Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

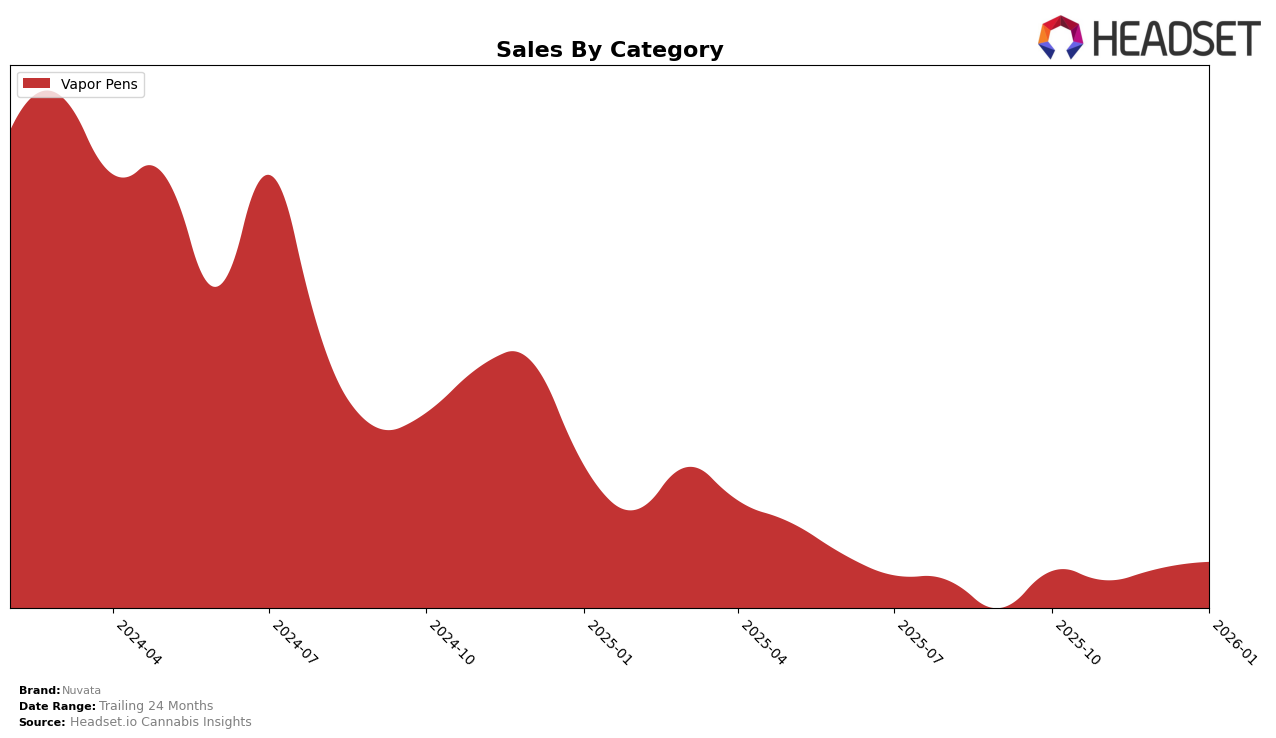

Nuvata's performance in the Vapor Pens category has shown some interesting trends across different states. In Arizona, Nuvata experienced a slight improvement in rankings, moving from 62nd in October 2025 to 56th by January 2026, indicating a steady climb in market position. However, their sales figures have seen fluctuations, with a notable dip in December 2025 before recovering in January 2026. In contrast, Illinois has been a more stable market for Nuvata, consistently maintaining a position around the 28th to 31st range, suggesting a solid foothold in the state despite a gradual decline in sales over the same period.

The situation in California and Missouri presents a more challenging landscape for Nuvata. In California, the brand was not ranked in the top 30 until January 2026, when it entered at 93rd, highlighting a significant gap in market presence. Meanwhile, in Missouri, Nuvata's entry into the rankings at 86th in December 2025, and subsequent improvement to 76th in January 2026, suggests emerging traction. New Jersey presents a mixed picture, with the brand's ranking fluctuating between 73rd and 82nd, indicating a volatile market position. These movements across states underscore the varying degrees of market penetration and competitive challenges Nuvata faces in different regions.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Nuvata has experienced fluctuating rankings, indicating a dynamic market presence. Despite not being in the top 20, Nuvata's rank improved from 31st in November and December 2025 to 28th by January 2026, reflecting a positive shift in market position. This improvement contrasts with brands like Alchemy (Ieso), which saw a decline from 26th in October to 29th in January. Meanwhile, Snackbar made a significant leap from 34th in December to 27th in January, surpassing Nuvata. Good Green also showed a strong upward trend, moving from 30th in December to 26th in January. These shifts highlight the competitive pressures Nuvata faces, as it strives to maintain and improve its market share amidst aggressive advancements by competitors. The data suggests that while Nuvata is making strides, the brand must continue to innovate and adapt to stay ahead of rapidly advancing competitors in the Illinois vapor pen market.

Notable Products

In January 2026, Nuvata's top-performing product was the CBD/THC 1:9 Strawberry Full Mind Distillate Disposable (0.5g) from the Vapor Pens category, maintaining its leading position from December with a notable increase in sales to 1898 units. The Flow - CBD/THC 1:1 Apricot Distillate Disposable (0.5g) secured the second position, consistently ranking high since November. The CBD/THC 1:9 Wild Grape Full Body Distillate Disposable (0.5g) climbed back to third place after a dip in November. The CBD/THC 1:9 Blueberry Body Dominant Distillate Disposable (0.5g) improved its ranking to fourth place since its debut in November. The CBD/THC 1:9 Lime Body Balance Distillate Disposable (0.5g) entered the rankings in January, rounding out the top five products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.