Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

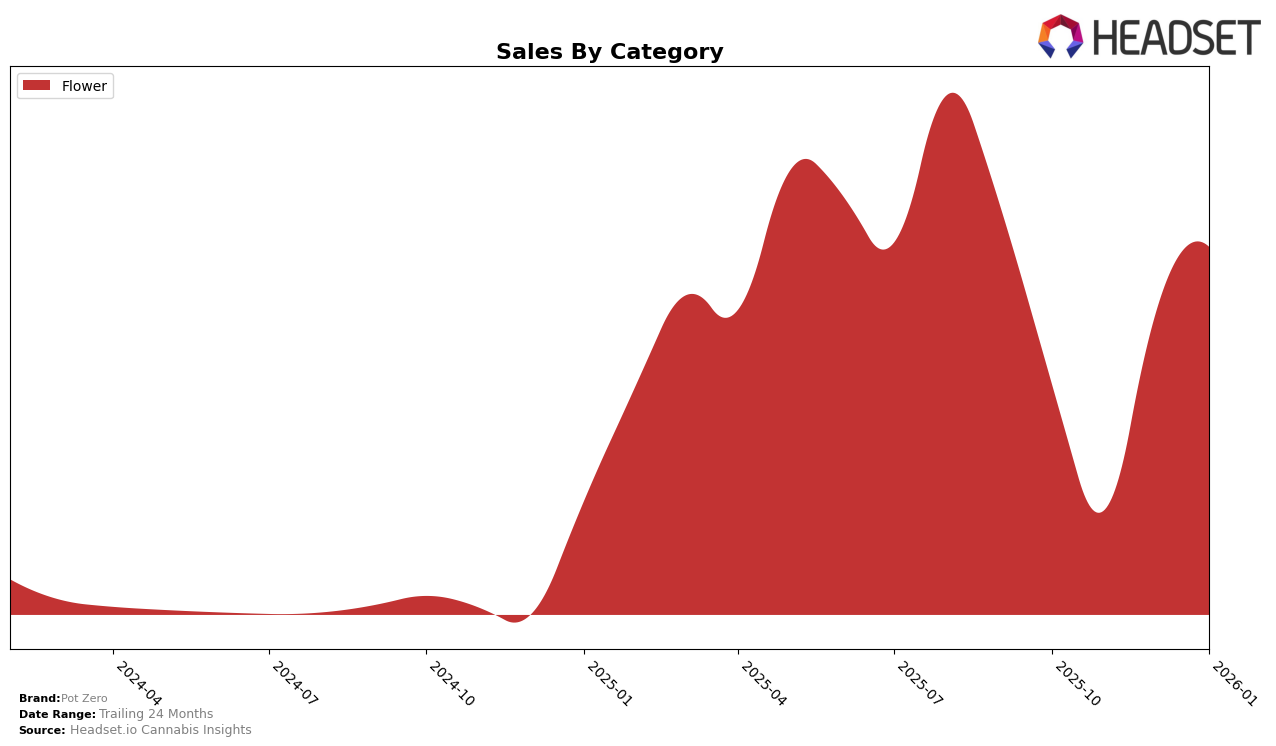

Pot Zero's performance in the Colorado market has seen significant fluctuations over recent months, particularly in the Flower category. In October 2025, the brand was ranked 43rd, which then dipped to 63rd in November. However, a substantial recovery was evident by December, as Pot Zero climbed to 31st place, further improving to 23rd by January 2026. Such a trajectory highlights a positive trend and suggests effective strategies or market conditions that favored the brand towards the end of the year. The notable jump in rankings from November to December indicates a potential pivot or seasonal demand surge that Pot Zero capitalized on.

Despite these improvements, it's important to note that Pot Zero was absent from the top 30 rankings in the early months, which might have raised concerns about its competitiveness during that period. The absence from the top 30 in November, in particular, could be seen as a setback, yet the subsequent recovery suggests resilience and adaptability. The brand's sales figures also reflect this volatility, with a low in November and a significant rebound in December and January, highlighting a strong finish to the year. This performance in Colorado could serve as a case study for understanding market dynamics and the impact of strategic adjustments in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Pot Zero has demonstrated a notable upward trajectory in recent months, reflecting a strategic recovery and growth in market presence. After starting at a rank of 43 in October 2025, Pot Zero experienced a dip to 63 in November, only to surge to 31 in December and further improve to 23 by January 2026. This positive momentum suggests effective marketing strategies or product improvements that have resonated with consumers. In comparison, Host maintained a relatively stable performance, consistently ranking within the top 30, while Boulder Built experienced a slight dip in December but regained its footing by January. Meanwhile, Grateful Grove made a remarkable leap from outside the top 50 to rank 22 in January, indicating a significant market shift. Pot Zero's ability to climb the ranks amidst such dynamic competition highlights its potential to capture further market share if the current trends continue.

Notable Products

In January 2026, Pot Zero's top-performing product was Cookies & Cream (Bulk) in the Flower category, achieving the number one rank with sales of 3428 units. Huckleberry #3 (Bulk) followed closely in second place, showing strong performance with a notable rise from previous months where it was unranked. Axilla (1g) secured the third position, also making its debut in the rankings. Caribbean Mustang (Bulk) and Purple Lagoon (Bulk) were ranked fourth and fifth, respectively, both entering the top five for the first time. This shift in rankings from earlier months indicates a significant change in consumer preferences towards these specific Flower products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.