Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

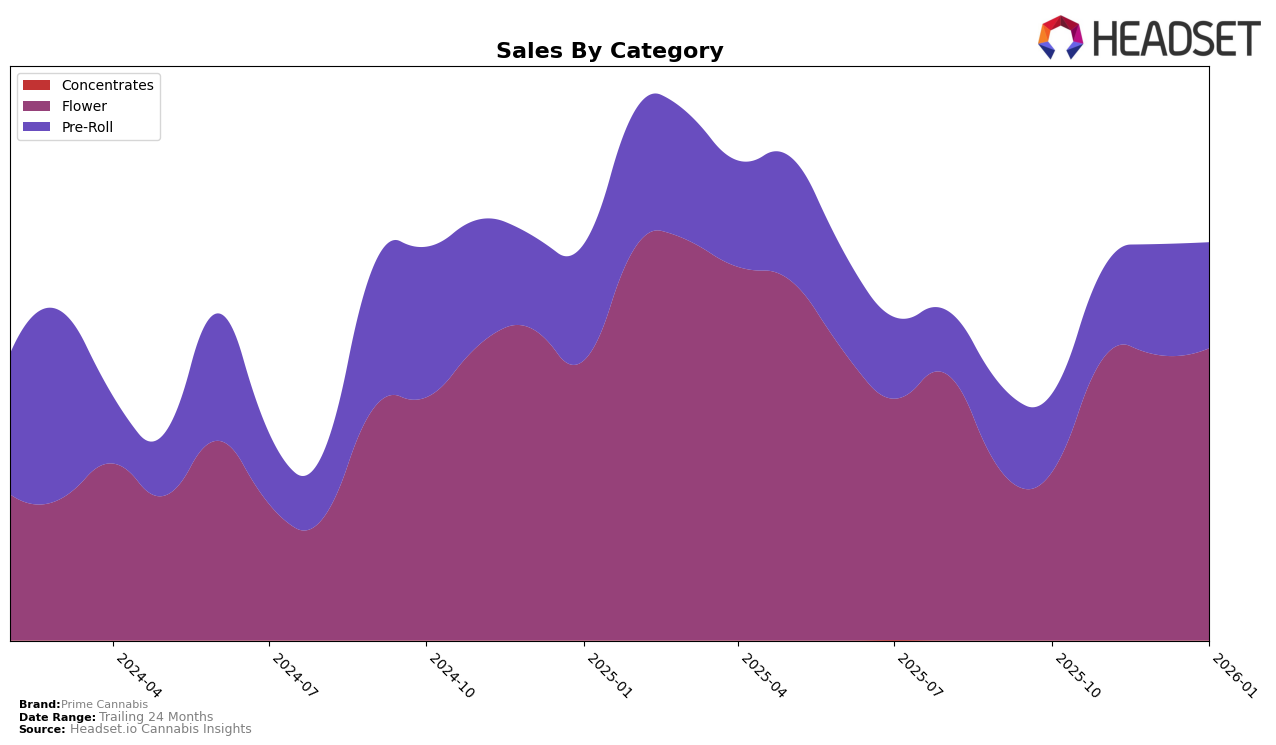

Prime Cannabis has shown a notable upward trajectory in the Nevada market, particularly in the Flower category. Starting from a rank of 41 in October 2025, the brand climbed to the 27th position by January 2026. This movement is indicative of a strengthening presence in the Flower category, suggesting increasing consumer preference and brand recognition. While specific sales figures are not disclosed here, the improvement in ranking implies a positive trend in sales performance. However, it's important to note that despite these gains, Prime Cannabis did not appear in the top 30 brands in October 2025, which highlights the competitive nature of this category in Nevada.

In the Pre-Roll category, Prime Cannabis also demonstrated consistent progress in Nevada, advancing from the 27th rank in October 2025 to maintaining the 20th position by January 2026. This steady climb suggests a solid foothold in the Pre-Roll segment, with the brand managing to sustain its position in the top 30 over several months. Such stability indicates a reliable consumer base and effective market strategies. Unlike the Flower category, Prime Cannabis was able to secure a spot within the top 30 consistently, reflecting a more established presence in Pre-Rolls. This performance could be a strategic focus area for the brand as it continues to compete in the dynamic Nevada market.

Competitive Landscape

In the highly competitive Nevada flower market, Prime Cannabis has shown a promising upward trajectory in recent months. Starting from a rank of 41 in October 2025, Prime Cannabis climbed to 27 by January 2026, indicating a consistent improvement in market positioning. This positive trend in rank is mirrored by a steady increase in sales, suggesting successful strategies in capturing consumer interest and expanding market share. Notably, Prime Cannabis has outperformed brands like The Grower Circle, which, despite a slight improvement, remained outside the top 20. Meanwhile, GB Sciences maintained a stronger position, consistently ranking higher than Prime Cannabis, yet the gap is narrowing as Prime Cannabis continues its ascent. The fluctuating performance of CAMP (NV), which dropped from 8th to 29th, highlights the volatility of the market and presents an opportunity for Prime Cannabis to further capitalize on its current momentum.

Notable Products

In January 2026, the top-performing product for Prime Cannabis was Purple Goats Pre-Roll 1g, maintaining its number one rank from December 2025 and achieving a notable sales figure of 3115 units. Following closely, Purple Goats 3.5g secured the second position, consistent with its rank from the previous month. Secret Weapon Pre-Roll 1g climbed to the third spot, improving from its fourth-place ranking in December 2025. Green Crack Pre-Roll 1g, although dropping one position from December, held the fourth rank. Lastly, Green Crack 3.5g re-entered the rankings at the fifth position after not being ranked in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.