Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

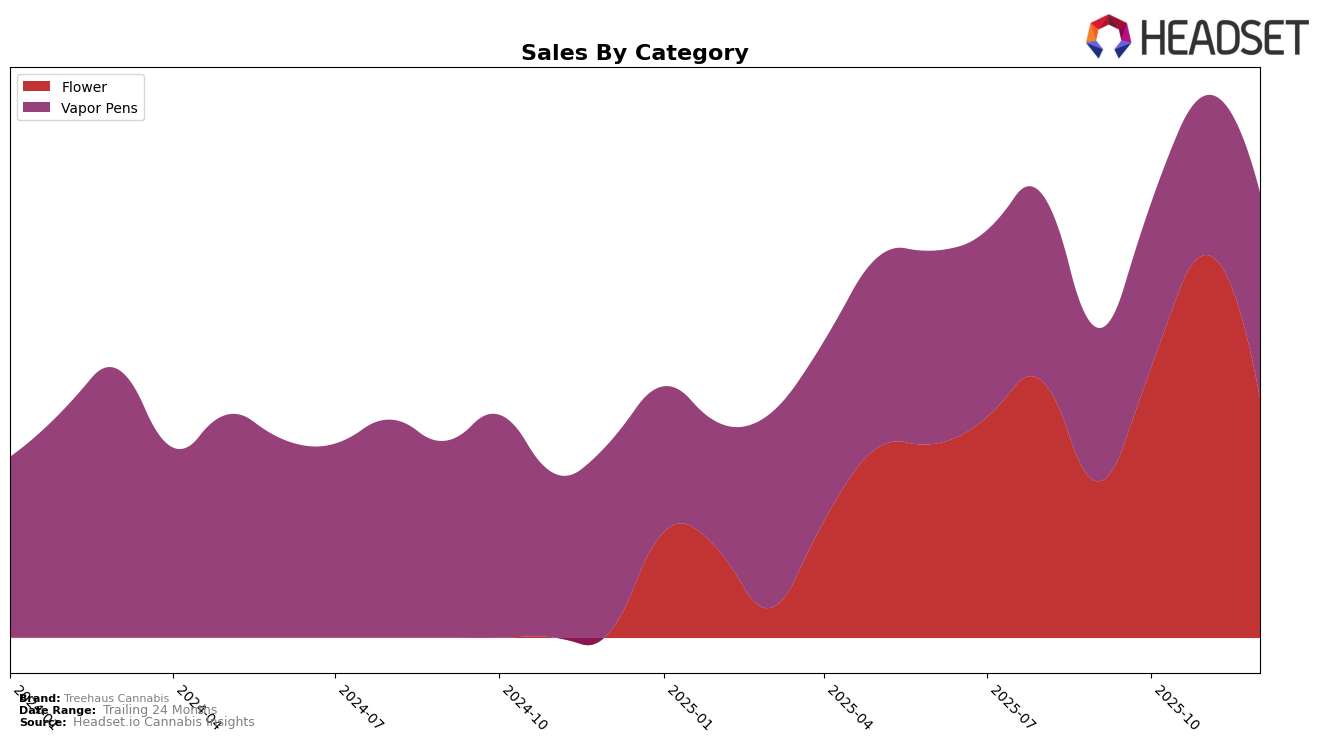

Treehaus Cannabis has shown varied performance across different categories and states in recent months. In the Ohio market, the brand's presence in the Flower category has improved significantly, climbing from a rank of 46 in September 2025 to 28 in November 2025, before slightly dropping to 34 in December 2025. This indicates a strong upward trend in the Flower category, suggesting Treehaus Cannabis is gaining traction in this segment, even though there was a slight dip at the end of the year. However, in the Vapor Pens category, Treehaus Cannabis did not manage to break into the top 30, with rankings hovering around the 60s and 70s throughout the last quarter of 2025, which suggests challenges in capturing significant market share in this category.

In Washington, Treehaus Cannabis has maintained a relatively stable presence in the Vapor Pens category, with a notable improvement in December 2025 when it rose to the 29th position from 40th in September. This upward movement in the rankings indicates a strengthening position in the Washington market for Vapor Pens, contrasting with its performance in Ohio. The brand's ability to climb into the top 30 in Washington by the end of the year is a positive sign, reflecting potential growth opportunities in this state. The lack of presence in other categories in Washington could either indicate a strategic focus or a gap in market penetration that might need addressing.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Treehaus Cannabis has shown significant fluctuations in its ranking over the last few months of 2025. Starting from a rank of 46 in September, Treehaus Cannabis improved its position to 28 in November before slightly dropping to 34 in December. This upward trajectory in October and November suggests a positive reception from consumers, potentially driven by strategic marketing or product innovation. However, the dip in December indicates a need to reassess strategies to maintain momentum. In comparison, Common Citizen also experienced a decline in December, ranking 36, while The Botanist maintained a relatively stable position around the low 30s. Interestingly, Cheech & Chong's showed a notable improvement, climbing from 50 in September to 31 in December, which may pose a competitive threat if their upward trend continues. Meanwhile, The Solid experienced a decline from 24 in September to 37 in December, indicating potential challenges in sustaining their earlier success. These dynamics highlight the competitive nature of the Ohio Flower market and underscore the importance for Treehaus Cannabis to continuously innovate and adapt to maintain and improve its market position.

Notable Products

In December 2025, the top-performing product for Treehaus Cannabis was the Purple Hindu Kush Distillate Cartridge (1g) from the Vapor Pens category, maintaining its number one rank from November with notable sales of 1033 units. The Electric Lemonade Distillate Cartridge (1g) also showed strong performance, holding the second position consistently from November to December. Frosty (14.15g) in the Flower category improved its rank from fourth in November to third in December. The Demon Slayer Distillate Cartridge (1g) re-entered the rankings in December, securing the fourth position. Meanwhile, Frosty (2.83g) maintained its fifth position from October, despite fluctuations in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.