Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

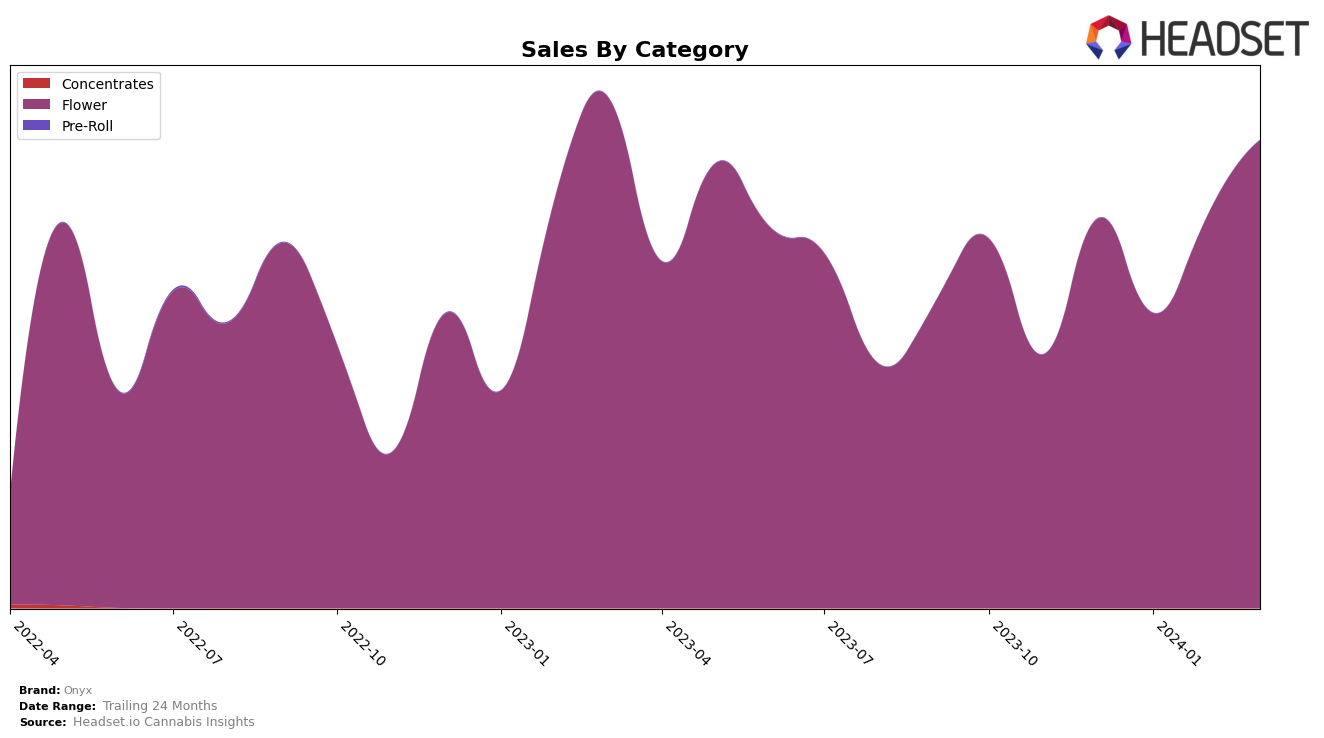

In the competitive cannabis market of Colorado, the brand Onyx has shown a notable performance within the Flower category over the recent months. Starting from December 2023, Onyx held the 19th position, experiencing a slight dip in January 2024 to the 25th rank, which indicates they were not able to maintain their position among the top 20 brands for that month. However, this setback was followed by a positive trajectory, with the brand climbing up to the 18th position in February 2024 and further ascending to the 14th rank by March 2024. This upward movement is particularly impressive, reflecting Onyx's ability to recover and improve its standing in a highly competitive market. The sales figures underline this success, with an increase from 374,108 in December 2023 to 449,672 by March 2024, showcasing a significant growth in consumer demand and market presence.

While the detailed performance of Onyx across other states or categories remains undisclosed in this analysis, the provided data from Colorado offers valuable insights into the brand's market dynamics and consumer acceptance. The fluctuation in rankings, especially the recovery and improvement in early 2024, suggests that Onyx has effectively navigated the challenges within the Flower category, possibly through strategic marketing, quality improvement, or other operational enhancements. The absence from the top 30 brands in January 2024 could be seen as a minor hiccup when considering the overall positive trend. This performance in a state known for its mature and competitive cannabis market speaks volumes about the potential and resilience of Onyx. Future analyses could further explore how Onyx is performing in other states or categories, shedding light on the brand's comprehensive market strategy and consumer appeal across the broader cannabis industry.

Competitive Landscape

In the competitive landscape of the Colorado flower cannabis market, Onyx has experienced fluctuating ranks over the recent months, indicating a dynamic position among its competitors. Starting from a rank of 19 in December 2023, Onyx saw a dip to 25 in January 2024, before slightly improving to ranks 18 and 14 in February and March 2024, respectively. This trajectory suggests a recovery in its market position, likely influenced by changes in sales volumes and consumer preferences. Notably, Bonsai Cultivation has shown significant improvement, moving from rank 22 in December to rank 12 by March, underscoring a strong competitive threat with higher sales growth. Conversely, Classix, despite a strong start, dropped from rank 10 to 16 by March, indicating potential opportunities for Onyx to capture a larger market share. Other competitors like Antero Sciences and Freedom Road have also shown rank improvements, suggesting a highly competitive market where brand positions can shift rapidly. Onyx's recent rank improvement, amidst this competitive backdrop, points towards a positive trend in consumer reception and sales performance, yet highlights the need for strategic initiatives to sustain and enhance its market position further.

Notable Products

In March 2024, Onyx's top-performing product was Alien Bubba x Super Lemon Haze (3.5g) in the Flower category, marking a significant sales figure of 6637 units. Following closely behind, Blue Dream (3.5g) maintained its consistent performance, securing the second rank with a slight difference in sales compared to the top product. Lilac Diesel Popcorn (3.5g) claimed the third position, showcasing its stable demand among consumers. Notably, Chem #4 OG Popcorn (3.5g), which had consistently held the first rank in previous months, experienced a drop to the fourth position in March, indicating a shift in consumer preferences. This change highlights the dynamic nature of product popularity within Onyx, reflecting varying consumer tastes and market trends over time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.