Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

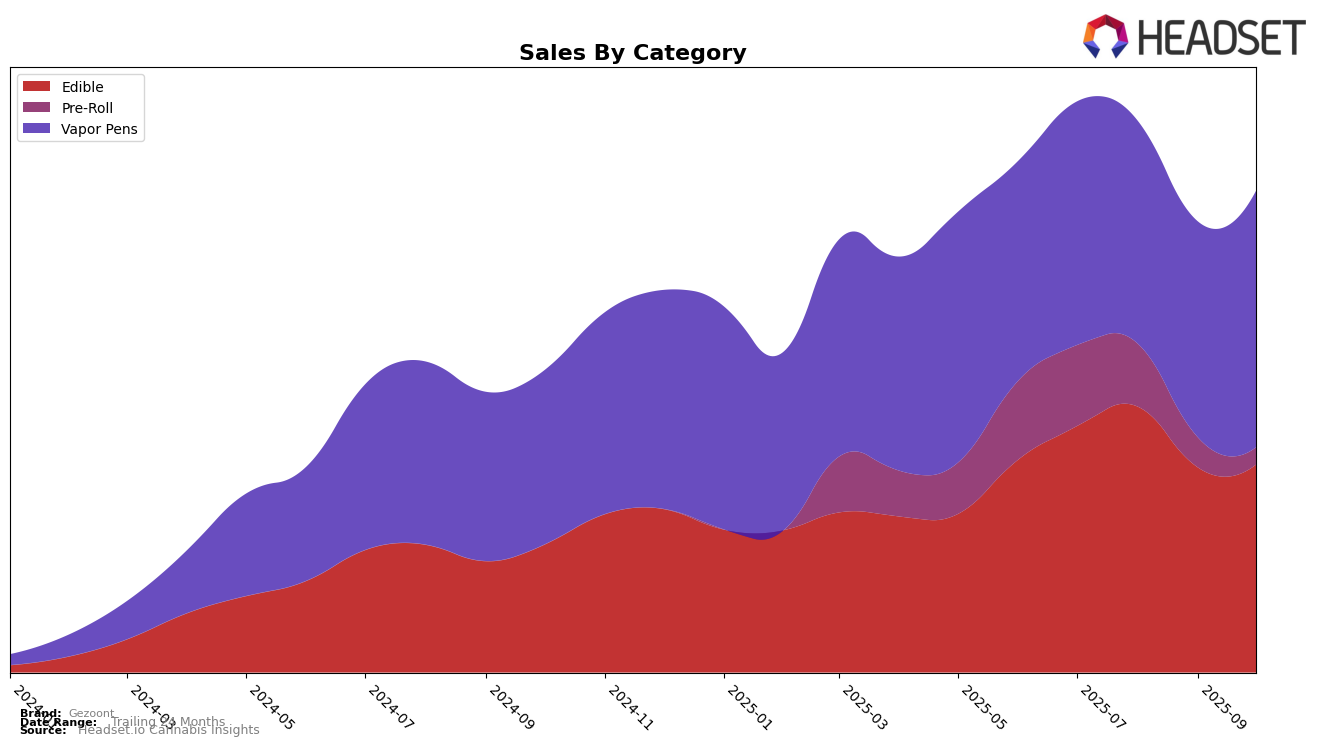

In the New York market, Gezoont has maintained a consistent presence in the Edible category, holding steady at the 29th position from July through October 2025. This stability indicates a reliable customer base and consistent demand for their edible products, despite a noticeable dip in sales during September. However, their performance in the Vapor Pens category tells a different story, as they have not broken into the top 30 ranks during these months, which may suggest a need for strategic adjustments or increased marketing efforts in this competitive segment.

While Gezoont's Edible category performance in New York shows resilience, the brand's challenge lies in enhancing its visibility and market share in the Vapor Pens category. The sales figures for Vapor Pens experienced a rebound in October, signaling potential for growth if the brand can capitalize on this upward trend. The absence of a top 30 ranking in this category over the months highlights the competitive nature of the market, and Gezoont may need to explore innovative approaches or product differentiation to climb the ranks and capture a larger market share.

Competitive Landscape

In the competitive landscape of Vapor Pens in New York, Gezoont has shown a steady presence, maintaining a rank in the low 50s over the past few months. Despite a slight dip in August 2025, Gezoont's sales rebounded in October 2025, indicating resilience and a positive response to market dynamics. Notably, Hepworth consistently outperformed Gezoont, holding a stronger rank in the 40s, which suggests a more robust market position. Meanwhile, Boutiq demonstrated significant volatility, with a remarkable leap from 61st in August to 37th in September, before settling at 46th in October, indicating aggressive market maneuvers that could pose a challenge to Gezoont. PUFF and Nyce have shown consistent performance with ranks similar to Gezoont, suggesting a tight competition among these brands. For Gezoont, these dynamics highlight the importance of strategic marketing and product differentiation to enhance its competitive edge and potentially improve its ranking in the New York Vapor Pens market.

Notable Products

In October 2025, Gezoont's top-performing product was the Blood Orange Diesel Live Resin Disposable in the Vapor Pens category, which surged to the number one rank with sales reaching 799 units. The Bangin Blueberry Gummies 10-Pack, previously holding the top spot, shifted to second place in the Edible category. The Strawberry Pomegranate Gummies 10-Pack maintained its third position from September, while Kim's Karamels dropped to fourth place despite its earlier higher ranks. Notably, the Gorilla Glue Live Resin Disposable entered the rankings at fifth place for October. This month showed a notable shift in consumer preference towards vapor pens over edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.