Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

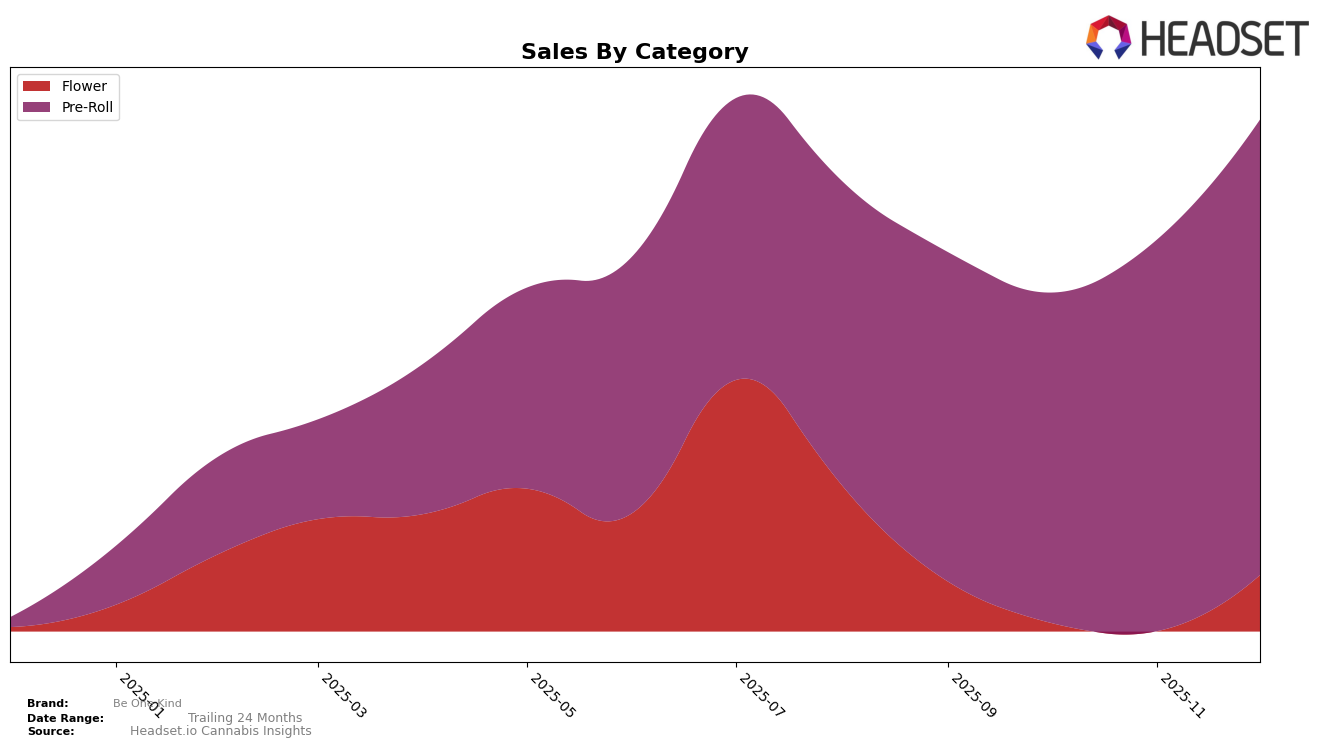

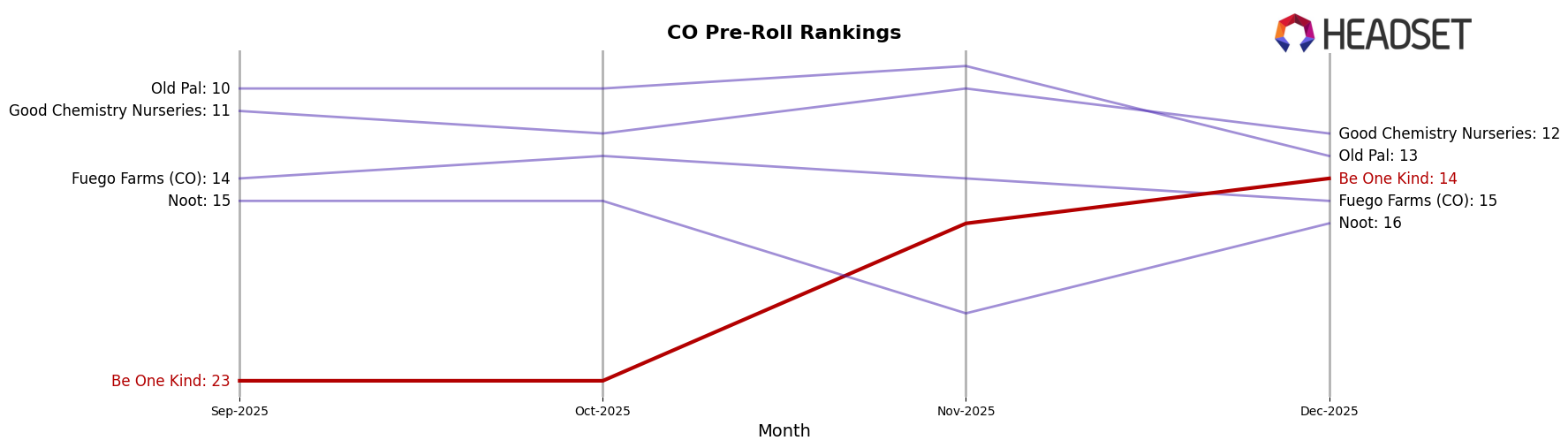

Be One Kind has shown a notable performance in the Colorado cannabis market, particularly in the Pre-Roll category. The brand maintained a strong presence, improving its ranking from 23rd in September and October 2025 to 16th in November and further to 14th by December 2025. This upward trend highlights their growing popularity and market share in the Pre-Roll segment. Conversely, their presence in the Flower category, while showing a re-entry into the top rankings in December at 76th, was absent from the top 30 in the preceding months, indicating a potential area for growth or a shift in consumer preferences towards their Pre-Roll products.

While the Flower category in Colorado saw Be One Kind rank at 76th in December 2025, the absence from the top 30 in previous months suggests a fluctuating performance or a lack of consistent consumer engagement in this category. This could be seen as a challenge for the brand to address or an opportunity to innovate and capture more market share. The Pre-Roll category, however, demonstrates a clear positive trajectory, with steady sales growth culminating in a significant jump in their ranking by the end of the year. This suggests that Be One Kind might be strategically focusing on enhancing their offerings in the Pre-Roll market, which seems to be resonating well with consumers in Colorado.