Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

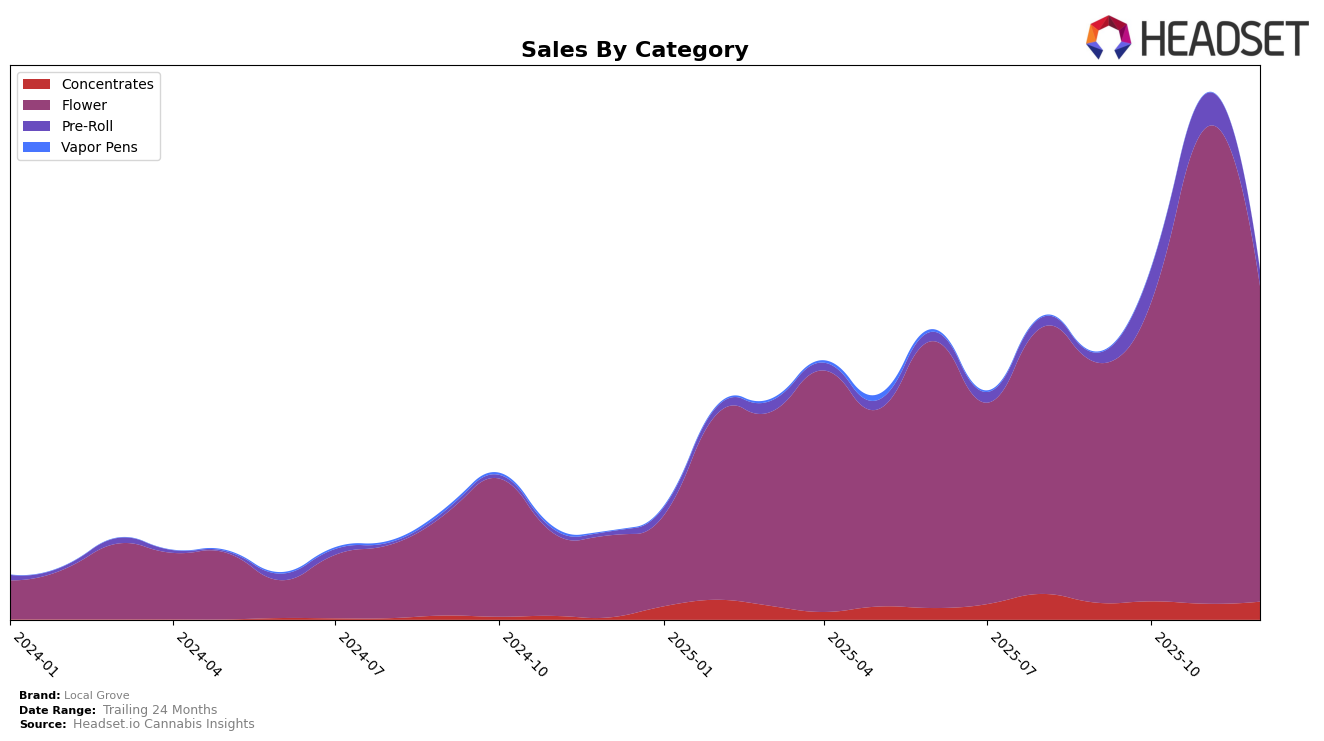

Local Grove has shown a dynamic performance across various categories in the state of Michigan. In the Flower category, the brand has seen a significant improvement, climbing from the 28th rank in September 2025 to the 13th rank in November, before settling at 23rd in December. This upward trajectory highlights a strong demand for their flower products, with sales peaking in November. Conversely, their performance in the Concentrates category has been more volatile, with rankings fluctuating and not breaking into the top 50 for most months, suggesting a need for strategic adjustments in this segment.

In the Pre-Roll category, Local Grove's presence has been less consistent, with no rank in September, but making an entry at 86th in October and improving to 75th in November. This indicates a growing interest, albeit from a lower starting point. The absence of a ranking in December might imply a drop in market share or a strategic pivot away from this category. Overall, while Local Grove has made notable strides in the Flower category, their performance across Concentrates and Pre-Rolls suggests areas for potential growth and optimization. The varying ranks across these categories underscore the importance of targeted marketing and product innovation to capitalize on emerging trends.

Competitive Landscape

In the competitive landscape of Michigan's flower category, Local Grove has demonstrated significant fluctuations in its market position, reflecting both opportunities and challenges. Starting from a rank of 28 in September 2025, Local Grove made a remarkable leap to 13 in November, before settling at 23 in December. This upward trajectory in November was accompanied by a peak in sales, surpassing competitors like Dog House and High Supply / Supply, who experienced declining ranks and sales during the same period. However, by December, Local Grove's rank dropped, indicating potential volatility or increased competition from brands such as Muha Meds, which also saw a decline in rank but maintained relatively stable sales. Meanwhile, Skymint showed inconsistency, with a brief rise in October but failing to sustain its position. These dynamics suggest that while Local Grove has the potential to capture significant market share, maintaining consistent performance amidst fluctuating competition remains a critical challenge.

Notable Products

In December 2025, Count Chunkula (Bulk) emerged as the top-performing product for Local Grove, maintaining its leading position from October and surpassing its November rank. Brain Stew (3.5g) made a significant debut at the second rank with notable sales of 4294 units. Alpha Runtz (3.5g) climbed to the third position, showing an improvement from its absence in previous months. Runtz Shake (28g) held steady at the fourth position, despite a drop in sales compared to November. Gogurtz (1g) entered the top five for the first time in December, indicating a growing interest in smaller quantities.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.