Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

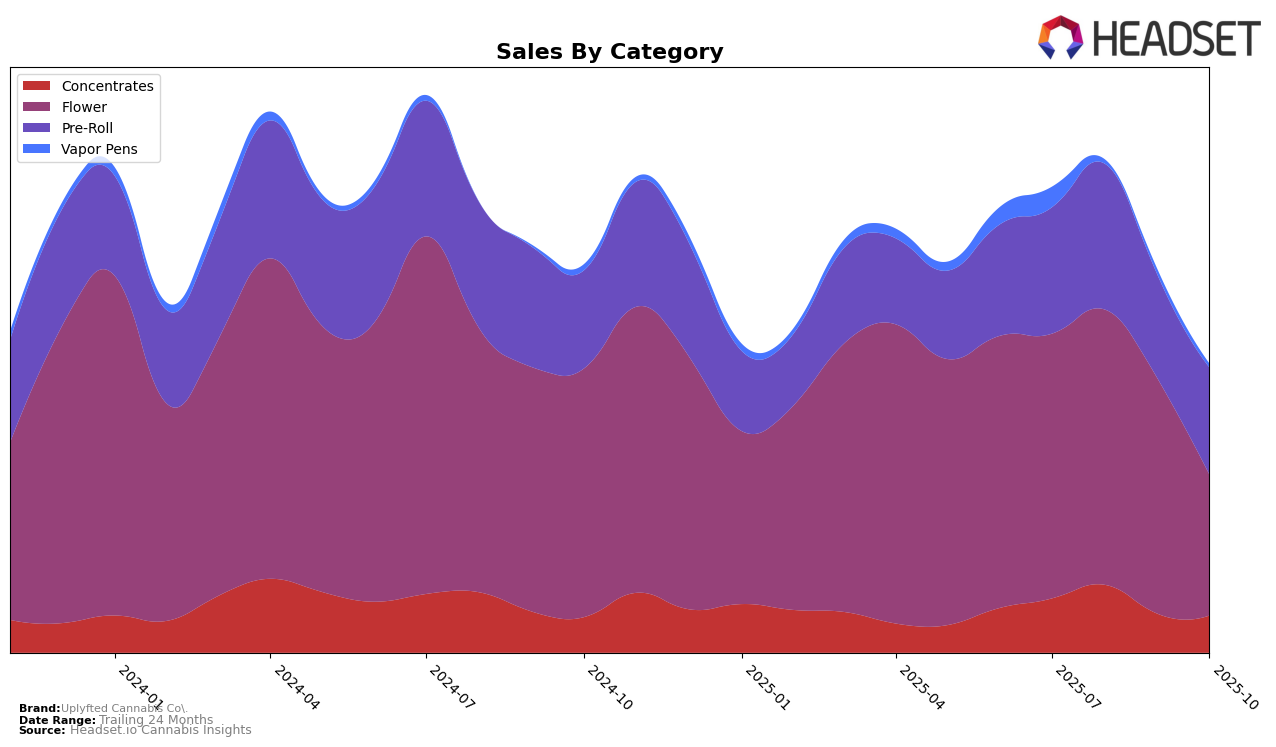

In the Michigan market, Uplyfted Cannabis Co. has shown varied performance across different product categories. In the Concentrates category, the brand saw a decline from a rank of 21 in July 2025 to 30 by October 2025, indicating a challenging competitive landscape despite a peak in August. Interestingly, their performance in the Pre-Roll category remained relatively stable, maintaining a position within the top 30 throughout the same period, suggesting a consistent consumer base. However, the Vapor Pens category presents a different picture; Uplyfted Cannabis Co. was ranked 84 in July and did not make it into the top 30 in subsequent months, highlighting a significant area for potential growth or reevaluation.

Meanwhile, the Flower category tells a more concerning story for Uplyfted Cannabis Co. in Michigan. The brand's rank dropped from 32 in July to 58 by October, which might reflect either increased competition or a shift in consumer preferences. This decline in rank is paired with a substantial decrease in sales, suggesting that the brand may need to reassess its strategy in this category to regain its footing. Overall, while Uplyfted Cannabis Co. maintains a presence in some categories, the fluctuations in rankings and sales indicate areas where strategic adjustments could be beneficial to strengthen their market position.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Uplyfted Cannabis Co. experienced a notable shift in its market position from July to October 2025. Initially ranked 32nd in July, Uplyfted Cannabis Co. maintained a stable position through August and September but saw a significant drop to 58th by October. This decline in rank coincides with a substantial decrease in sales, suggesting potential challenges in maintaining market share. In contrast, brands like Garcia Hand Picked and Springtime demonstrated resilience, with Garcia Hand Picked maintaining a higher rank than Uplyfted Cannabis Co. throughout the period, despite a sales dip, and Springtime recovering from an unranked position in August to surpass Uplyfted Cannabis Co. by October. Meanwhile, Rkive Cannabis showed a positive trend, climbing from 94th in August to 62nd in October, indicating a potential emerging threat. These dynamics highlight the competitive pressures Uplyfted Cannabis Co. faces in retaining its market position amidst fluctuating sales and evolving competitor strategies.

Notable Products

In October 2025, the top-performing product for Uplyfted Cannabis Co. was Permanent Marker Pre-Roll (1g) in the Pre-Roll category, regaining its number one ranking from July with a notable sales figure of 4,793 units. Sherbstack (3.5g) in the Flower category maintained its second-place position from September with consistent sales performance. Ze Marker Pre-Roll (1g) dropped one position from September, ranking third in October. OG Runtz (Bulk) experienced a significant decline, falling from first place in August and September to fourth in October. Canal St. Runtz Pre-Roll (1g) debuted in the rankings at fifth place, showing potential for future growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.