Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

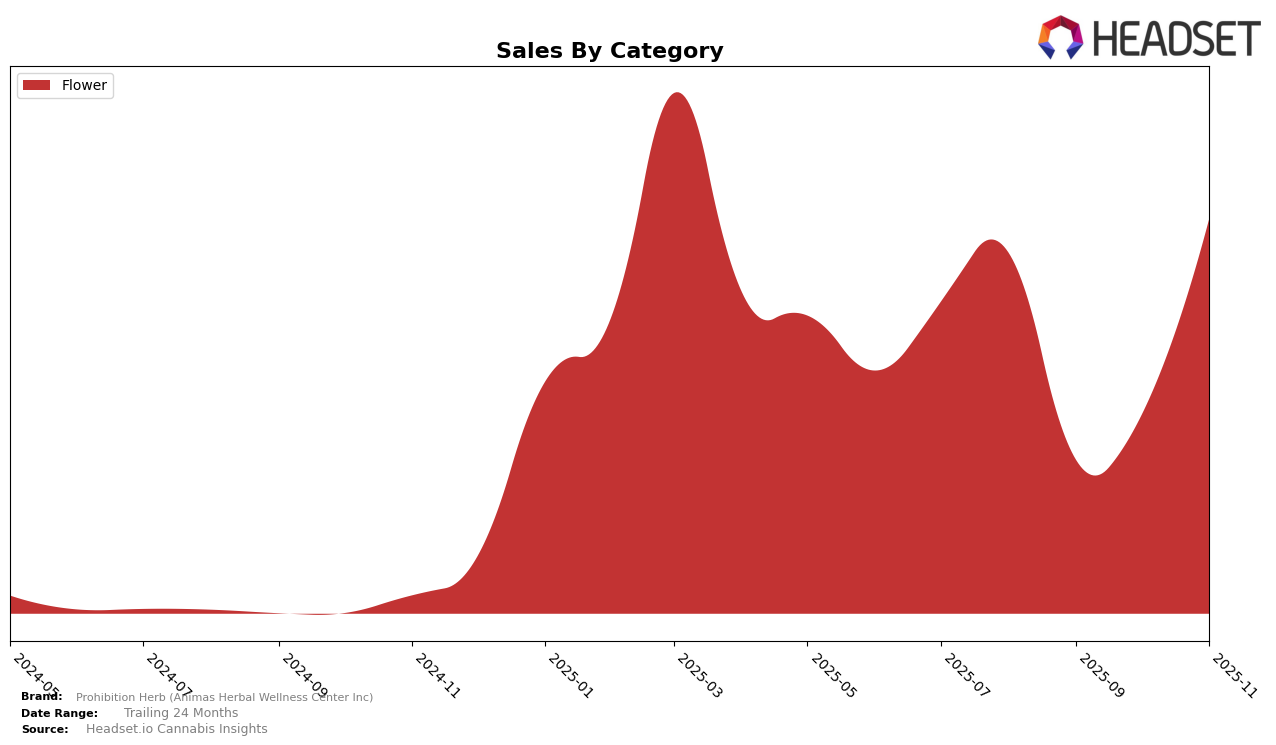

Prohibition Herb (Animas Herbal Wellness Center Inc) has shown a dynamic performance in the Colorado market, particularly within the Flower category. In August 2025, the brand was ranked 25th, but it experienced a dip to 53rd in September. However, this decline was short-lived as the brand made a notable comeback, climbing to 39th in October and further improving to 20th in November. This upward trend suggests a strong recovery and potential growth trajectory, which is particularly impressive given the competitive nature of the Flower category in Colorado. The November sales figure highlights a significant rebound from previous months, indicating a successful strategy adjustment or market response.

Despite the fluctuations in rankings, Prohibition Herb's ability to re-enter the top 30 in November is a positive indicator of its resilience and market presence. The absence from the top 30 in September could have been seen as a setback, yet the subsequent recovery demonstrates the brand's capacity to adapt and thrive. The performance in Colorado serves as a crucial indicator of the brand's overall health and strategy execution, making it a key market to watch for future developments. Observing how Prohibition Herb continues to leverage its position in Colorado could provide valuable insights into its potential strategies in other states or categories.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Prohibition Herb (Animas Herbal Wellness Center Inc) has demonstrated a notable recovery in its market position, climbing from a rank of 53 in September 2025 to 20 in November 2025. This resurgence indicates a significant improvement in sales performance, contrasting with its earlier dip. Competitors such as The Health Center and Host have shown more stable rankings, with The Health Center moving from 38 to 22 and Host from 24 to 21 over the same period. Meanwhile, Old Pal and Natty Rems have experienced fluctuations, with Old Pal dropping from 10 to 19 and Natty Rems from 8 to 18. Prohibition Herb's ability to rebound and surpass some of its competitors in November suggests a strategic adjustment that could be capitalized on for sustained growth and improved market share in the coming months.

Notable Products

In November 2025, the top-performing product for Prohibition Herb (Animas Herbal Wellness Center Inc) was Baked Alaska (Bulk) in the Flower category, securing the first rank with sales reaching 2049 units. Pink Banana (Bulk) also showed strong performance, climbing to the second position from its previous third rank in August, with a noticeable increase in sales to 1654 units. Pine Fruit (Bulk) improved its standing from fourth to third place, demonstrating consistent growth over the months. Watermelon Martini (Bulk), which was the top product in October, slipped to fourth place in November. Sangiovese (14g) entered the top five for the first time, indicating a growing interest in diverse product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.