Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

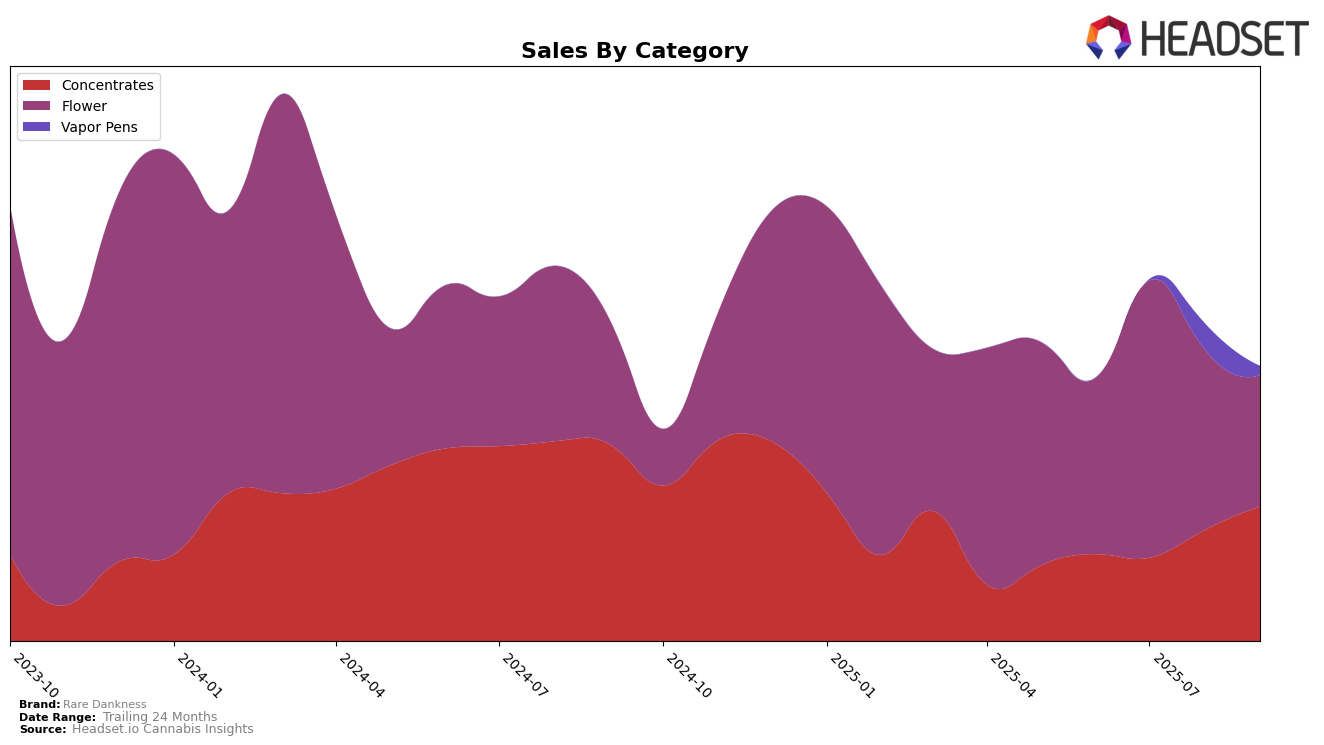

Rare Dankness has shown notable performance fluctuations across different product categories in Colorado. In the concentrates category, the brand has experienced a positive trajectory, moving from a rank of 35 in June 2025 to 25 by September 2025. This upward trend is indicative of increasing consumer interest and possibly improved product offerings or marketing strategies. On the other hand, the flower category has seen a less favorable movement, with the rank dropping from 52 in July to 70 in September. This decline suggests potential challenges in maintaining competitiveness or consumer preference in this category, despite a peak in sales during July.

The vapor pens category presents an interesting case for Rare Dankness in Colorado. The brand was absent from the top 30 rankings until August 2025, where it entered at rank 81. This late entry could signal a new product launch or a strategic push into this category, although it remains outside the top 30, indicating room for growth and improvement. The absence of rankings in some months across categories highlights areas where the brand may not be as competitive or present, which could be an opportunity for expansion or a focus area for future growth strategies.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, Rare Dankness has shown a notable upward trend in rankings from June to September 2025, moving from 35th to 25th position. This improvement is significant given the competitive pressures from brands like RVRS, which consistently outperformed Rare Dankness, ranking as high as 23rd in September. Meanwhile, AO Extracts experienced a decline, dropping from 13th to 24th, which may have opened up opportunities for Rare Dankness to climb the ranks. Despite Next1 Labs LLC maintaining a stable position outside the top 20, Rare Dankness's sales growth from $54,521 in June to $84,343 in September indicates a robust performance, potentially driven by strategic marketing or product innovation. This upward trajectory suggests that Rare Dankness is effectively navigating the competitive landscape, positioning itself for continued growth in the Colorado concentrates market.

Notable Products

For September 2025, Rare Dankness saw outstanding performance with Apricot Scone Sugar Wax (1g) leading the sales, securing the top rank with sales of 1014 units. Following closely, Amnesia OG Sugar Wax (1g) and Electro Lime Sugar Wax (1g) ranked second and third, respectively, both maintaining strong positions in the concentrates category. Swiss Watch (Bulk) in the flower category, which was ranked first in June and third in August, settled at fourth place in September with sales of 815 units. Chem De La Chem Sugar Wax (1g) completed the top five, showcasing the dominance of concentrates in this month's rankings. Notably, Swiss Watch (Bulk) experienced a slight decline from its peak in June, reflecting a shift in consumer preference towards sugar wax products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.