Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

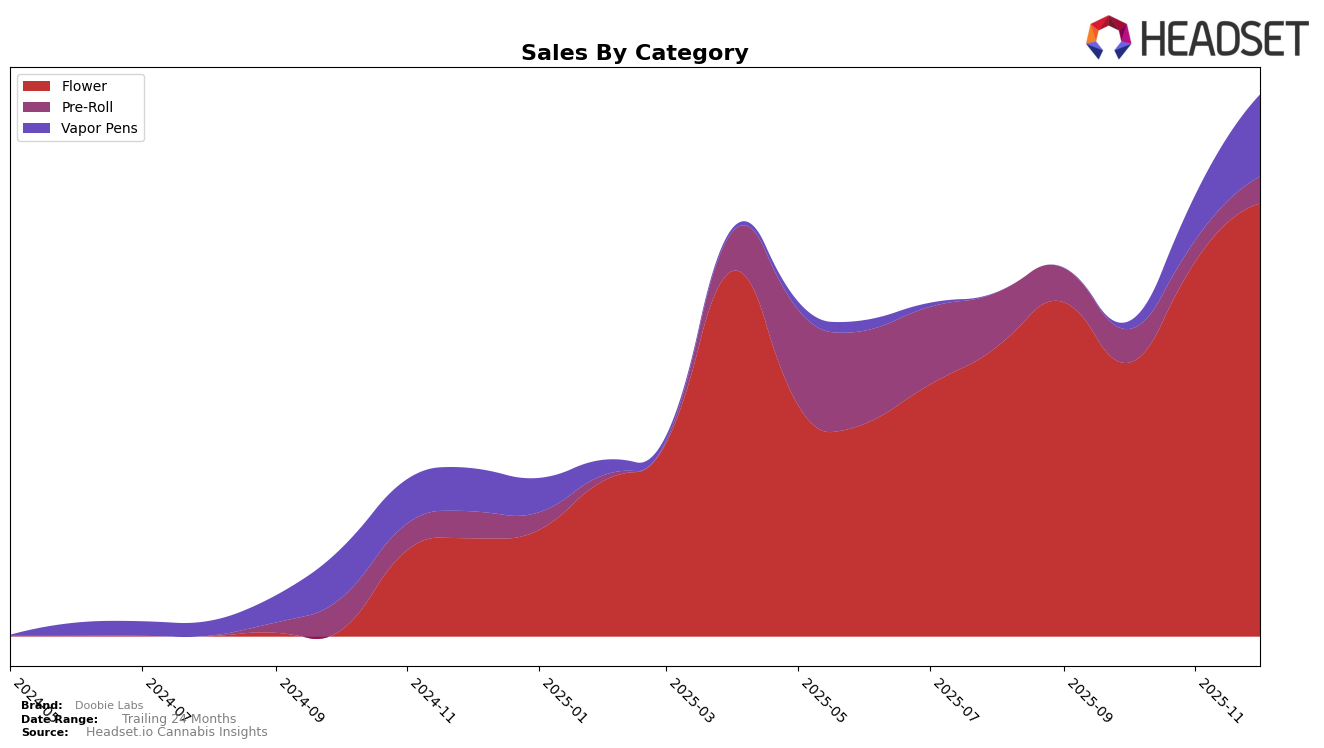

Doobie Labs has shown a notable performance in the New York market, particularly in the Flower category. After a slight dip in October, where they fell out of the top 30, Doobie Labs rebounded strongly by November, securing the 22nd position and maintaining it through December. This upward trajectory is indicative of a recovery and growth in their market share, with December sales reaching an impressive $558,789. Such a recovery highlights Doobie Labs' resilience and ability to capture consumer interest, even in a competitive marketplace.

In contrast, the Vapor Pens category in New York has been a challenging arena for Doobie Labs. The brand did not rank in the top 30 until November, debuting at 68th position and improving to 50th by December. This late entry into the rankings suggests either a recent strategic push into this category or a slow build-up in consumer acceptance. Despite these challenges, the significant sales increase from November to December indicates a growing consumer base and potential for future growth in this segment.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Doobie Labs has shown a dynamic shift in its ranking and sales performance over the last few months of 2025. Starting from a rank of 26 in September, Doobie Labs experienced a dip to 33 in October but made a notable recovery to 22 by November and maintained this position in December. This recovery aligns with a significant increase in sales from October to December, indicating a positive response to potential strategic adjustments. In contrast, Stone Road fluctuated around the 18 to 24 rank range, while Jetpacks remained stable at 23, and Hepworth showed variability, dropping to 26 in November but recovering to 21 in December. Notably, RIPPED made a significant leap from not being in the top 20 in September to reaching 19 in November, showcasing a remarkable sales surge. This competitive environment highlights the volatility and opportunities within the New York Flower market, where Doobie Labs' recent performance suggests a promising upward trend.

Notable Products

In December 2025, Doobie Labs' top-performing product was Blue Lobster (3.5g) in the Flower category, maintaining its number one rank consistently from September through December despite a noticeable decline in sales from 5020 in September to 2187 in December. Day Wrecker (3.5g) emerged as the second-best product, making its debut in the rankings this month. Zangria (3.5g) improved its position to third place, up from fourth in November, showing a positive trend in sales. Grape Stomper (3.5g) dropped from second place in November to fourth in December, indicating a slight decrease in sales performance. Maraschino Runtz (3.5g) re-entered the rankings at fifth place, having been unranked in November, suggesting a recovery in its market presence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.