Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

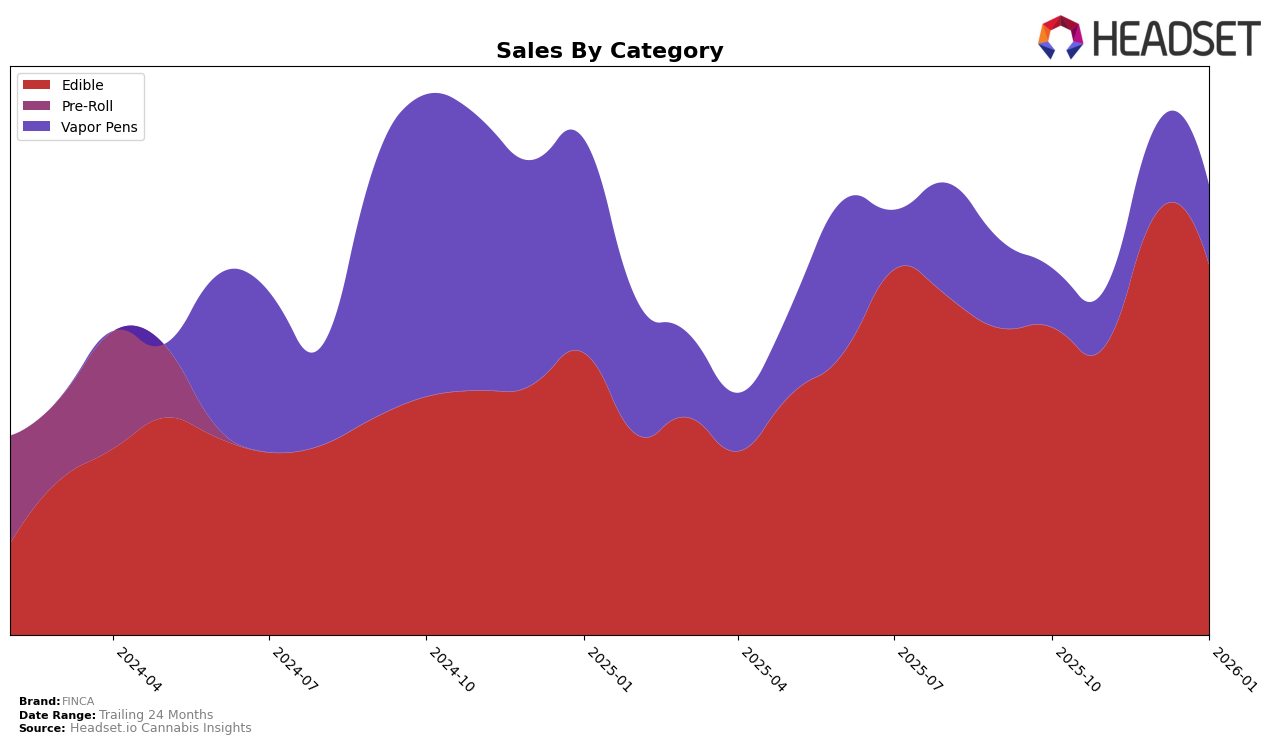

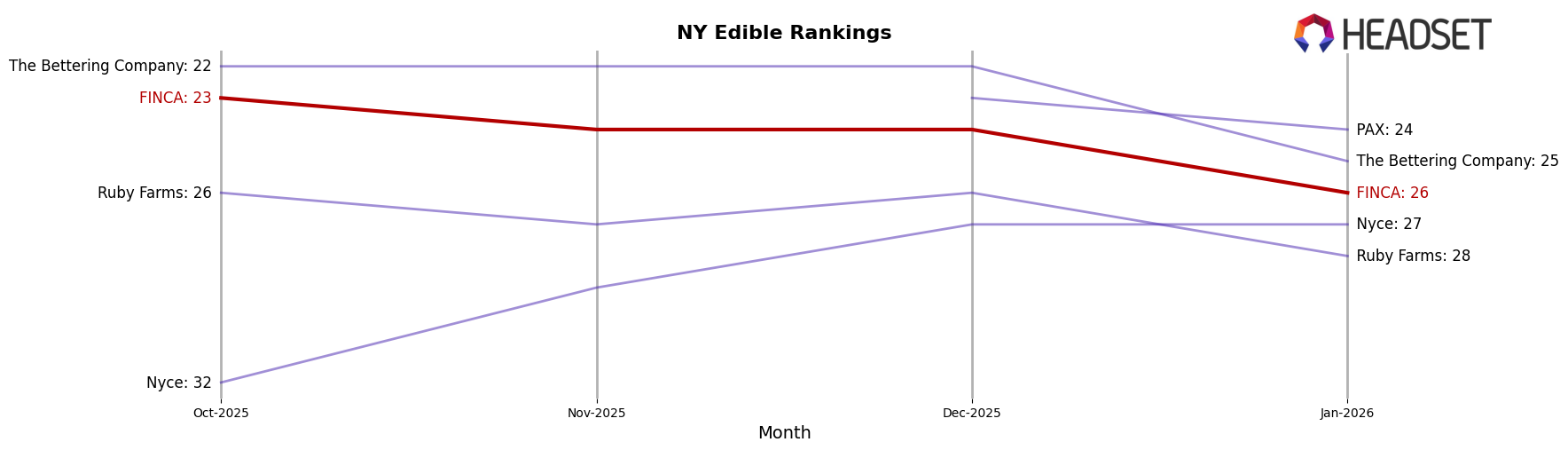

In the New York market, FINCA's performance in the Edible category has shown some fluctuations over the past few months. Despite maintaining a position within the top 30, the brand experienced a slight decline, moving from 23rd place in October 2025 to 26th by January 2026. This downward trend suggests increased competition or shifting consumer preferences. Interestingly, there was a notable spike in sales in December 2025, indicating a potential seasonal boost or successful promotional activity, although the exact reasons remain speculative without further data.

Meanwhile, FINCA's presence in the Vapor Pens category in New York has been less prominent, as the brand has not broken into the top 30 rankings during the observed period. Starting from the 96th position in October 2025, FINCA managed to climb to the 79th spot by January 2026, showing positive momentum and potential for future growth. This upward movement, despite not yet reaching the top 30, could signal strategic improvements or increased consumer interest in their vapor pen offerings. However, without additional insights, it's challenging to determine the precise factors driving this progress.

Competitive Landscape

