Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

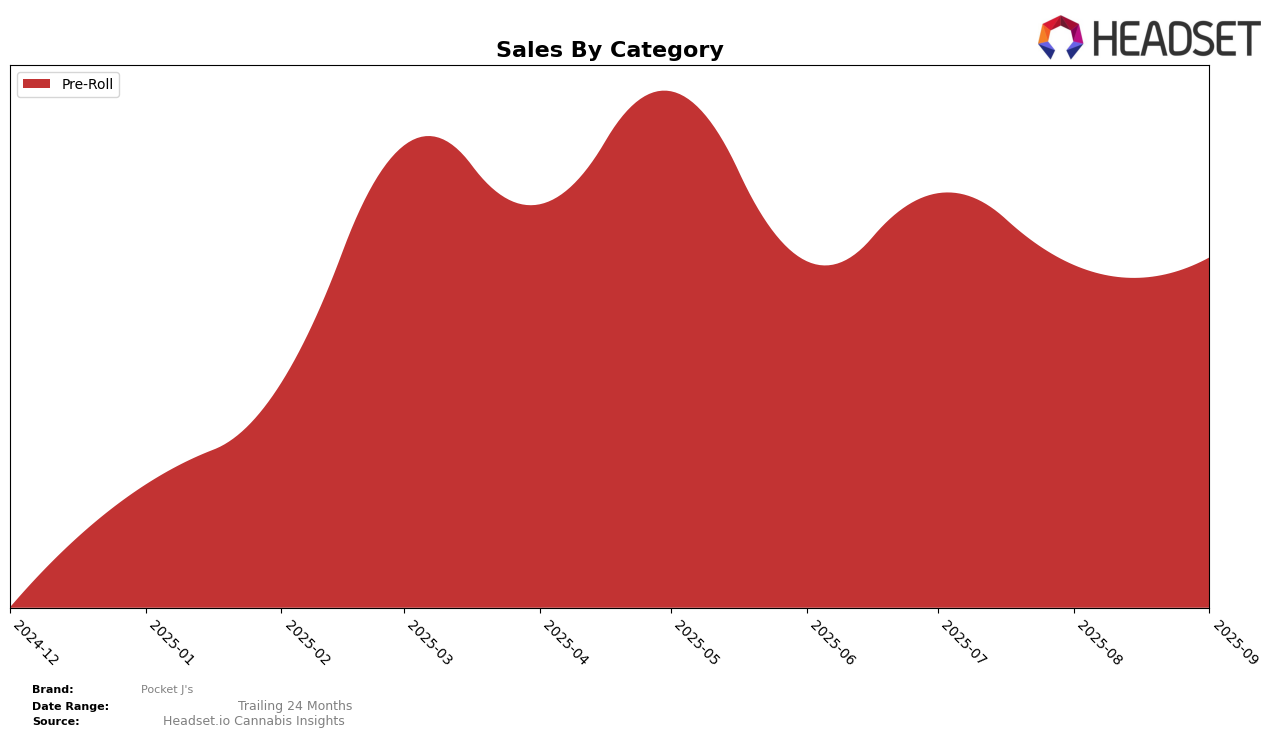

Pocket J's has shown a noteworthy performance trajectory in the Pre-Roll category across different states, with particular attention to its movement in Missouri. In June 2025, the brand was ranked 30th, and although it slipped slightly in the subsequent months of July and August, falling to 31st and 33rd respectively, it made a commendable recovery by September, climbing back to 28th place. This fluctuation in rankings indicates a competitive market environment and suggests that Pocket J's is capable of regaining momentum despite temporary setbacks. The sales figures, which started at approximately $138,953 in June and saw a slight increase and subsequent fluctuation, further highlight the brand's resilience and ability to adapt to market dynamics.

While Pocket J's did not maintain a steady presence in the top 30 brands in Missouri during July and August, their re-entry into the rankings by September is a positive indicator of their market strategy's effectiveness. The absence of rankings in certain months suggests areas for potential growth and improvement. This performance pattern is crucial for stakeholders looking to understand the brand's market positioning and competitive edge. Observing these movements could provide insights into the brand's operational strategies and consumer reception, especially in a market as dynamic as Missouri's. For a deeper dive into how Pocket J's navigates other regions and categories, further analysis would be required.

Competitive Landscape

In the competitive landscape of the Missouri Pre-Roll category, Pocket J's has demonstrated a stable yet slightly fluctuating presence in the rankings over the past few months. Despite not breaking into the top 20, Pocket J's maintained a consistent position, peaking at rank 28 in September 2025. This stability is notable when compared to competitors like TRIP, which consistently ranked lower, and Farmer G, which showed a significant upward trend, climbing from rank 40 in June to 30 in September. Meanwhile, Bambino / Bambino Blunts experienced a decline from rank 20 in July to 26 in September, indicating potential volatility. Rooted (MO) also showed improvement, moving from rank 34 in June to 27 in September. These dynamics suggest that while Pocket J's maintains a steady course, there is a competitive pressure from brands like Farmer G and Rooted (MO) that are gaining traction, which could impact Pocket J's future market positioning and sales growth.

Notable Products

For September 2025, the top-performing product from Pocket J's is the OG Lime Killer Wax Infused Pre-Roll 5-Pack, leading the sales with a notable figure of 1049 units sold. Following closely is the Lemon Cherry Gelato Infused Pre-Roll 5-Pack, securing the second spot with strong sales performance. The Tangerine Dream Infused Pre-Roll 5-Pack comes in third, maintaining a steady presence in the rankings. The Clementine Wax Infused Pre-Roll 5-Pack, which was ranked third in August, has slipped to fourth place. Meanwhile, the Lemon Cherry Gelato Pre-Roll 5-Pack debuts in the rankings at fifth position this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.