Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

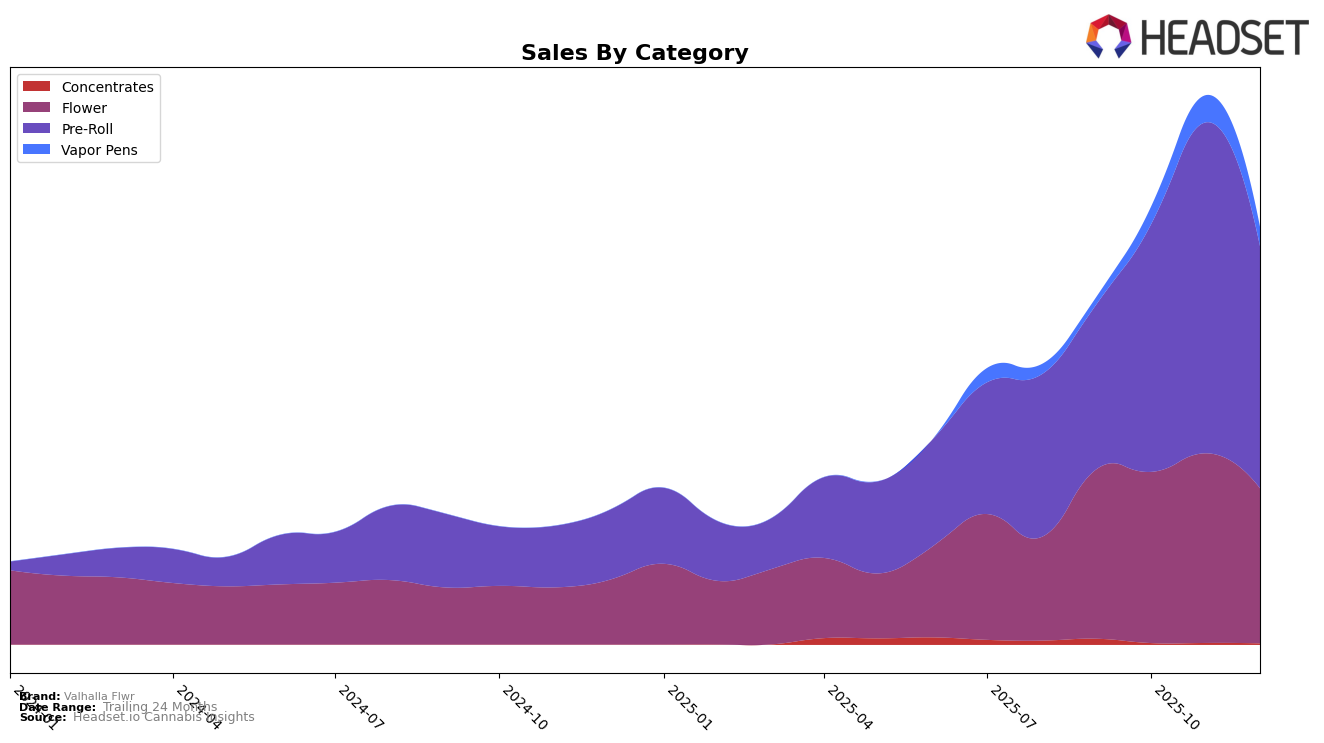

Valhalla Flwr has shown notable fluctuations in its performance across different categories in British Columbia. In the Flower category, the brand exhibited a strong presence, peaking at the 2nd position in October 2025, before dropping to 13th by December. This movement suggests a competitive market environment and possibly seasonal demand shifts. Meanwhile, in the Pre-Roll category, Valhalla Flwr achieved the top rank in October, a significant leap from 16th in September, indicating a successful strategic move or product launch that resonated well with consumers. However, by December, the brand had slipped to the 8th position, which might be a reflection of increased competition or changing consumer preferences.