In the competitive landscape of the New York edible cannabis market, FINCA has experienced notable fluctuations in its ranking and sales performance. From October 2025 to January 2026, FINCA's rank shifted from 23rd to 26th, indicating a slight decline in its competitive position. Despite this, FINCA's sales showed a positive trend, particularly in December 2025, where it achieved a significant increase, closely rivaling The Bettering Company, which consistently held a higher rank but saw a decrease in January 2026. Meanwhile, PAX entered the rankings in December 2025 and quickly surpassed FINCA, maintaining a higher sales volume. Ruby Farms remained outside the top 20, suggesting less competitive pressure from this brand. These dynamics highlight the competitive pressures FINCA faces, particularly from emerging brands like PAX, and underscore the importance of strategic positioning to regain and maintain a higher rank in the market.

Notable Products

In January 2026, the top-performing product from FINCA was Ariba - THC/CBG 2:1 Pina Pineapple Flavour Gummies 10-Pack, which climbed to the number one position with 993 units sold. Buenos Dias - THC/THCv 2:1 Mandarin X Tangerine Flavour Energy Gummies, previously holding the top rank for three consecutive months, moved to the second position. Fiesta - THC/CBG 1:1 Mango Pina Flavour Gummies secured the third spot, maintaining a consistent presence in the top five. Buenas Noches - THC/CBN 2:1 Agave Flavour Sleep Gummies, which was ranked third in October and November, settled at fourth place. Calma- THC/CBD 2:1 Guayaba Guava Flavour Gummies remained stable, ranking fifth for the second consecutive month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.