Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

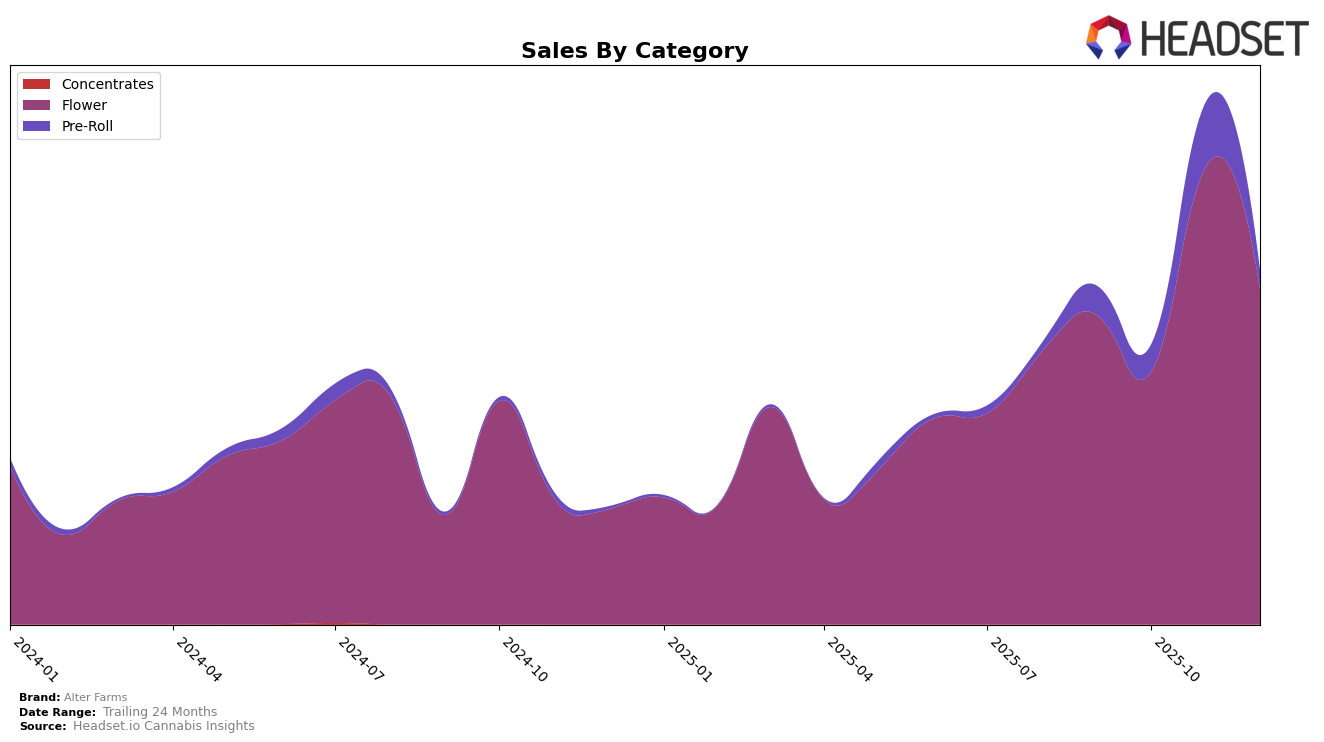

Alter Farms has shown a dynamic performance in the Oregon market, particularly in the Flower category. Notably, the brand experienced a significant leap in its rankings from October to November 2025, moving from 38th to 13th place, which suggests a successful strategy or product launch during that period. However, despite this impressive ascent, Alter Farms faced a slight decline to 21st place in December. This fluctuation could indicate a highly competitive landscape or seasonal factors affecting consumer preferences. It's worth noting that in September, Alter Farms was ranked 24th, which means they were consistently within the top 30, except for October, highlighting the volatile nature of the cannabis market.

In contrast, Alter Farms' presence in the Pre-Roll category in Oregon has been less stable, with rankings fluctuating outside the top 30 for much of the period. The brand maintained a 71st position in both September and October, before climbing to 49th in November, only to fall back to 77th in December. This erratic performance suggests challenges in maintaining a consistent market presence in the Pre-Roll category. The temporary rise in November could imply a short-lived promotional effort or a temporary shift in consumer demand, yet the inability to sustain this momentum raises questions about the brand's strategy in this segment. Despite these challenges, the significant sales increase in November indicates potential areas for growth if Alter Farms can capitalize on past successes.

Competitive Landscape

In the highly competitive Oregon Flower market, Alter Farms has experienced notable fluctuations in its ranking over the last few months, which could impact its sales trajectory. After starting at rank 24 in September 2025, Alter Farms saw a dip to rank 38 in October, before making a significant recovery to rank 13 in November, only to fall again to rank 21 in December. This volatility contrasts with competitors like PDX Organics, which consistently maintained a higher rank, peaking at 8 in November. Meanwhile, Drewby Doobie / Epic Flower and Midnight Fruit Company have shown more stable rankings, with Midnight Fruit Company climbing steadily to rank 19 in December. The fluctuations in Alter Farms' rank suggest potential challenges in maintaining market share, especially against brands like The Crop Shop, which held a consistent rank around the mid-20s. As Alter Farms aims to stabilize its position, understanding these competitive dynamics will be crucial for strategic planning and sales optimization.

Notable Products

In December 2025, Lemon Sour Diesel (3.5g) emerged as the top-performing product for Alter Farms, achieving the number one rank with a notable increase in sales to 3613 units. Purple Hindu Kush Pre-Roll (1g), which led in November, moved to the second position, with its sales dropping to 2713 units. Strawberry Guava (Bulk) made its debut in the rankings at third place, indicating a strong entry. Lemon Sour Diesel (Bulk) and Cherry Wine (Bulk) followed closely, securing the fourth and fifth ranks respectively. Compared to previous months, Lemon Sour Diesel (3.5g) showed significant improvement, climbing from fourth place in November to the top spot in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.