Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

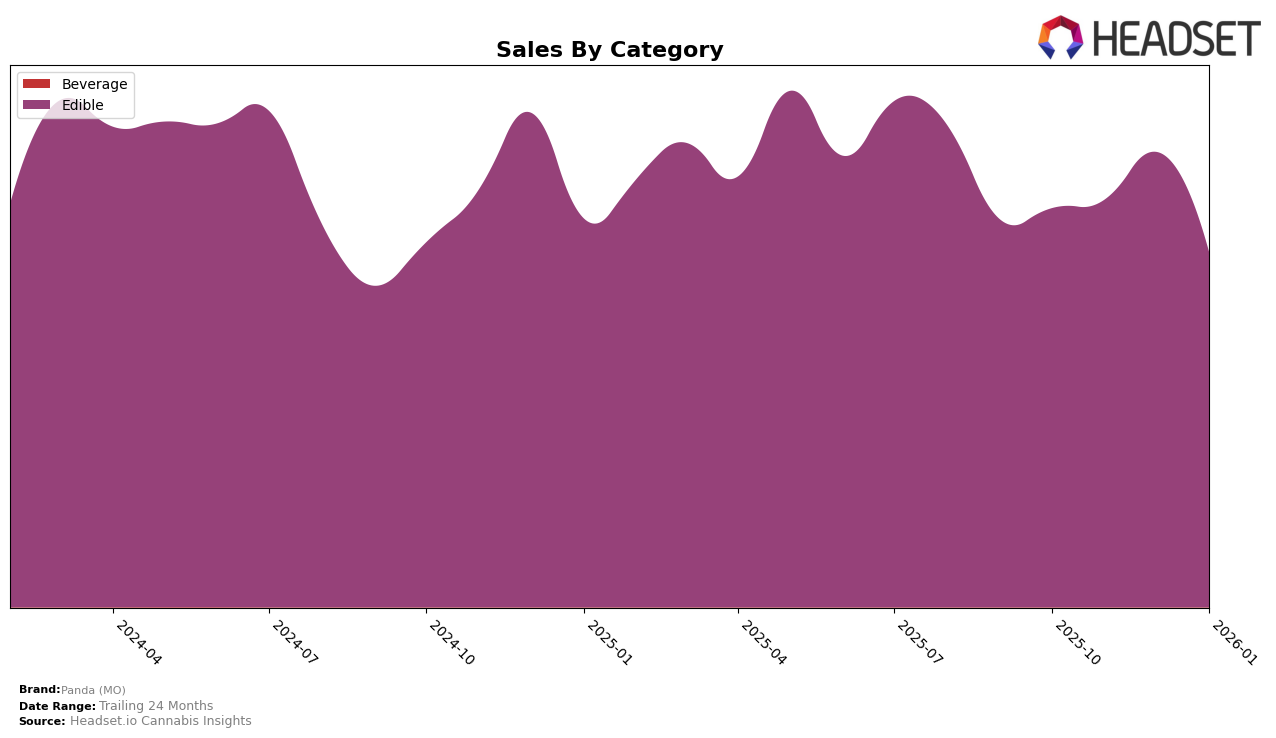

Panda (MO) has shown a consistent presence in the Edible category within Missouri, maintaining a strong position throughout the last quarter of 2025 and into early 2026. The brand held the 8th rank from October to December 2025 but experienced a slight dip to 9th place in January 2026. This minor drop in ranking could be indicative of increased competition or a temporary fluctuation in consumer preferences. Despite this slight decline in rank, Panda (MO) demonstrated a notable increase in sales from November to December 2025, suggesting a strong holiday season performance.

The brand's consistent ranking within the top 10 in Missouri's Edible category highlights its solid market presence. However, the absence of Panda (MO) from the top 30 in other states or categories suggests that their influence is currently concentrated in Missouri's edible market. This could be seen as a limitation in terms of geographic and category expansion. Such a focused market presence may offer opportunities for targeted growth strategies, but it also poses challenges in terms of diversification and risk management across a broader spectrum of markets and product lines.

```Competitive Landscape

In the Missouri edible cannabis market, Panda (MO) has experienced a slight decline in its competitive standing, moving from 8th place in the last quarter of 2025 to 9th in January 2026. Despite this drop in rank, Panda (MO) has maintained a relatively stable sales performance, although there was a noticeable decrease in January 2026. This shift in rank is particularly significant when compared to competitors like Zen Cannabis, which improved its position from 9th to 7th place over the same period, indicating a stronger upward trajectory in sales. Meanwhile, Wana remains a strong competitor, consistently ranking higher than Panda (MO) and maintaining a robust sales volume, albeit with a slight decline in January. DOSD Edibles and Tsunami have shown stable rankings, with DOSD Edibles even improving its rank slightly, which could pose a challenge to Panda (MO) if the trend continues. These dynamics suggest that while Panda (MO) remains a key player, it faces increasing pressure from both established and rising competitors in the Missouri edible market.

Notable Products

In January 2026, Panda (MO) continued to see strong sales from Black Cherry FECO Gummies 2-Pack (100mg), which maintained its position as the top-ranking product for the fourth consecutive month, with sales reaching 4149 units. Mixed Berry FECO Gummies 20-Pack (100mg) held steady at the second rank, demonstrating consistent popularity among consumers. Notably, the CBD/THC 2:1 Indica Blueberry Bliss Gummies 20-Pack (200mg CBD, 100mg THC) entered the rankings for the first time in January, securing the third position. Meanwhile, THC/CBN 1:1 Snoozeberry Fruit Gummies 20-Pack (100mg THC, 100mg CBN) slipped from third to fourth place, indicating a slight decline in consumer preference. Mixed Berry FECO Gummies 20-Pack (500mg) remained consistently in fifth place, showing stable performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.