Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

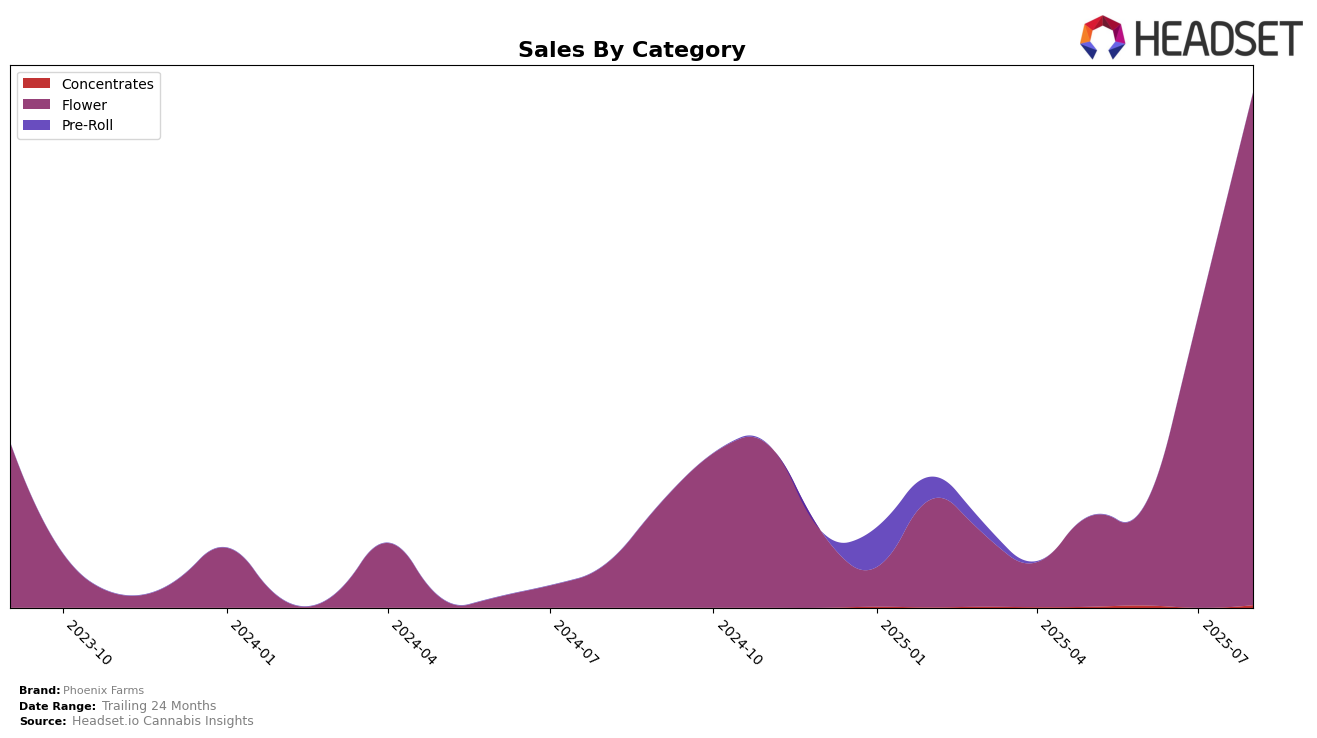

Phoenix Farms has demonstrated a remarkable upward trajectory in the Colorado market, particularly within the Flower category. The brand's rank improved significantly from 81st in May 2025 to breaking into the top 30 by August 2025. This positive movement suggests that Phoenix Farms is successfully capturing consumer interest and expanding its market presence. The noticeable jump in sales figures from May to August underscores this trend, indicating a strategic or operational shift that could be worth exploring further.

While Phoenix Farms has made impressive strides in Colorado, their absence from the top 30 rankings in other states or provinces suggests potential areas for growth or challenges in those markets. The lack of a top 30 presence indicates either a highly competitive landscape or a need for Phoenix Farms to strengthen its brand recognition and distribution channels outside of its current stronghold. Understanding the factors behind their success in Colorado could provide insights into how they might replicate this performance in other regions.

Competitive Landscape

In the competitive landscape of the Colorado flower market, Phoenix Farms has demonstrated a remarkable upward trajectory in recent months, significantly improving its rank from 81st in May 2025 to an impressive 30th by August 2025. This surge in rank is indicative of a substantial increase in sales, showcasing a more than fivefold growth from May to August. In contrast, competitors like LoCol Love (TWG Limited) and NOBO have maintained relatively stable positions, with LoCol Love improving slightly from 40th to 35th and NOBO fluctuating between 36th and 47th. Meanwhile, Shift Cannabis and BULK Cannabis Co have experienced minor declines in rank, suggesting potential challenges in sustaining their sales momentum. Phoenix Farms' rapid ascent in rank and sales highlights its growing influence in the market, positioning it as a formidable contender against established brands.

Notable Products

In August 2025, Don Mega Bulk emerged as the top-performing product for Phoenix Farms, with impressive sales figures of 7,678 units. Cherry Punch Bulk held the second spot, showing a significant rise from its first-place ranking in July 2025, with sales reaching 5,045 units. Marsh-Mellow Bulk climbed to third place, maintaining a steady performance with 4,274 units sold. Alligator Wine Bulk and Lemon Cherry Gelato Bulk rounded out the top five, securing fourth and fifth positions respectively. Notably, Alligator Wine Bulk and Lemon Cherry Gelato Bulk entered the top five for the first time, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.