May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

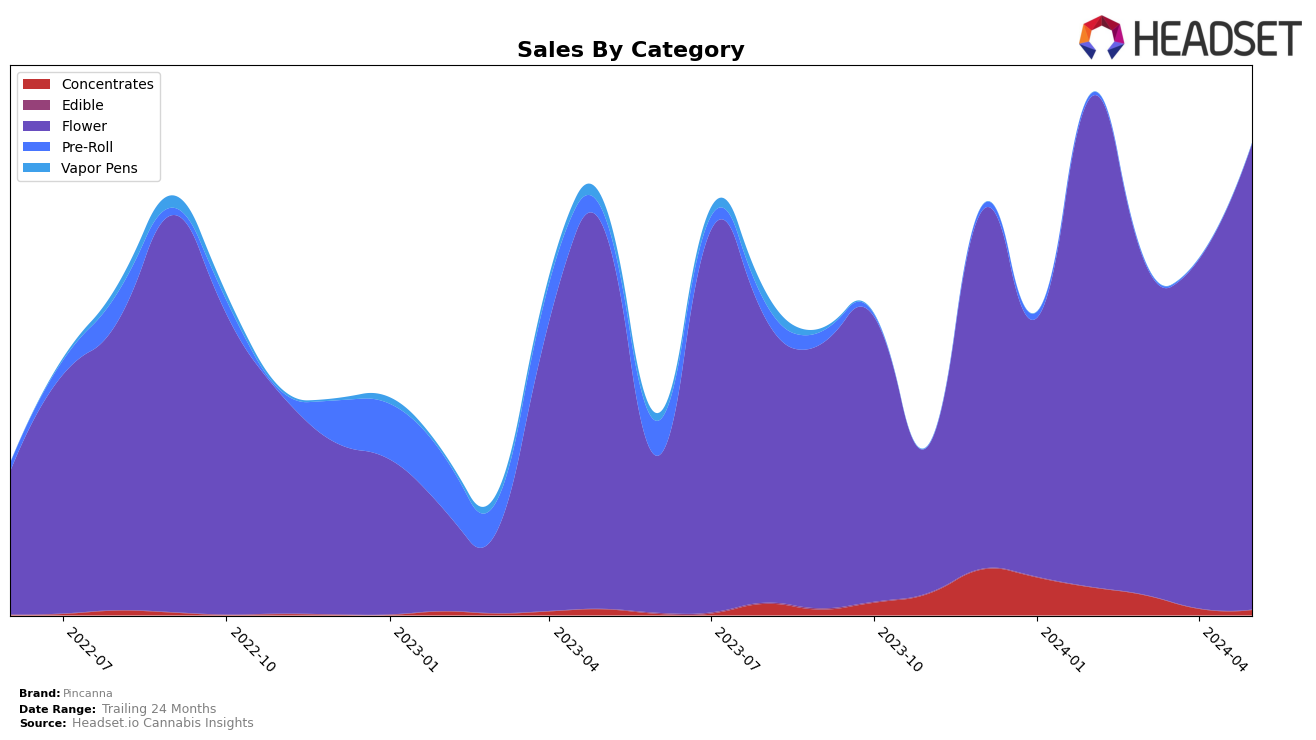

Pincanna's performance in the Michigan market has shown some interesting trends across various categories. In the Concentrates category, Pincanna did not make it into the top 30 rankings from March through May 2024, which indicates a decline in their market presence in this segment. Despite this, their sales in February 2024 were notable, but there has been a downward trend since then. This drop in rankings and sales could be a point of concern for the brand as they evaluate their strategies in the Concentrates category.

In contrast, Pincanna's performance in the Flower category in Michigan has been more stable and encouraging. Starting at rank 28 in February 2024, Pincanna experienced a dip in March, falling to rank 49, but then managed to climb back up to rank 30 by May 2024. This recovery indicates resilience and a positive trend in their Flower category. The sales figures reflect a similar pattern, with a dip in March followed by a steady increase in the subsequent months, suggesting that Pincanna's Flower products are regaining traction in the Michigan market.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Pincanna has experienced notable fluctuations in its ranking and sales over the past few months. In February 2024, Pincanna held a strong position at rank 28, but saw a significant drop to rank 49 in March 2024. However, the brand managed to recover, climbing back to rank 30 by May 2024. This volatility is contrasted by the steady rise of Traphouse Cannabis Co., which improved its rank from 70 in February to 28 in May, indicating a strong upward trend. Meanwhile, Redemption experienced a decline, dropping from rank 29 in February to 35 in May, suggesting a potential loss of market share. Emerald Mountain Labs (MI) also showed a remarkable improvement, moving from rank 62 in February to 29 in May. Lastly, Uplyfted Cannabis Co. demonstrated consistent performance, maintaining a position within the top 50 throughout the period. These competitive dynamics highlight the challenges and opportunities Pincanna faces in maintaining and improving its market position amidst aggressive competitors.

Notable Products

In May-2024, the top-performing product for Pincanna was Jungle Cake (3.5g) in the Flower category, which saw a significant surge to the number one rank with sales of 16,159. Snowman (3.5g), also in the Flower category, moved to the second position with sales of 11,909, dropping from its first-place position in April. Frosted Cherry Cookies (3.5g) maintained a strong presence, ranking third with sales of 11,207, down from its peak in February. GGB (3.5g) re-entered the rankings at fourth place with 9,474 in sales, having been absent in March and April. Sunshine #4 (3.5g) slipped to the fifth position with sales of 6,053, showing a decline from its third-place rank in April.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.