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Colorado, Be One Kind has demonstrated a notable upward trend in rankings over the last few months of 2025. Starting from a rank of 23 in September, Be One Kind improved to 16 by November and further to 14 by December. This positive trajectory is significant when compared to competitors like Old Pal, which experienced a decline from rank 10 in September to 13 in December. Similarly, Good Chemistry Nurseries maintained a relatively stable position but did not show the same upward momentum as Be One Kind. Meanwhile, Fuego Farms (CO) and Noot have fluctuated in their rankings, with Noot dropping to 20 in November before recovering slightly. This consistent improvement in rank suggests that Be One Kind is effectively capturing market share and increasing its sales, positioning itself as a rising contender in the Colorado Pre-Roll market.

Notable Products

In December 2025, the top-performing product for Be One Kind was Pink Zkittles Pre-Roll (1g) in the Pre-Roll category, securing the first rank with notable sales of 1706 units. Following closely, Tropicana Banana Pre-Roll (1g) ranked second with significant sales figures. Cherry Gar-See-Ya Pre-Roll (1g) and Gary Poppins Pre-Roll (1g) were third and fourth, respectively, showing a strong market presence. Super Boof Pre-Roll 10-Pack (3.5g) completed the top five, indicating a consistent demand for pre-rolls. These rankings represent a new entry for December, as the dataset does not provide previous months' ranks, suggesting a fresh lineup or a re-evaluation of sales strategy.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.