Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

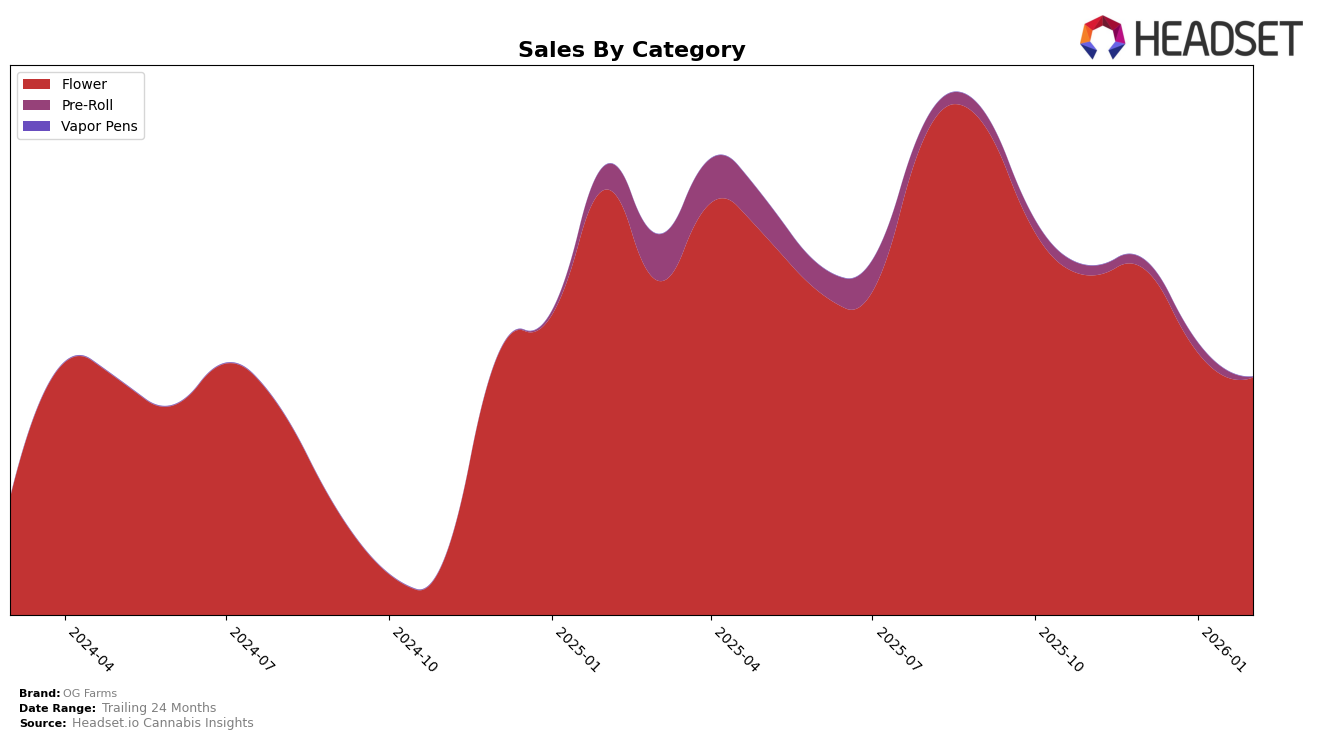

OG Farms has demonstrated a varied performance across different categories and states, with notable movements in the flower category in Michigan. In this state, the brand experienced a decline in its ranking from 15th in November 2025 to 19th by February 2026, suggesting a decrease in market share or increased competition. This downward trend is further emphasized by a decrease in sales over the same period, indicating potential challenges in maintaining consumer interest or facing stronger competitors. The absence of OG Farms from the top 30 rankings in other states or categories might suggest areas where the brand is either not focusing its efforts or where it faces stiff competition.

While Michigan remains a significant market for OG Farms, the brand's performance trajectory suggests a need for strategic adjustments to regain or enhance its position. The downward rank movement in the flower category could be a signal for the brand to innovate or diversify its offerings to capture a larger market share. The absence from the top 30 in other states and categories highlights potential growth opportunities that the brand might explore to expand its footprint. Such insights can be crucial for stakeholders looking to understand the brand's position and future potential in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Michigan flower market, OG Farms has experienced a notable decline in its rankings, moving from 15th in November 2025 to 19th by February 2026. This downward trend in rank corresponds with a decrease in sales, highlighting potential challenges in maintaining market share. Meanwhile, competitors such as Glacier Cannabis have shown an impressive rise, jumping from 49th in December 2025 to 17th by February 2026, indicating a successful strategy that has led to increased sales. Similarly, Glorious Cannabis Co. experienced a dip in January 2026 but rebounded to 18th place by February 2026, suggesting resilience in their market approach. Glo Farms entered the top 20 in January 2026 and improved to 21st by February, while Dubs & Dimes fluctuated slightly but maintained a competitive position, ending February 2026 in 20th place. These dynamics suggest that OG Farms may need to reassess its strategies to counteract the rising competition and regain its foothold in the Michigan flower market.

Notable Products

In February 2026, OG Farms' top-performing product was Grape Pie (28g) in the Flower category, which climbed to the number one spot with sales amounting to 9,542 units. Bop Gun (28g) maintained its position as the second-best seller, although its sales figures saw a decline compared to previous months. Banana Mochi (28g) rose to third place, showing a steady increase in popularity since January 2026. Grape Pie (Bulk) made its debut in the rankings, securing the fourth position. Chem Dog (3.5g) dropped to fifth place from its peak in January, indicating a shift in consumer preference within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.