Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

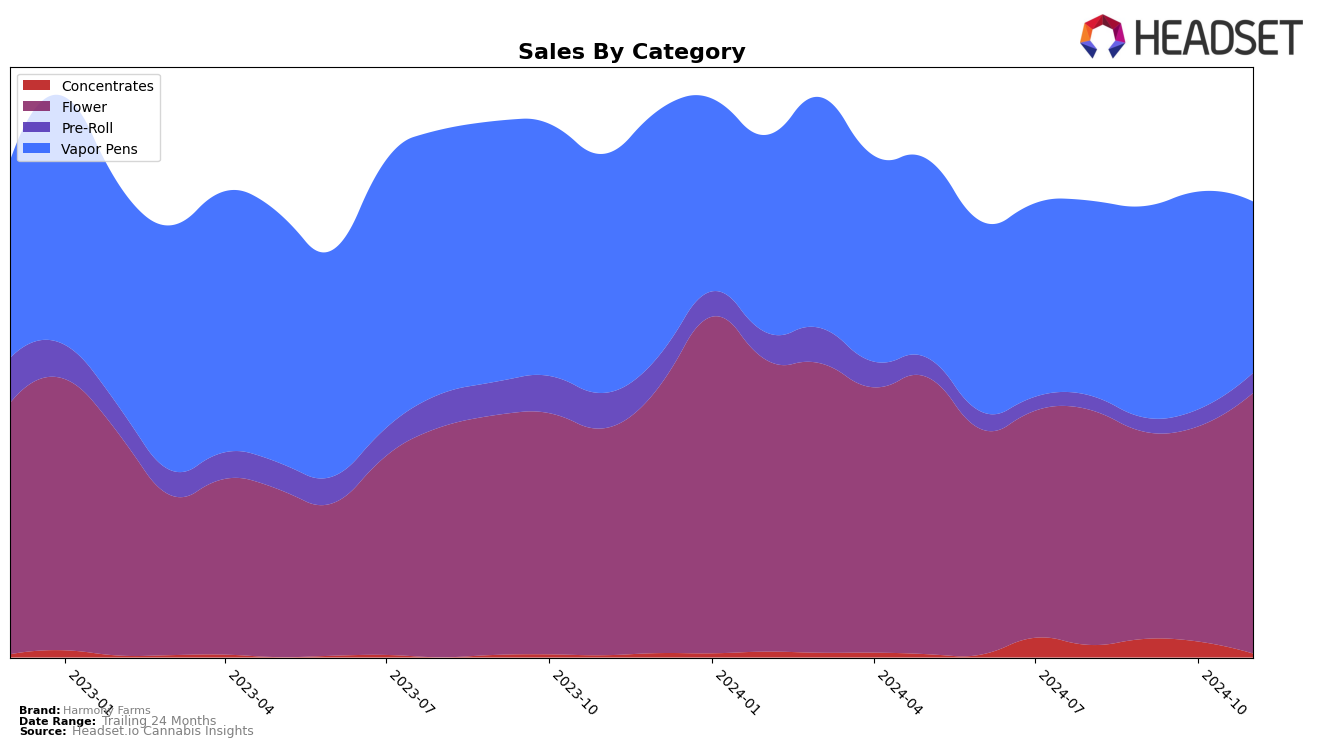

In Colorado, Harmony Farms has shown varied performance across different product categories. In the Concentrates category, the brand has been close to entering the top 60, improving from a rank of 71 in August 2024 to 61 by October 2024. However, it did not maintain this momentum into November, as it fell out of the top 30 entirely. In the Vapor Pens category, Harmony Farms experienced a similar trend, peaking at rank 70 in September before dropping to 84 in October. This suggests that while there was initial growth in sales, sustaining a top position in the rankings proved challenging for Harmony Farms in Colorado.

Meanwhile, in Washington, Harmony Farms has demonstrated a more stable presence, particularly in the Flower category. The brand maintained a consistent ranking, moving from 26 in August to 19 by November, indicating a steady upward trajectory. In the Vapor Pens category, Harmony Farms remained within the top 40, though it experienced minor fluctuations, ending at rank 33 in November. This stability in Washington, especially in the Flower category, highlights the brand's strong foothold in the market compared to its performance in Colorado. However, the marginal decline in Vapor Pens sales towards November could be an area to watch for potential improvement.

Competitive Landscape

In the Washington flower category, Harmony Farms has demonstrated a notable upward trajectory in terms of rank and sales over the past few months. After starting at a rank of 26 in August 2024, Harmony Farms improved to 19 by November 2024, indicating a positive shift in market presence. This improvement is particularly significant when compared to competitors like Sweetwater Farms, which also saw an increase in rank but maintained a slightly higher position at 17 in November. Meanwhile, Hemp Kings and Viking Cannabis have fluctuated in their rankings, with Hemp Kings moving from 31 to 20 and Viking Cannabis showing a strong performance in October but dropping slightly to 18 in November. Despite these shifts, Harmony Farms' consistent sales growth, culminating in a notable increase in November, positions it as a strong contender in the market, suggesting a strategic advantage over brands like Thunder Chief Farms, which has seen a steadier but less dynamic rank and sales performance.

Notable Products

In November 2024, the top-performing product from Harmony Farms was Wedding Cake Pre-Roll (1g), which climbed to the number one spot with notable sales of 956 units. Following closely was White Tara (3.5g) in the Flower category, which improved its ranking to second place with 897 units sold. XJ-13 (3.5g) maintained a strong presence, securing the third position, although it dropped from the top spot in September. Oreoz (3.5g) held steady at fourth, showing consistent performance across the months. Pineapple Express Pre-Roll (1g) experienced a drop to fifth place, after previously achieving the top rank in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.