Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

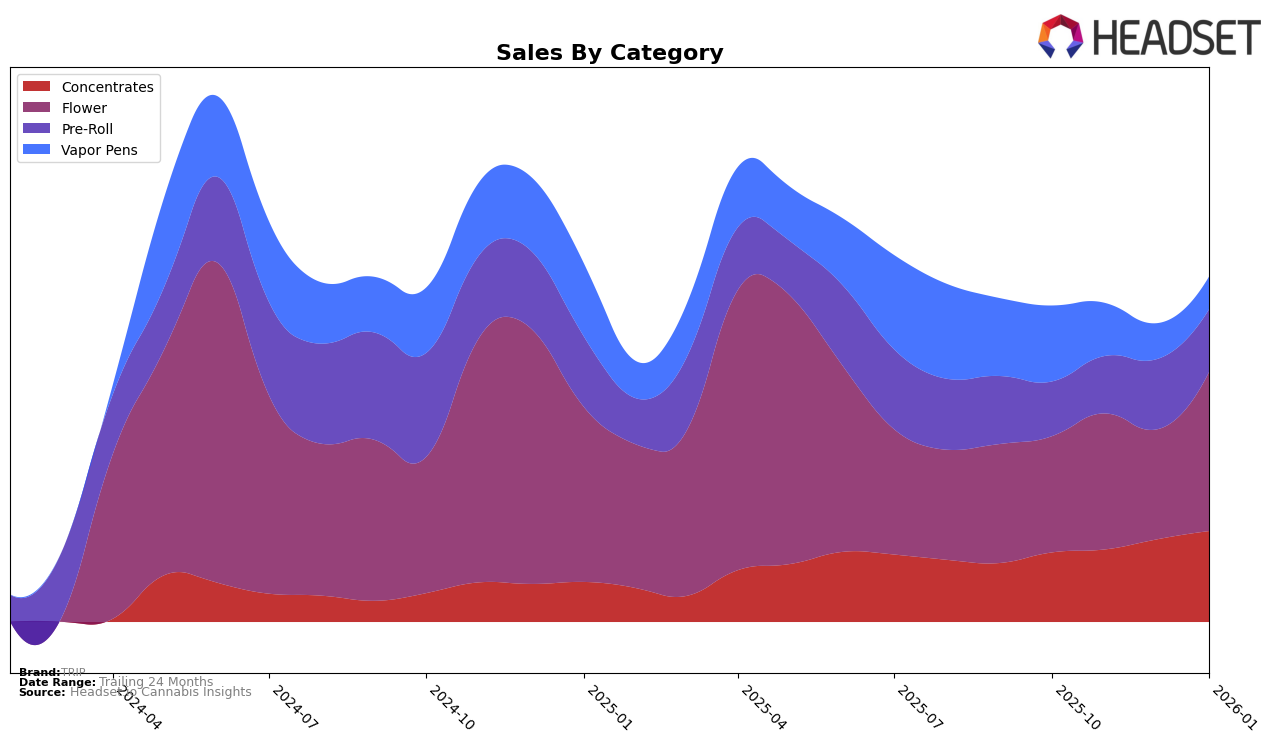

TRIP has shown a notable upward trajectory in the Concentrates category within Arizona, moving from a rank of 9 in October 2025 to 6 by January 2026. This steady climb reflects a consistent increase in sales for this category, with sales figures rising from $142,121 to $186,043 over the same period. In contrast, their performance in the Vapor Pens category in Arizona indicates a declining trend, as they dropped out of the top 30 by December 2025 and continued to slide to rank 39 in January 2026. This suggests that while TRIP is gaining traction in Concentrates, they may need to reassess their strategy for Vapor Pens in this market.

