Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

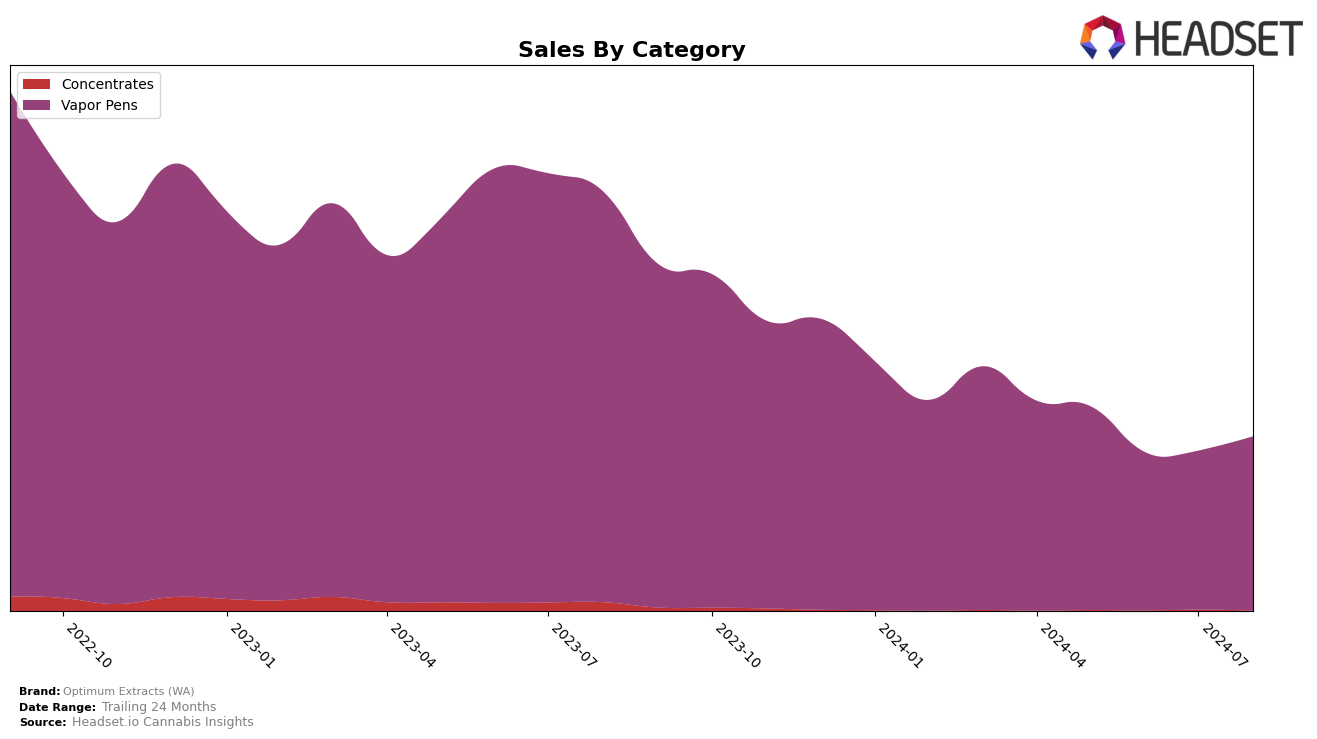

Optimum Extracts (WA) has demonstrated varied performance across different states and categories over the past few months. In Nevada, the brand's presence in the Vapor Pens category has been inconsistent, with rankings missing for May and July 2024, indicating that they were not in the top 30 brands during those months. However, they made a noticeable jump to 42nd place in August 2024, suggesting a resurgence in popularity or market strategy adjustment. This movement could be seen as a positive indication of their potential to regain and possibly improve their market position in Nevada.

In Washington, Optimum Extracts (WA) has maintained a more stable presence in the Vapor Pens category, consistently ranking within the top 30 brands from May to August 2024. Their rankings fluctuated slightly, moving from 23rd in May to 29th in August, but overall, they have maintained a solid foothold in the market. Despite a dip in sales in June, the brand saw a steady increase in July and August, indicating a positive trend. This stability in Washington suggests a strong brand loyalty and effective market penetration in their home state.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Optimum Extracts (WA) has experienced fluctuating ranks over the past few months, indicating a dynamic market presence. Despite a drop from 23rd in May 2024 to 29th in August 2024, Optimum Extracts (WA) has managed to maintain relatively stable sales figures, suggesting a resilient customer base. Notably, Harmony Farms and Leafwerx have also shown similar volatility in their rankings, with Harmony Farms moving from 28th to 32nd and Leafwerx from 30th to 30th within the same period. Meanwhile, Freddy's Fuego (WA) and Tasty Terps have demonstrated more stable performance, with Freddy's Fuego fluctuating between 23rd and 30th and Tasty Terps improving from 31st to 27th. These trends highlight the competitive pressures and opportunities for Optimum Extracts (WA) to strategize for better market positioning and capitalize on its steady sales to climb the ranks in the Washington vapor pen category.

Notable Products

In August 2024, the top-performing product from Optimum Extracts (WA) was the Fruit Punch #5 HTE Disposable (0.8g) in the Vapor Pens category, which secured the first rank with notable sales of 468 units. The Georgia Peach MAC Distillate Cartridge (1g), also in the Vapor Pens category, held the second position, dropping from its top rank in July. The Blackberry Crumble Kush Distillate Cartridge (1g) maintained a steady presence, ranking third, consistent with its position in July. The Green Crack Live Resin Cartridge (1g) saw a slight dip to fourth place from its second position in July. Finally, the Maui Mango Diesel Botanical Terp Distillate Cartridge (1g) entered the rankings at fifth place in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.