Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

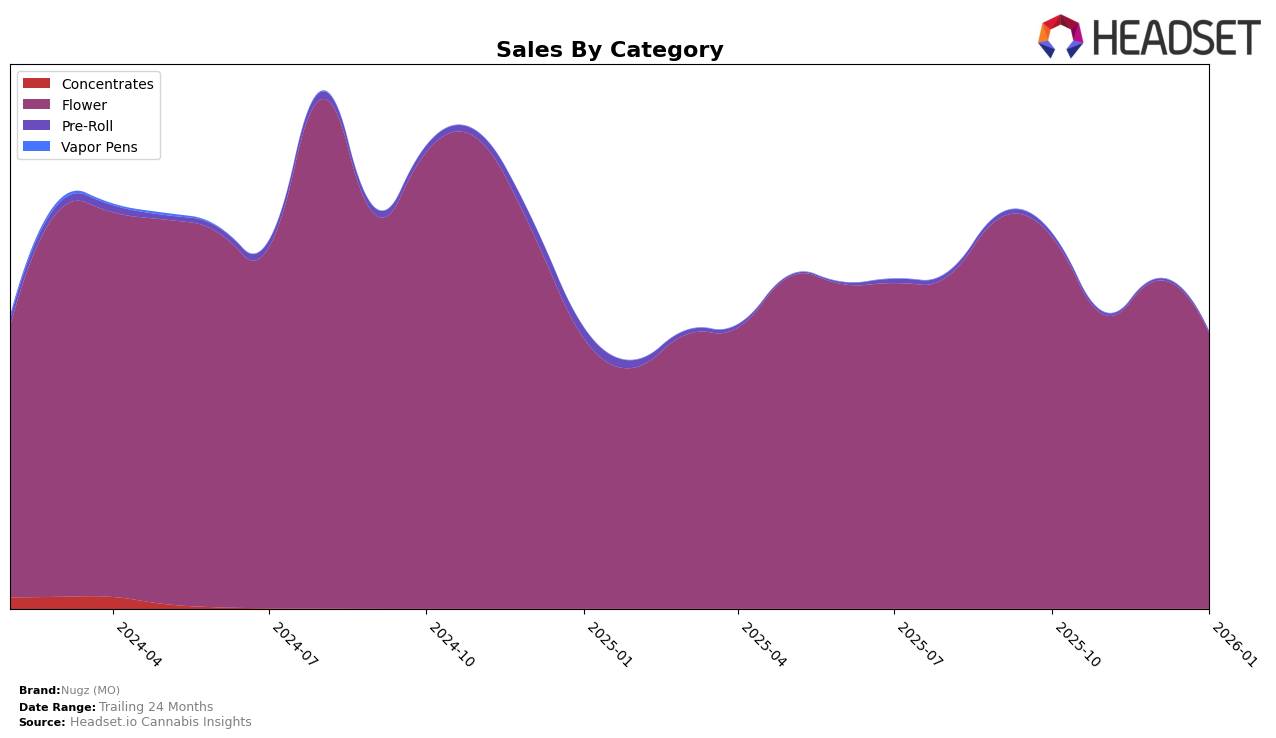

In the Missouri market, Nugz (MO) has shown notable performance in the Flower category. Starting from October 2025, the brand was ranked 10th, but it experienced a slight decline over the following months, settling at the 13th position by January 2026. This downward trend might be attributed to fluctuations in sales, which dropped from over $1.5 million in October to approximately $1.1 million by January. Despite the decline in rank, the brand has maintained a presence in the top 15, indicating a stable but competitive position within the Missouri Flower market.

Interestingly, Nugz (MO) did not appear in the top 30 rankings for any other state or category during the same period, which could suggest a strong regional focus or potential challenges in expanding their market presence beyond Missouri. This absence highlights both an opportunity and a challenge for the brand to explore new markets or diversify their product offerings. The data suggests that while Nugz (MO) is holding its ground in Missouri, there is room for growth and expansion into other categories or states, which could provide new avenues for revenue and brand recognition.

```Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Nugz (MO) has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 10th in October 2025, Nugz (MO) saw a decline to 12th in November and further to 13th in December and January. This downward trend in rank coincides with a decrease in sales from October to January, suggesting a potential challenge in maintaining market share. In contrast, Curio Wellness consistently held the 11th position, except for a brief improvement to 10th in November, indicating stable performance with sales peaking in December. Meanwhile, Proper Cannabis improved its rank from 15th in October to 12th by January, showcasing a positive trajectory in both rank and sales. Additionally, Farmer G made significant strides, climbing from 24th in October to 14th by January, reflecting a strong upward trend. These dynamics highlight the competitive pressures Nugz (MO) faces, emphasizing the need for strategic initiatives to regain and enhance its market position.

Notable Products

In January 2026, the top-performing product for Nugz (MO) was Slurricane (3.5g) in the Flower category, which secured the number one rank with sales of 5294 units. Bull Dance (3.5g) followed closely, dropping to the second rank after leading in November and December 2025. Blue Burger (14g) maintained its third position from December 2025, showing consistent performance. The Blue Burger (3.5g) and Bananaconda (14g) entered the rankings in January 2026 at fourth and fifth positions respectively, indicating a positive shift in consumer preference. Overall, the month observed a reshuffling of product rankings, with Slurricane (3.5g) emerging as the new leader.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.