In the Vapor Pens category within British Columbia, Valhalla Flwr managed to enter the top 30 rankings for the first time in October 2025, securing the 28th spot, and maintained its presence through December, albeit with slight fluctuations. This entry into the rankings could signify the brand's expansion efforts or a growing acceptance of its products in this segment. Conversely, in Ontario, Valhalla Flwr's performance in the Pre-Roll category has been less remarkable, consistently ranking outside the top 30. This persistent low ranking suggests challenges in gaining traction in this market, which could be due to stronger competition or differing consumer tastes. These insights highlight the varying dynamics and challenges Valhalla Flwr faces across different regions and categories.

Competitive Landscape

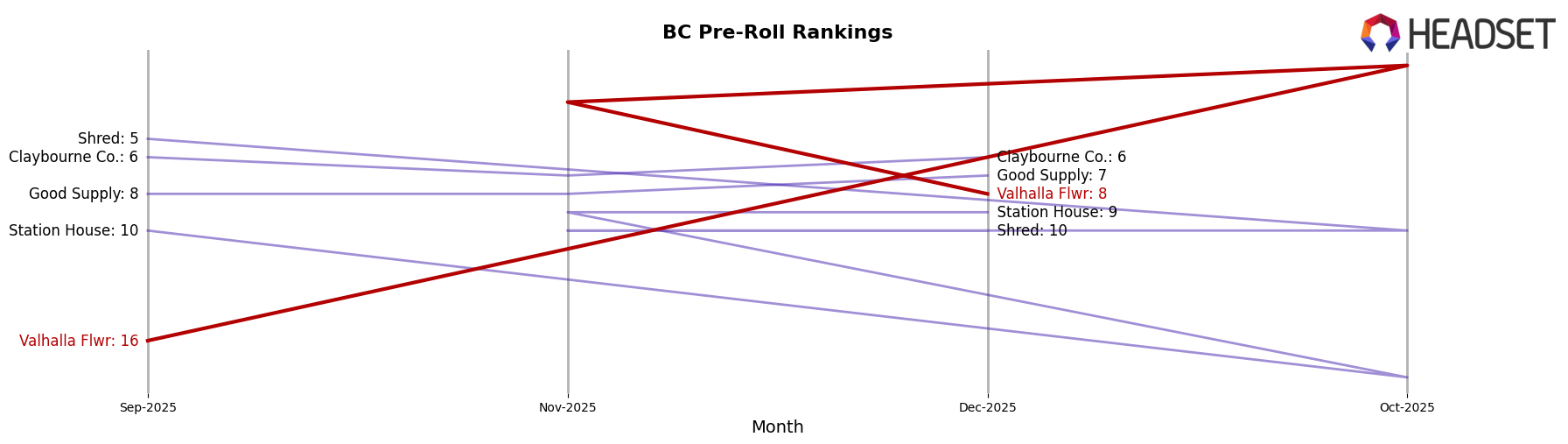

In the competitive landscape of the pre-roll category in British Columbia, Valhalla Flwr has demonstrated remarkable volatility in its market position, reflecting both opportunities and challenges. After a significant leap from 16th place in September 2025 to the top rank in October, Valhalla Flwr experienced a decline to 3rd in November and further to 8th in December. This fluctuation suggests a dynamic market presence, potentially driven by promotional activities or product launches in October. Despite the decline, Valhalla Flwr's sales in November were notably higher than those of competitors like Good Supply and Claybourne Co., who maintained more stable ranks but with lower sales figures in comparison. Brands like Shred and Station House also show varied performance, with Shred dropping to 10th place from 5th in September, indicating potential market shifts that Valhalla Flwr could capitalize on to regain its top position.

Notable Products

In December 2025, the top-performing product for Valhalla Flwr was Rainbow Lava Pre-Roll 3-Pack (1.5g), maintaining its first-place ranking from November with sales reaching 7412. Pebble Punch Pre-Roll 3-Pack (1.5g) held steady in the second position, showing a consistent upward trend from September. Twisted Trio Variety Pack Pre-Roll 3-Pack (1.5g) secured the third rank, although it experienced a decrease in sales compared to November. Rainbow Lava Diamond & Terp Sauce Infused Pre-Roll 5-Pack (2.5g) entered the top five in December at the fourth position, marking its first appearance in the rankings since October. Project X Pre-Roll 3-Pack (1.5g) emerged in fifth place, highlighting its entry into the competitive landscape for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.