Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

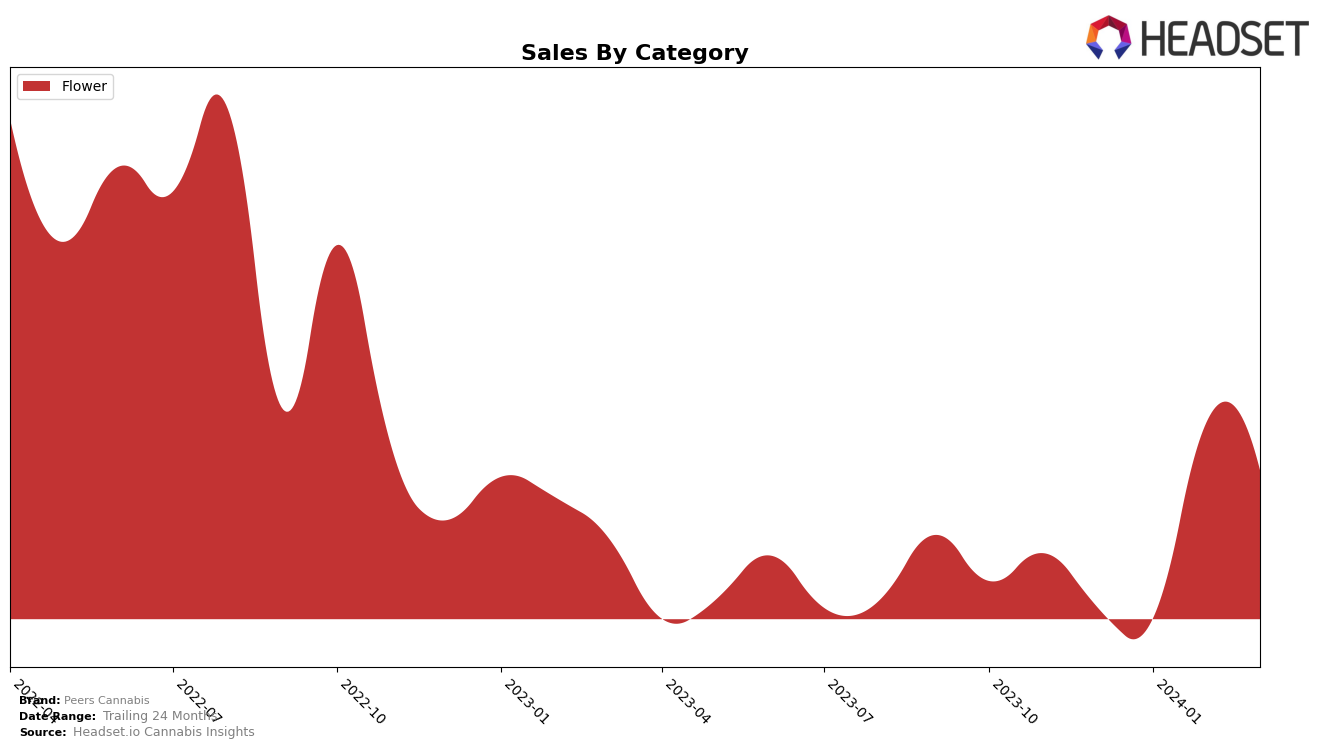

In the competitive cannabis market, Peers Cannabis has shown a varied performance across different provinces in Canada, particularly in the flower category. In British Columbia, the brand did not make it into the top 30 rankings for December 2023 through February 2024, which is a significant indicator of its struggle to capture a substantial market share in this province. However, a notable entry at rank 97 in March 2024, despite not being in the top 30, suggests a potential shift in its market presence, possibly due to strategic marketing efforts or product launches. The lack of ranking in the preceding months could be seen as a missed opportunity in a highly competitive market, but the eventual appearance signals a positive, albeit slow, momentum.

Conversely, in Saskatchewan, Peers Cannabis has demonstrated a more consistent and promising performance. The brand managed to secure a spot within the top 30 in the flower category, ranking 22nd in February 2024 and slightly dropping to 28th in March 2024. This consistent ranking within the top 30 is indicative of a stable consumer base and suggests that the brand has been successful in maintaining its market position amidst competition. The slight drop in rank could be attributed to normal market fluctuations or increased competition. Nonetheless, maintaining a position in the rankings across consecutive months is a positive sign of the brand's resilience and acceptance among consumers in Saskatchewan.

Competitive Landscape

In the competitive landscape of the flower category in Saskatchewan, Peers Cannabis has shown a notable entry into the market, securing a rank of 22 in February 2024 and improving slightly to rank 28 by March 2024. This is a significant achievement considering the brand was not ranked in the top 20 before February 2024. Its competitors, such as Top Leaf, Jonny Chronic, Ritual Green, and Random Acts, have shown varying degrees of performance over the same period. Notably, Random Acts has consistently improved its rank, moving from 29th in December 2023 to 27th by March 2024, indicating a strong upward trend in sales and market presence. On the other hand, Top Leaf experienced a significant fluctuation, not ranking in February 2024 but making a substantial jump to 26th place in March 2024. Jonny Chronic and Ritual Green have seen some volatility in their rankings but remained competitive. This dynamic market scenario underscores the importance of Peers Cannabis maintaining its momentum and exploring strategies to enhance its market position amidst stiff competition.

Notable Products

In March 2024, Peers Cannabis saw Giggly Bits (28g) leading the sales chart within the Flower category, maintaining its top position from February with a notable sales figure of 439 units. Following closely, Cat Nap (28g) climbed to the second rank, showing significant growth from its previous third-place position in February, highlighting the increasing consumer preference for this product. Nana Punch (7g), once the leader in December 2023 and January 2024, experienced a decline, settling at third place in March, which indicates a shift in consumer preferences within the Flower category. The smaller pack of Nana Punch (3.5g) did not make it into the top rankings in March, suggesting that customers are favoring larger quantities. These shifts in rankings and the outstanding performance of the top products underscore the dynamic nature of consumer demand within Peers Cannabis' product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.