Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

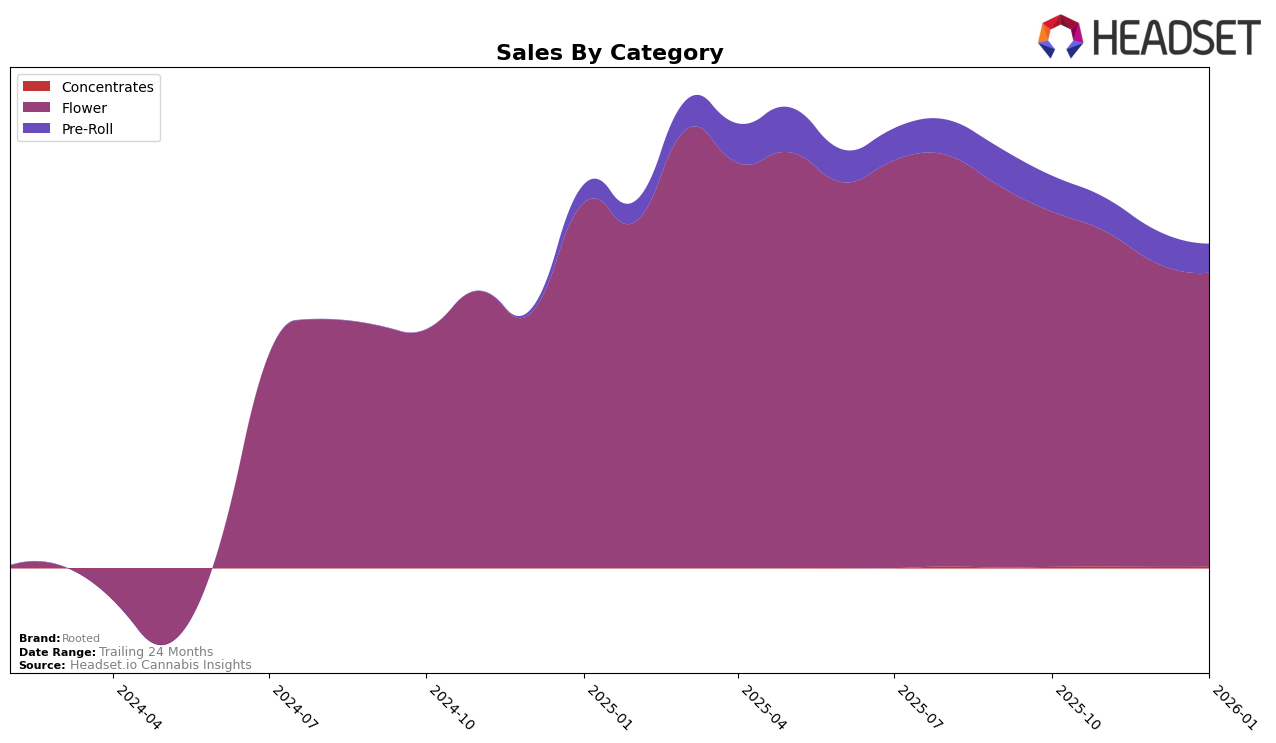

Rooted has shown a mixed performance across various states and product categories from October 2025 to January 2026. In Arizona, the brand's Flower category saw some fluctuations, hovering around the 40th rank, with sales peaking in November 2025 before dropping again. This indicates a volatile market presence in Arizona, where Rooted is struggling to break into the top 30. In contrast, Illinois presents a slightly more positive trend, with Rooted's Flower category improving its rank from 64th in October 2025 to 54th by January 2026, suggesting a gradual strengthening of their market position. However, it's important to note that their Pre-Roll category only appeared in the rankings starting December 2025, indicating a late but potentially promising entry into this segment.

In Missouri, Rooted's performance in the Flower category shows a slight decline in rankings from 13th in October 2025 to 16th by January 2026, although it still maintains a strong presence within the top 20. This suggests a competitive but stable position in Missouri's Flower market. Meanwhile, their Pre-Roll category experienced a more noticeable dip, moving from 34th to 40th over the same period, which could signal challenges in maintaining consumer interest or facing intensified competition. The absence of Rooted in the top 30 of certain categories and states highlights areas for potential growth and strategic focus as they continue to navigate the competitive landscape of the cannabis industry.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Rooted has experienced a slight decline in its ranking, moving from 13th in October 2025 to 16th by January 2026. This downward trend in rank is mirrored by a decrease in sales over the same period, indicating potential challenges in maintaining market share. Notably, Farmer G has shown significant improvement, ascending from 24th in October to 14th in January, suggesting a strong upward momentum that could pose a threat to Rooted's position. Meanwhile, TwentyTwenty has maintained a relatively stable rank around the mid-teens, while Nuthera has climbed steadily from 23rd to 17th, indicating a competitive push that Rooted must address to reclaim its higher standing. These shifts highlight the dynamic nature of the Missouri Flower market, where Rooted must strategize to counteract the gains of its competitors and bolster its sales trajectory.

Notable Products

In January 2026, the top-performing product for Rooted was Wedding Cake (3.5g) in the Flower category, maintaining its number one rank from December 2025 with sales of 4246 units. Ozark Hash (3.5g) held the second position, dropping from its first-place rank in December. Dark Starz (3.5g) showed a significant rise, moving up from fifth place in December to third place in January. Pave (3.5g) remained stable in fourth place, while Do Si Dos (3.5g) re-entered the top five, securing the fifth rank after not being ranked in December. This shift in rankings highlights the dynamic nature of consumer preferences within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.