Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

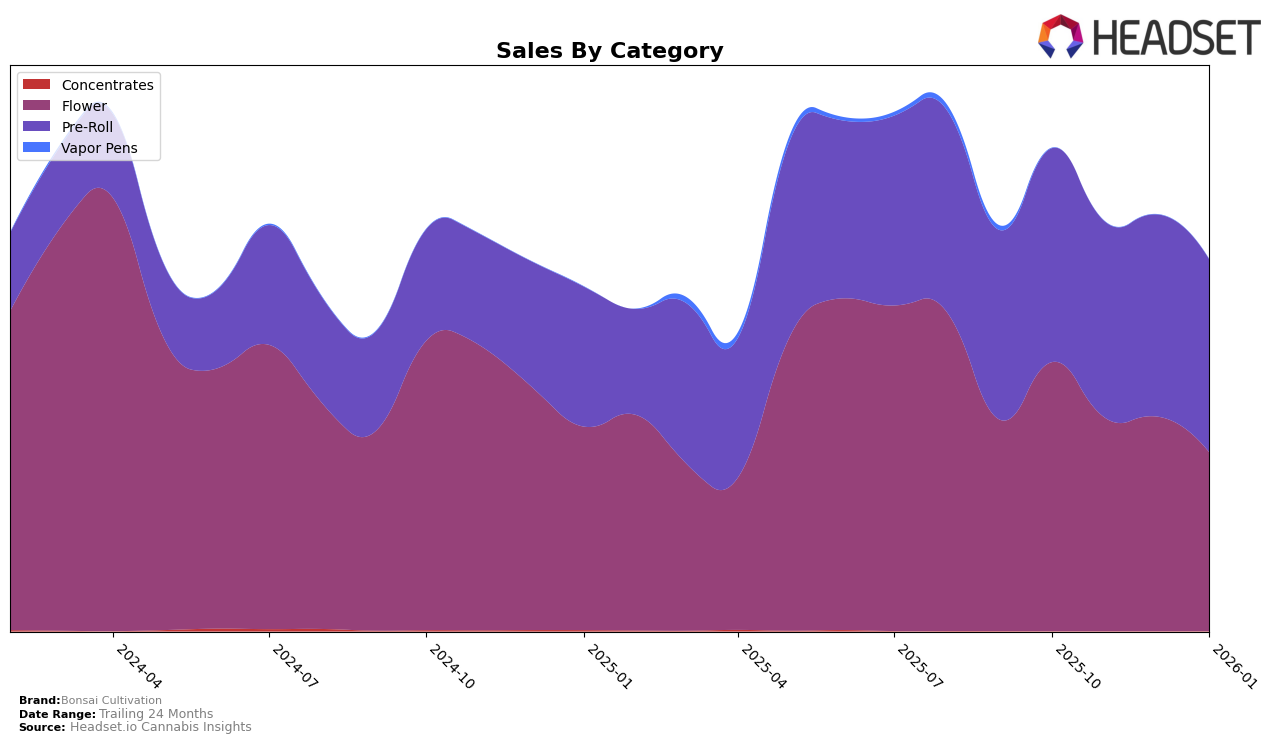

Bonsai Cultivation has shown varied performance across different categories and states, particularly in the Colorado market. In the Flower category, the brand has experienced a downward trend, sliding from the 13th position in October 2025 to the 20th position by January 2026. This decline in ranking is accompanied by a decrease in sales, with January 2026 figures showing a notable drop from October 2025. Such a trend indicates potential challenges in maintaining market share within this category. Meanwhile, the Pre-Roll category paints a different picture; Bonsai Cultivation has maintained a consistent 5th place ranking from October 2025 through January 2026, demonstrating a stable foothold in this segment despite some fluctuations in sales figures.

The consistent performance in the Pre-Roll category suggests that Bonsai Cultivation has a strong product offering or brand loyalty in this segment within Colorado. The stability in rankings, despite slight sales variations, could imply effective marketing strategies or consumer preferences aligning with their pre-roll products. However, the brand's declining position in the Flower category might require strategic adjustments to regain competitive standing. The absence of top 30 rankings in other states or categories could highlight areas for potential growth or indicate strong competition. Understanding these dynamics could be crucial for stakeholders looking to assess Bonsai Cultivation's market positioning and potential areas for expansion or improvement.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Colorado, Bonsai Cultivation has maintained a consistent rank of 5th from October 2025 to January 2026. Despite this stability in rank, the brand experienced a gradual decline in sales over the same period. Notably, Kaviar has consistently held the 3rd position, with sales significantly higher than Bonsai Cultivation, although they too have faced a downward sales trend. Meanwhile, Bloom County saw a decline in rank from 4th to 7th, indicating a more volatile performance, while TWAX improved its position from 11th to 6th, showing a positive sales trajectory. Seed & Strain Cannabis Co. has emerged as a strong competitor, climbing from 6th to 4th place, with sales surpassing Bonsai Cultivation by January 2026. These dynamics suggest that while Bonsai Cultivation maintains a stable market presence, it faces increasing competition from brands showing either upward momentum or higher sales volumes.

Notable Products

In January 2026, Bonsai Cultivation's top-performing product was the Energy Pre-Roll (1g), maintaining its leading position with sales reaching 27,244 units. Following closely was the Relaxation Pre-Roll (1g), which also retained its consistent second place, showing a notable increase in sales to 24,291 units. The Creativity Pre-Roll (1g) held firm in third place, although its sales saw a decline compared to previous months. Energy Pre-Roll 2-Pack (1g) and Relaxation Pre-Roll 2-Pack (1g) continued to rank fourth and fifth respectively, with the latter showing a gradual increase in sales. Overall, the rankings for Bonsai Cultivation's top products remained stable, with minor fluctuations in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.