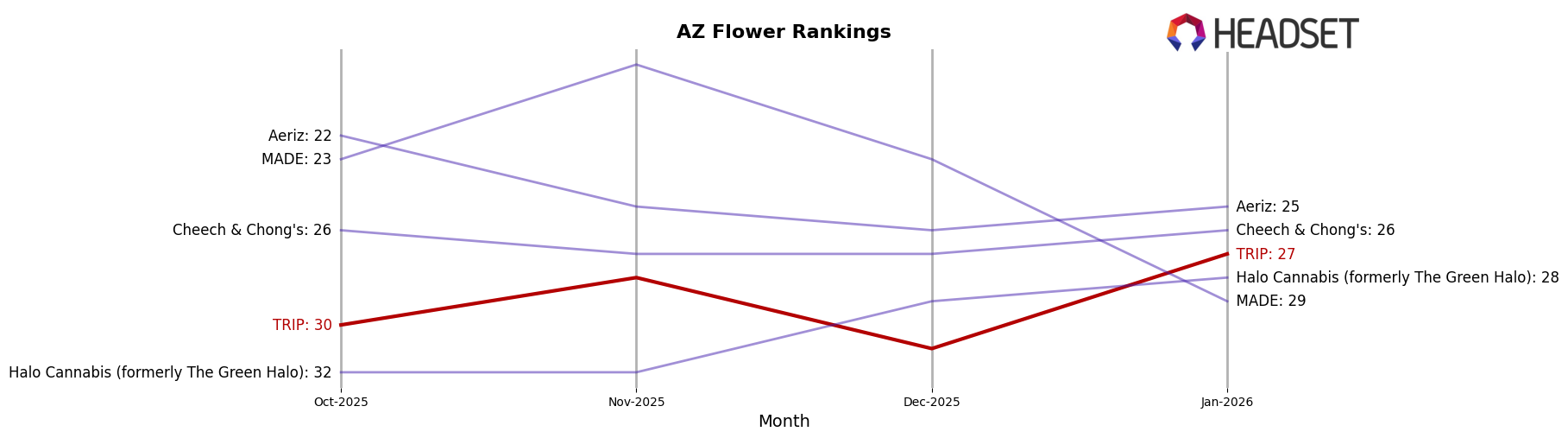

In terms of their Flower category performance in Arizona, TRIP experienced fluctuations, dropping slightly out of the top 30 in December 2025 but recovering to rank 27 by January 2026. This recovery could be indicative of strategic adjustments or market shifts favoring their products. Meanwhile, in Missouri, TRIP's Pre-Roll category saw an improvement, reaching a rank of 29 in December 2025 before slipping to 33 in January 2026. The brief entry into the top 30 suggests potential in this category, although sustaining this position remains a challenge. These movements highlight the varying dynamics TRIP faces across different states and product categories.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, TRIP has shown a dynamic performance from October 2025 to January 2026. Although TRIP's rank fluctuated, dropping to 31st in December 2025, it rebounded to 27th by January 2026, indicating a positive trajectory in the market. This improvement in rank is notable considering the consistent performance of competitors like Cheech & Chong's and Aeriz, which maintained higher ranks throughout the period. Despite Halo Cannabis (formerly The Green Halo) showing an upward trend, TRIP outpaced them in January 2026. Furthermore, while MADE experienced a decline in rank from 19th in November to 29th in January, TRIP's ability to climb back up suggests resilience and potential for growth in sales. This competitive analysis highlights TRIP's capacity to navigate the market effectively amidst strong competition, making it a brand to watch in the Arizona Flower category.

Notable Products

In January 2026, Gelato 41 Pre-Roll (1g) emerged as the top-performing product for TRIP, securing the number one spot in sales. Starfighter Cured Crumble (1g) saw a significant rise in popularity, moving up to the second position from fifth place the previous month, with sales reaching 1420 units. Jet Fuel Badder (1g) maintained a consistent performance, holding the third rank for two consecutive months. Platinum Cookies Badder (1g) experienced a decline, dropping from the top spot in December to fourth in January. Sherbanger (14g) entered the rankings at fifth place, indicating a growing interest in flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.