Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

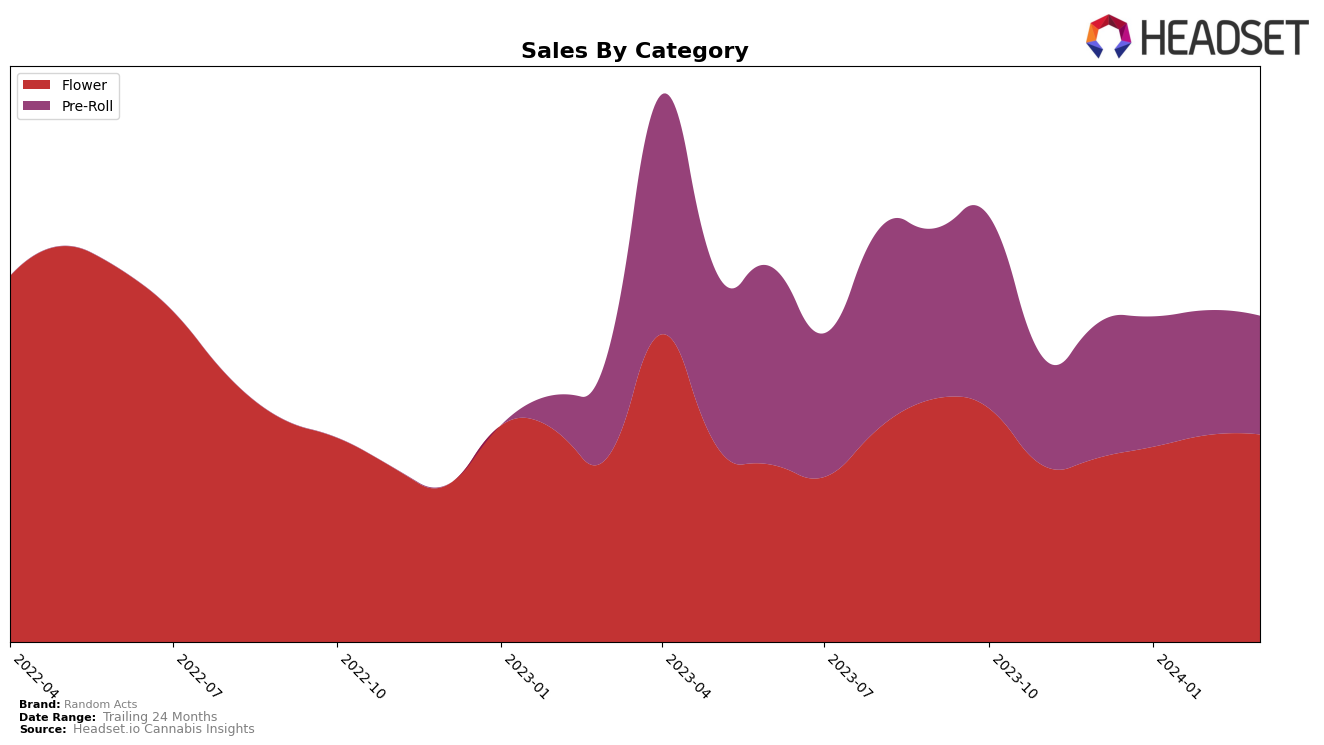

In Saskatchewan, Random Acts has shown a notable performance across two different categories: Flower and Pre-Roll. For the Flower category, the brand demonstrated a positive trajectory from December 2023 to February 2024, moving up from rank 29 to rank 20, indicating a growing consumer preference and increased sales, from 53,760 in December to 60,524 in February. However, in March 2024, there was a slight decline to rank 27, suggesting a potential shift in consumer interest or increased competition within the category. This fluctuation in ranking, while showing an overall positive sales trend, highlights the volatile nature of consumer preferences in the cannabis market.

Conversely, in the Pre-Roll category, Random Acts experienced a gradual decline in rankings from December 2023 to March 2024, moving from rank 25 to 27. This downward trend may point to challenges the brand faces in maintaining its market share against competitors or could reflect broader market dynamics affecting the Pre-Roll category in Saskatchewan. Despite the diminishing rank, it's crucial to note that being consistently in the top 30 indicates a solid presence in the market, although the decreasing sales from 39,330 in December to 34,656 in March could be a cause for concern for the brand. This contrast between the Flower and Pre-Roll categories underlines the importance of strategy adaptation and innovation to sustain and enhance market positioning.

Competitive Landscape

In the competitive landscape of the cannabis flower category in Saskatchewan, Random Acts has shown a notable performance trajectory. Starting from December 2023, Random Acts held the 29th rank, improving its position to 25th in January 2024, reaching 20th in February, and finally settling at 27th in March 2024. This fluctuation in rank, alongside a consistent increase in sales from December 2023 through March 2024, underscores Random Acts' resilience and growing consumer interest. Competing brands such as Top Leaf, despite a significant sales spike in March, did not maintain a consistent rank, indicating a volatile market position. Ritual Green and Peers Cannabis have shown more stability in rankings but with varied sales performance. Notably, Space Race Cannabis experienced a significant rank improvement to 25th in March 2024, coupled with a sales rebound, positioning it as a direct competitor to Random Acts. The dynamic shifts in rankings and sales among these brands highlight the competitive intensity within the Saskatchewan cannabis flower market, with Random Acts demonstrating a promising upward trend in both sales and market position.

Notable Products

In March 2024, Random Acts saw Lightning Strikes Pre-Roll 3-Pack (1.5g) maintain its top position for the fourth consecutive month with sales reaching 2374 units. Following closely, Karaoke Bar (7g) climbed one rank to secure the second spot, showcasing a notable increase in consumer preference. The Bonfire Pre-Roll 3-Pack (1.5g) slightly dipped to third place, indicating a shift in the pre-roll category's competitive landscape. A new entry, Bonfire (7g) in the Flower category, made an impressive debut at fourth place, hinting at a growing interest in varied cannabis experiences. Lastly, Karaoke Bar (3.5g) experienced a slight decline, settling in at fifth, reflecting the dynamic nature of product popularity within Random Acts.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.