Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

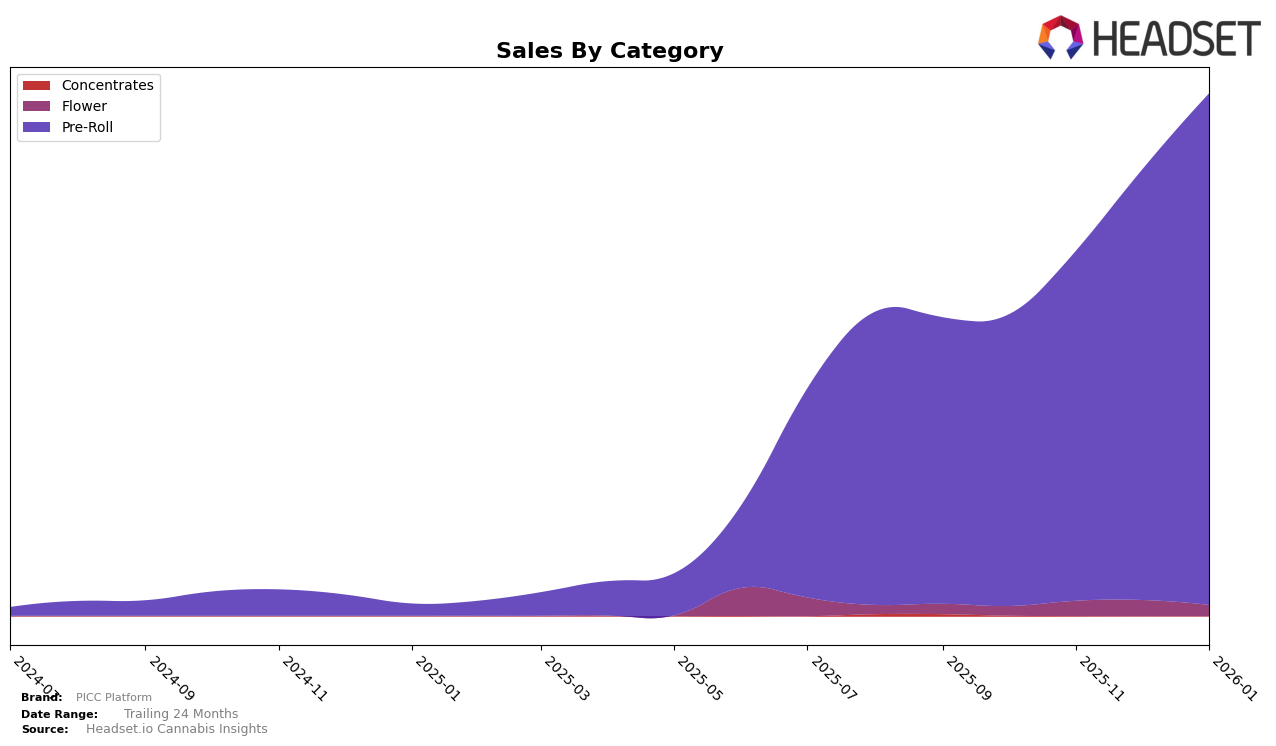

In the New York market, PICC Platform has shown a notable upward trajectory in the Pre-Roll category. Starting from a rank of 61 in October 2025, the brand improved its position to 40 by January 2026. This steady climb in rankings is accompanied by a consistent increase in sales, indicating a growing consumer preference and market presence. Despite not being in the top 30 brands initially, their progress suggests strategic moves or product improvements that resonate well with New York consumers, marking a positive trend for the brand in this state.

Meanwhile, in Washington, PICC Platform has also experienced a significant rise in the Pre-Roll category. From a rank of 52 in October 2025, the brand ascended to 23 by January 2026, demonstrating a more pronounced improvement compared to New York. This advancement into the top 30 is a strong indicator of the brand's competitive edge and market penetration in Washington. However, the absence of top 30 rankings in earlier months highlights the potential challenges the brand faced before gaining traction. The notable increase in sales aligns with their improved rankings, suggesting successful marketing or distribution strategies that could serve as a model for expansion in other regions.

Competitive Landscape

In the New York Pre-Roll category, PICC Platform has shown a notable upward trajectory in its ranking from October 2025 to January 2026. Initially positioned at 61st in October, PICC Platform climbed to 40th by January, indicating a significant improvement in market presence. This upward movement is particularly impressive considering competitors like Presidential and KOA Exotics experienced fluctuating ranks, with KOA Exotics dropping from 28th to 42nd. Meanwhile, High Peaks also saw a decline, moving from 25th to 41st. Despite these competitors having higher sales figures, PICC Platform's consistent rank improvement suggests a growing consumer preference or effective marketing strategies that are enhancing its competitive edge in the market. This trend positions PICC Platform as a rising contender in the New York Pre-Roll sector, potentially attracting more consumer interest and sales momentum in the coming months.

Notable Products

In January 2026, the top-performing product for PICC Platform was Smack - Pineapple Express way Infused Pre-Roll (1g), which climbed from the fifth position in December 2025 to the first position, achieving sales of 1386 units. Laff Gas - Rainier Lemon Chiffon x Lemon Fuel Infused Pre-Roll (1g) secured the second spot, debuting in the rankings this month. Ichi Roll - Super Slushie Pre-Roll (1g) also made its first appearance, coming in third. #Juan-Roll - Sour Berry Pre-Roll (1g) dropped from its consistent first-place ranking in the previous months to fourth place. Meanwhile, #Juan-Roll - Berry Lemonade Pre-Roll (1g) held the fifth position, showing a slight decline from its second-place ranking in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.