Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

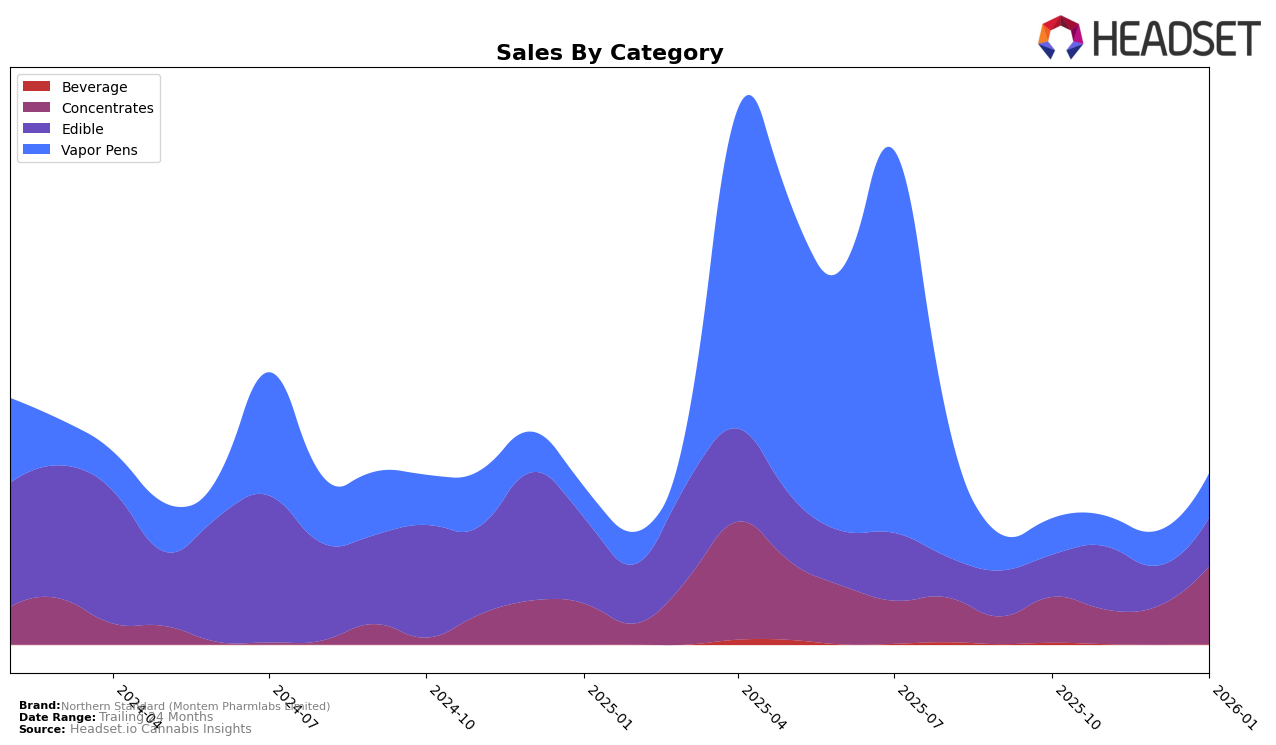

In the Colorado market, Northern Standard (Montem Pharmlabs Limited) has shown a noticeable absence from the top 30 rankings in the Concentrates category from October 2025 to January 2026. This indicates a potential struggle to maintain a competitive edge in this highly dynamic segment. Despite not making it into the top 30, the brand recorded sales of $11,688 in January 2026, suggesting there is some level of consumer interest and existing market presence. However, their absence from the rankings could point to the need for strategic adjustments to enhance visibility and capture a larger market share.

The performance of Northern Standard across other states or provinces is currently not detailed here, but the data from Colorado provides a glimpse into the challenges faced in maintaining a strong foothold in competitive categories. The lack of top 30 rankings over consecutive months in a key market like Colorado may hint at similar trends in other regions, although this would require further data to confirm. This pattern underscores the importance of adapting to regional market dynamics and consumer preferences to improve brand positioning and performance across different geographies.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, Northern Standard (Montem Pharmlabs Limited) experienced a notable shift in its ranking, entering the top 20 in January 2026 at rank 59. This entry into the rankings signifies a positive momentum for Northern Standard, especially considering the competitive pressures from established brands. For instance, Spherex and TICAL have shown fluctuating rankings, with TICAL improving its position from 61 in December 2025 to 53 in January 2026, suggesting a competitive edge that Northern Standard must contend with. Meanwhile, Craft / Craft 710 and NectarBee have not consistently maintained top 20 positions, indicating potential opportunities for Northern Standard to capitalize on market gaps. The upward trend in Northern Standard's sales and rank reflects a growing consumer interest, positioning the brand as a rising contender in the concentrates category.

Notable Products

In January 2026, Northern Standard (Montem Pharmlabs Limited) saw Campfire S'mores Chocolate Bar (100mg) rise to the top as the best-performing product, with sales reaching 106 units. The Downhill Dark Chocolate Bar 10-Pack (100mg) maintained a strong position, ranking second, consistent with its rank from December 2025. Watermelon Goober Live Rosin (1g) emerged as a notable contender in the Concentrates category, securing the third spot despite having no recorded sales in previous months. Mountain Mint Chocolate Bar (100mg) experienced a decline, moving from first place in November 2025 to fourth in January 2026. Meanwhile, Mile-High Milk Chocolate Bar (100mg) dropped to fifth place, reflecting a decrease in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.