Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

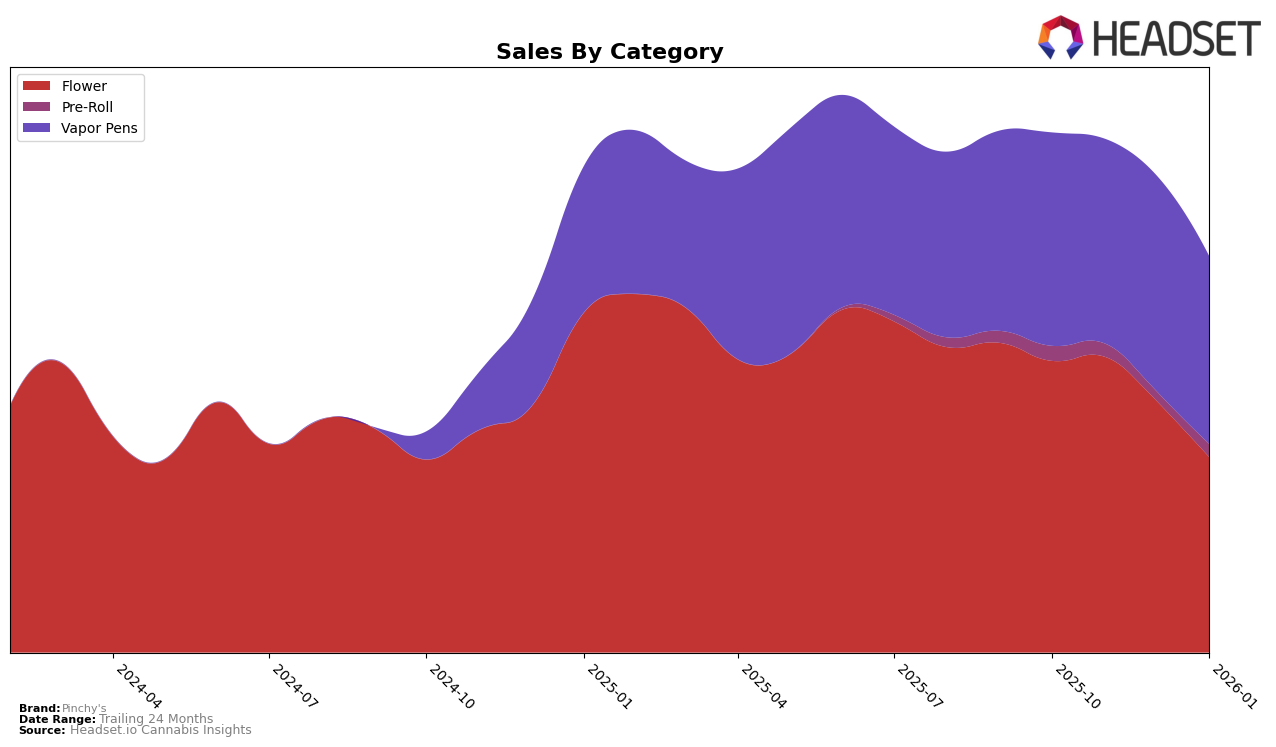

Analyzing Pinchy's performance in different categories across various states reveals some intriguing trends. In the Missouri market, Pinchy's has shown fluctuating performance in the Flower category, dropping from 18th place in October 2025 to 27th by January 2026. This downward trend could be a concern for the brand, especially considering their sales decreased from $806,198 in October to $539,555 in January. In contrast, their Vapor Pens category has demonstrated more stability, maintaining a consistent position within the top 20, despite slight fluctuations. This consistency suggests a solid consumer base for their vapor products in Missouri, even though sales slightly dipped from November to January.

On the other hand, Pinchy's performance in the Pre-Roll category in Missouri is less impressive, as they failed to make it into the top 30 in December 2025. However, they managed to climb back to 57th place by January 2026, indicating a potential recovery or strategic shift. This fluctuation might suggest challenges in sustaining consumer interest or facing stiff competition. The lack of a top 30 ranking in December could be seen as a setback, yet their ability to re-enter the rankings in January could point to a responsive strategy or seasonal demand changes. These insights into Pinchy's category performance across states and provinces can help stakeholders make informed decisions about potential growth areas and strategic adjustments.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Pinchy's has experienced a notable decline in its market position, dropping from 18th place in October 2025 to 27th by January 2026. This downward trend in rank is mirrored by a decrease in sales over the same period. In contrast, Sundro Cannabis and Hermit's Delight have shown resilience, with Hermit's Delight climbing from 31st to 26th place, indicating a potential shift in consumer preference. Meanwhile, Atta experienced fluctuations but maintained a stronger sales performance compared to Pinchy's, despite a temporary dip in rank. The ascent of Scout & Seed from 52nd to 29th suggests an emerging threat as they rapidly gain traction. These dynamics highlight the increasing competition Pinchy's faces, necessitating strategic adjustments to regain its footing in the Missouri market.

Notable Products

In January 2026, Pinchy's top-performing product was the Fire Cake Pre-Roll (1g), which secured the number one rank. Following closely, the Lemon Cherry Gelato (3.5g) climbed to the second position, despite a drop in sales from 2008.0 in December 2025 to 1441.0 in January 2026. The Bacio Gelato Distillate Cartridge (1g) made a notable entry into the rankings at the third position. The Orange 43 (3.5g) fell to fourth place, showing a consistent decline from its peak rank in October 2025. Meanwhile, Rainbow Icee (3.5g) entered the rankings for the first time, capturing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.