spot with 2088 units sold, after not being ranked in the previous months. Lost Cause Live Rosin Cartridge (1g) and Wedding Crasher Live Rosin Cartridge (1g) from the Vapor Pens category secured the fourth and fifth ranks, respectively, with a decrease in their sales figures compared to February. These shifts highlight a strong performance in the Concentrates category, with a clear lead by Cookie Cake Live Rosin (1g).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.