Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

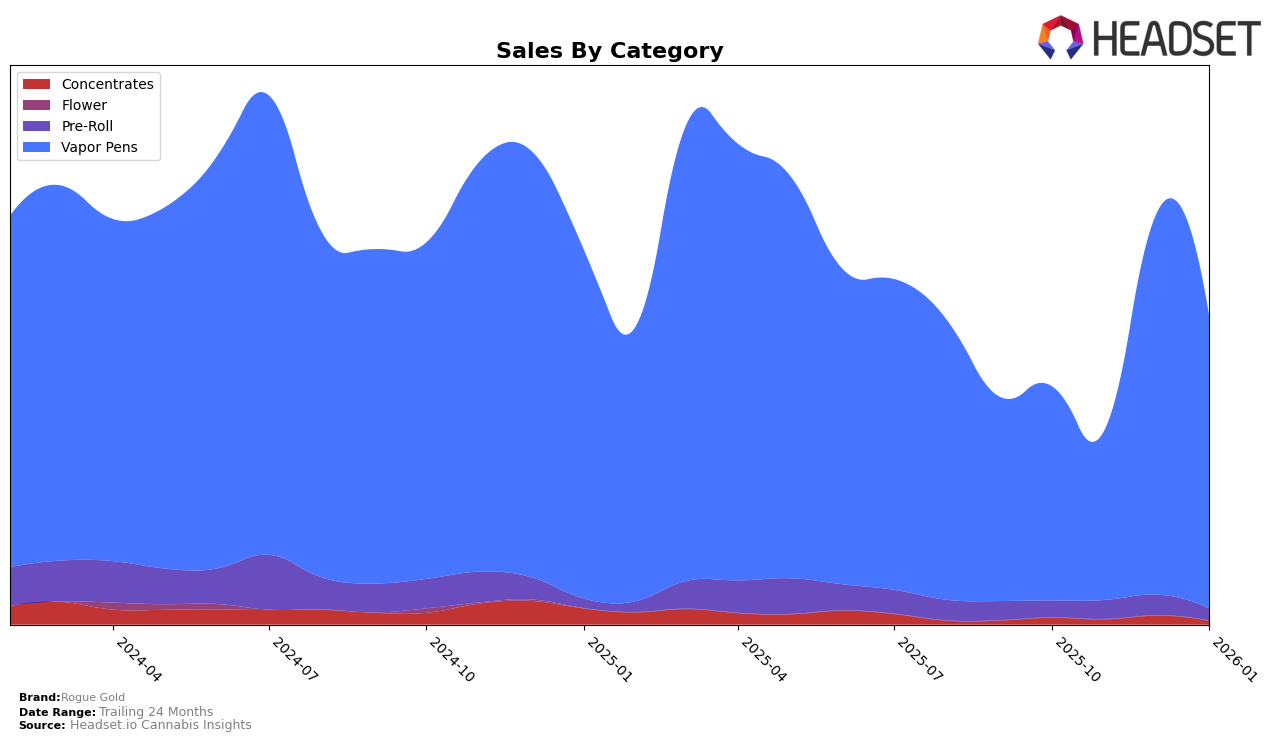

Rogue Gold's performance in the Oregon market has shown varied results across different product categories. In the Vapor Pens category, the brand demonstrated a strong presence, moving from a rank of 24 in October 2025 to 15 by December, before settling at 19 in January 2026. This upward trajectory in the latter months suggests a growing consumer preference for their vapor pens, which is further supported by a noticeable increase in sales during this period. However, Rogue Gold's absence from the top 30 in the Concentrates category throughout these months indicates a challenging market position in that segment, highlighting a potential area for strategic improvement.

In the Pre-Roll category, Rogue Gold experienced fluctuations in its rankings. Starting at 71 in October 2025, the brand improved its position to 62 by December, yet dropped to 72 in January 2026. This volatility suggests that while there was an initial positive reception, sustaining that momentum proved challenging. The sales figures reflect this inconsistency, with a significant dip in January following a peak in December. The brand's ability to regain and maintain a strong position in this category could be crucial for future growth, especially considering the competitive nature of the pre-roll market in Oregon.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Rogue Gold has demonstrated a dynamic performance over the past few months, particularly in terms of rank and sales. Starting from October 2025, Rogue Gold was ranked 24th, but saw a dip to 25th in November, before making a significant leap to 15th in December, and then settling at 19th in January 2026. This fluctuation is indicative of a volatile market position, yet the substantial sales increase in December suggests a potential strategic move or product launch that resonated well with consumers. In contrast, Bobsled Extracts maintained a steady 18th rank throughout the same period, indicating consistent performance. Meanwhile, Beehive Extracts and Private Stash experienced more modest rank changes, with Beehive Extracts notably climbing from 28th to 19th by December, before slightly dropping to 21st in January. The competitive dynamics suggest that while Rogue Gold has the potential for rapid sales growth, maintaining a stable rank amidst strong competitors like Boujee Blendz (OR), which consistently ranked higher, will require strategic marketing and product innovation.

Notable Products

In January 2026, the top-performing product for Rogue Gold was the Lemon Berry Tarts Oil Cartridge (1g) in the Vapor Pens category, leading the sales with 1,205 units sold. Following closely were Sweet Strawberry Flavored Oil Cartridge (1g) and Pot of Gold Flavored Distillate Cartridge (1g), ranking second and third respectively. Rocket Fuel Distillate CO2 Cartridge (1g) held the fourth position, while Lemon Slushie Fruit Oil Cartridge (1g) rounded out the top five. Notably, this is the first month these products have been ranked, indicating a strong debut for Rogue Gold's Vapor Pens lineup. The sales figures suggest a competitive market presence, with each product making a significant impact in its category.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.