Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

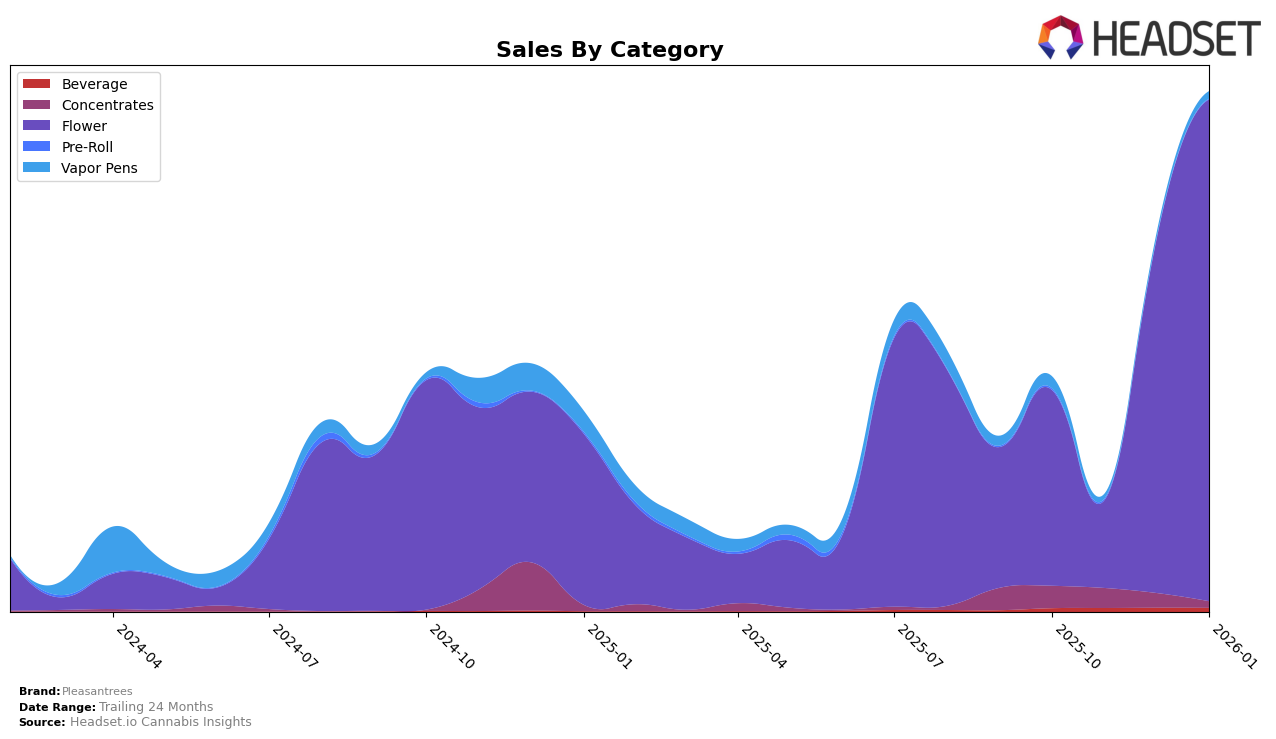

In the state of Michigan, Pleasantrees has demonstrated a notable improvement in their performance within the Flower category. By January 2026, the brand climbed to rank 58, a significant jump from not being within the top 30 brands in the preceding months. This upward movement indicates a growing market presence and possibly an increase in consumer preference or effective distribution strategies. The sales figures also show a positive trend, with sales reaching $430,963 in January 2026, highlighting the brand's successful penetration in the Michigan market.

However, the absence of Pleasantrees in the top 30 rankings for the months of October, November, and December 2025 suggests that the brand had challenges in maintaining a competitive edge during those periods. This could point to a variety of factors, such as increased competition or fluctuations in consumer demand. The improvement in January 2026 could be attributed to strategic adjustments or seasonal factors favoring their product offerings. Understanding these dynamics and the factors contributing to their resurgence in January can provide deeper insights into the brand's overall strategy and market adaptability.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Pleasantrees has shown a notable improvement in its market position, climbing from being unranked in October and November 2025 to securing the 91st spot in December 2025 and further advancing to 58th in January 2026. This upward trajectory suggests a positive reception and growing consumer interest. In contrast, Garcia Hand Picked experienced a fluctuating performance, peaking at 38th in December 2025 before dropping to 56th in January 2026, indicating potential volatility or market challenges. Meanwhile, Strane maintained relatively stable rankings, with a slight dip from 49th in November 2025 to 54th in January 2026, which could suggest consistent consumer demand. Zips and True Health have shown less dramatic changes, with Zips hovering around the mid-50s to 60s rank and True Health maintaining a consistent presence in the mid-60s. These dynamics highlight Pleasantrees' potential for continued growth and increased market share in the coming months.

Notable Products

In January 2026, the top-performing product for Pleasantrees was Purple Milk (Bulk) in the Flower category, securing the first rank with sales of 1847 units. Poison Berries (Bulk) followed closely in second place, indicating strong performance within the same category. Jet Fuel Runtz (Bulk) climbed to third place from its previous fourth-place ranking in December 2025, showcasing a notable increase in sales momentum. Truffle Runtz Smalls (Bulk) made its debut in the rankings at fourth place, while Galactic Warheadz (Bulk) secured the fifth position. These rankings highlight a shift in consumer preference towards Purple Milk and Poison Berries, as they were not ranked in the previous months but soared to the top in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.