Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

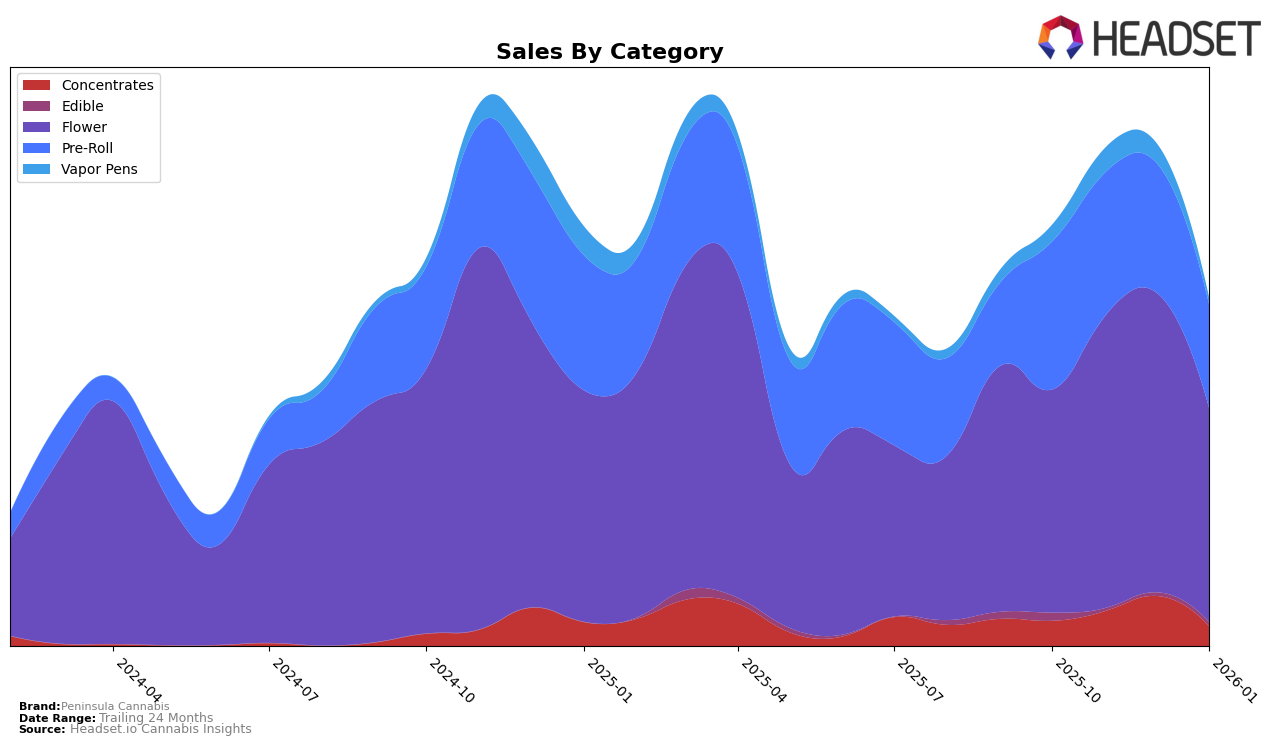

Peninsula Cannabis has shown a varied performance across different categories in Michigan. In the Concentrates category, the brand saw a promising rise from a rank of 46 in October to 31 by December 2025, before experiencing a notable drop to 55 in January 2026. This fluctuation indicates a volatility that might be influenced by market competition or seasonal factors. Meanwhile, in the Flower category, Peninsula Cannabis maintained a fairly stable presence, with rankings hovering between 28 and 41, suggesting a steady consumer base. However, the brand did not make it into the top 30 in the Vapor Pens category, highlighting a potential area for growth or re-evaluation of market strategy in this segment.

In the Pre-Roll category, Peninsula Cannabis consistently stayed within the top 30, with rankings ranging from 25 to 28 over the four-month period. This consistency suggests a strong foothold in the Pre-Roll market in Michigan. Despite the stable rankings, there was a decline in sales from November to January, which could be indicative of broader market trends or changing consumer preferences. The absence of a ranking for Vapor Pens in January 2026, after being present in the previous months, underscores an area where the brand might need to focus on innovation or marketing efforts to regain visibility and improve performance.

