Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

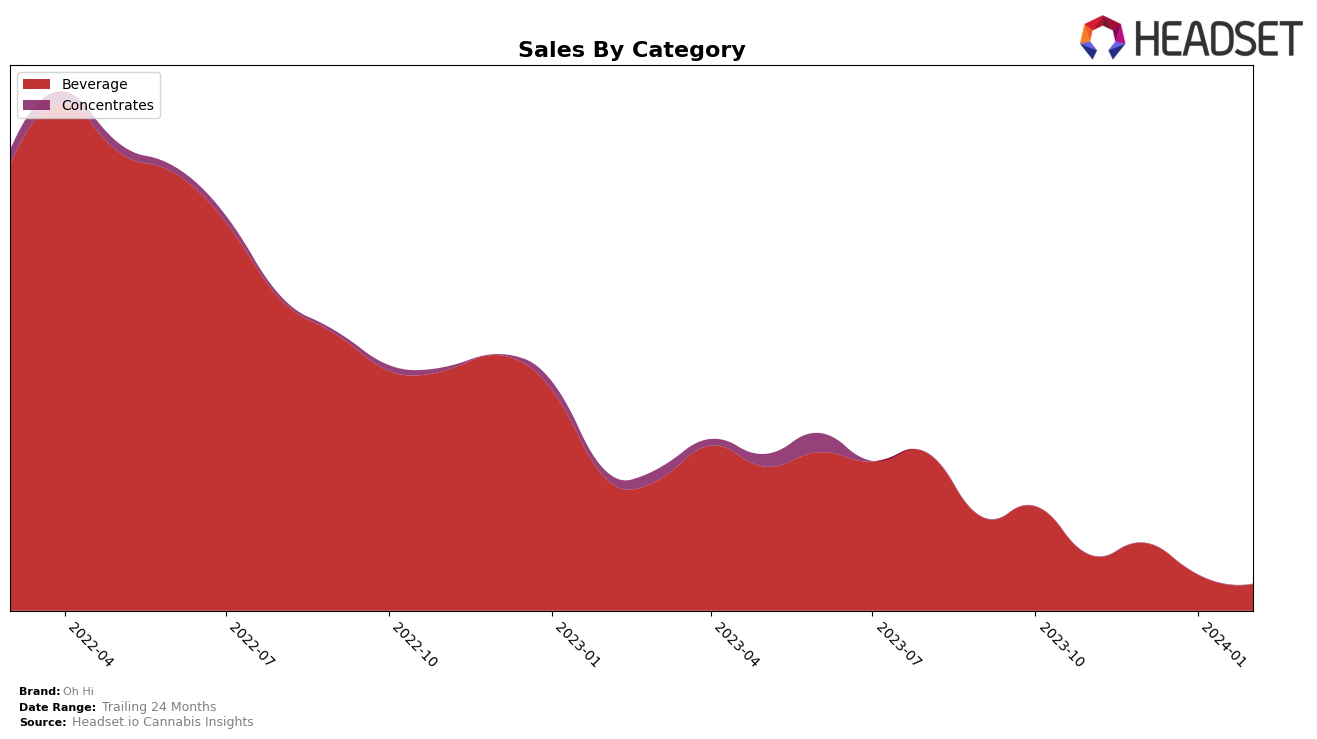

In the competitive cannabis beverage sector within Colorado, Oh Hi has shown a consistent presence but with a slight downward trend in their category ranking over the last four months. Starting as the 8th top brand in November 2023, they slipped to the 10th position by February 2024. This movement indicates a steady demand for their products, yet they are facing increasing competition within the state. The sales figures reflect a peak in December 2023 with $5,544, before experiencing a decline in the following months, dropping to $2,161 by February 2024. This fluctuation in sales, coupled with their ranking slip, suggests challenges in maintaining their market share amidst a dynamic competitive landscape.

While the brand maintained a spot within the top 10 throughout the observed period, the gradual decline in ranking is a critical point for analysis. Notably, the absence from a higher rank in the earlier months could be seen as a missed opportunity for greater visibility and sales. However, staying within the top 10 in a state like Colorado, known for its mature and competitive cannabis market, is still an achievement. The data suggests that while Oh Hi has a solid foothold in the beverage category, there is room for strategic adjustments to counteract the slight downward trend and capitalize on market opportunities. The detailed sales and ranking data, although not fully disclosed here, would offer more insights into specific areas for focus in their marketing and sales strategies.

Competitive Landscape

In the competitive landscape of the cannabis beverage market in Colorado, Oh Hi has shown a consistent yet challenging performance. Starting from November 2023, Oh Hi ranked 8th, gradually slipping to 10th by February 2024. This indicates a resilient presence in the top 10, despite facing stiff competition and fluctuating sales figures. Notably, Bosky Labs has maintained a higher rank and sales volume than Oh Hi, indicating a stronger market position with a rank improvement from 7th to 8th between November 2023 and February 2024. Conversely, The Myx showed remarkable growth, moving from 11th to 9th in the same period, surpassing Oh Hi in February 2024 with higher sales. Meanwhile, Highgrade Brands and Sano Gardens have seen a decline in both rank and sales, positioning them below Oh Hi by February 2024. This competitive analysis underscores the dynamic nature of the cannabis beverage market in Colorado, with Oh Hi facing both opportunities and challenges from emerging and established brands alike.

Notable Products

In February 2024, Oh Hi's top-selling product was the CBD/THC 1:1 Ginger Basil Limeade Sparkling Seltzer (5mg CBD, 5mg THC), maintaining its leading position from the previous two months with impressive sales of 467 units. The second-ranked product was the Grapefruit Sparkling Seltzer (10mg), which also held its rank consistently from January 2024. Notably, the Budtender's Reserve - Orange Sunshine (100mg THC, 140mg Caffeine) made a significant jump to the fourth position in February after not being ranked in the previous month. This shift indicates a changing consumer preference or possibly a successful marketing push for this product. Overall, these rankings highlight the popularity of Oh Hi's beverage category, with consumers showing a strong preference for both CBD/THC balanced products and high-THC options.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.