Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

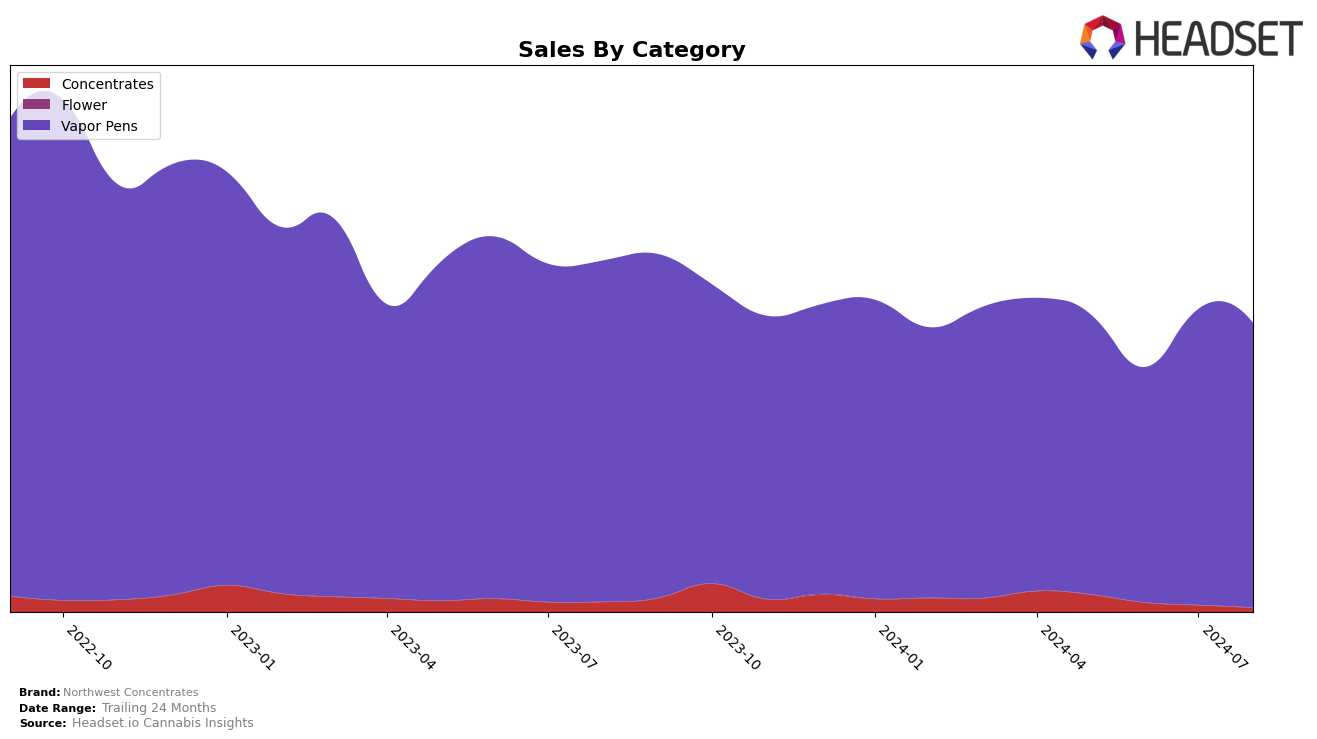

Northwest Concentrates has shown a dynamic performance in the Vapor Pens category in Washington. Despite a dip in their ranking from 26th in May 2024 to 32nd in June 2024, the brand rebounded significantly to 22nd in July before settling at 25th in August. This fluctuation indicates a volatile but resilient market presence. Their sales figures reflect a similar trend with a notable increase from June to July, showcasing a recovery phase that aligns with their improved ranking. However, the brand's inability to consistently stay within the top 30 in June highlights a challenge in maintaining a steady market position.

In terms of overall performance across states and categories, Northwest Concentrates has faced both highs and lows. Their presence in the top 30 for three out of four months in Washington's Vapor Pens category suggests a strong foothold, yet the brief exit from the top 30 in June is a point of concern. This inconsistency could be attributed to market competition or internal factors affecting supply and demand. Observing their ability to bounce back quickly is encouraging, but it also underscores the need for strategic adjustments to sustain and improve their market share. Further analysis would be required to understand the underlying factors contributing to these movements.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Northwest Concentrates has experienced fluctuating ranks over the past few months, indicating a dynamic market position. Despite a dip in June 2024 to rank 32, the brand rebounded to rank 22 in July 2024, before slightly dropping to rank 25 in August 2024. This suggests a resilient performance amidst strong competition. For instance, Treehaus Cannabis has consistently maintained a stable rank around the mid-20s, while Slusheez made a notable climb from rank 33 in June to rank 24 in August. Meanwhile, SPOIL'D and Tasty Terps have shown varying degrees of improvement, with SPOIL'D moving from rank 34 in May to rank 26 in August, and Tasty Terps from rank 31 in May to rank 27 in August. These shifts highlight the competitive pressures and opportunities for Northwest Concentrates to further optimize its market strategies to enhance its rank and sales performance.

Notable Products

In August 2024, Northern Lights Distillate Cartridge (1g) retained its top position among Northwest Concentrates products, achieving sales of 1231 units. Super Lemon Haze Distillate Cartridge (1g) climbed to the second spot from its previous fourth rank in July, showing a notable increase in sales. Pineapple Express Live Resin Cartridge (1g) remained steady in third place, having been second in June. Blue Dream Distillate Cartridge (1g) dropped to fourth from its third position in July, despite strong sales figures. Death Star Distillate Cartridge (1g) entered the rankings at fifth place with impressive initial sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.