Competitive Landscape

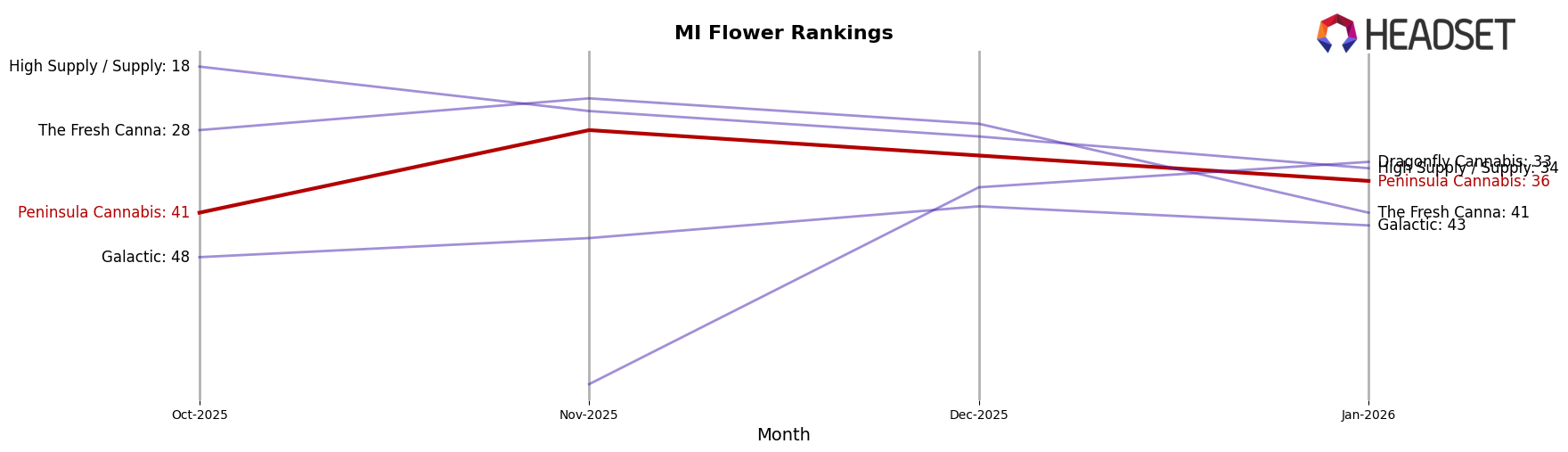

In the competitive landscape of the Michigan flower category, Peninsula Cannabis has demonstrated notable fluctuations in its rankings over the past few months. Starting from October 2025, Peninsula Cannabis was ranked 41st, then climbed to 28th in November, before experiencing a slight decline to 32nd in December and 36th in January 2026. This pattern indicates a competitive struggle, particularly against brands like High Supply / Supply, which maintained a higher rank throughout the period, despite a downward trend from 18th to 34th. Meanwhile, Dragonfly Cannabis showed a significant improvement from being unranked in October to 33rd by January, suggesting a potential emerging competitor. The Fresh Canna also presented a competitive edge, consistently ranking higher than Peninsula Cannabis, although it dipped to 41st in January. These dynamics highlight the intense competition Peninsula Cannabis faces, necessitating strategic adjustments to improve its market position and capitalize on sales opportunities.

Notable Products

In January 2026, Runtz Pre-Roll (1g) maintained its position as the top-performing product for Peninsula Cannabis, with sales reaching 11,642 units. Party Poppers Pre-Roll (1g) emerged as a new contender, securing the second spot, despite not being ranked in previous months. The Runtz (7g) flower product consistently held the third rank since November 2025, although its sales have decreased over the months. Sherb Pie Pre-Roll (1g) climbed to the fourth position from being unranked in November 2025, showing a slight decline in sales. Runtz (3.5g) dropped to fifth place in January, despite previously ranking fourth in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.