Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

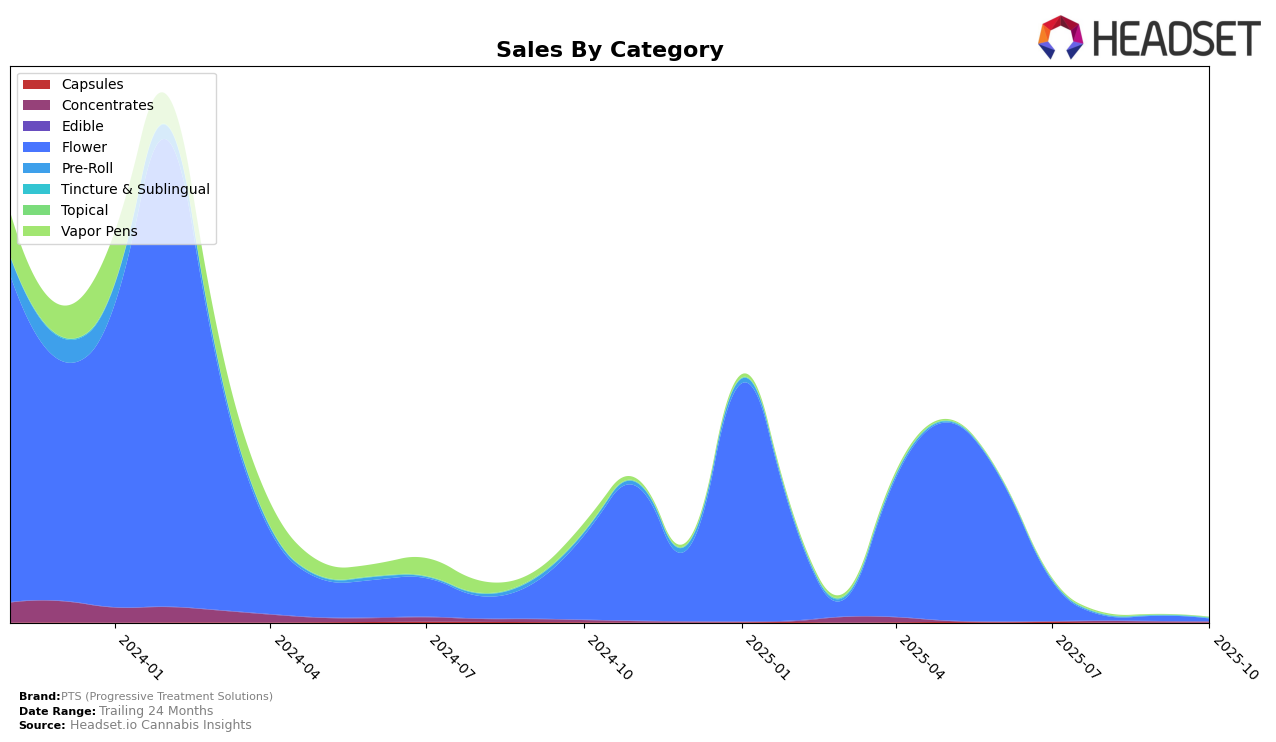

PTS (Progressive Treatment Solutions) has shown varied performance across different states and product categories. In the Arizona market, PTS did not make it into the top 30 brands in the Flower category from August to October 2025, indicating a potential area for improvement or increased competition in this segment. In July 2025, they were ranked 54th, which suggests that while they had a presence, it was not strong enough to maintain visibility in subsequent months. This decline in ranking could be due to several factors, such as increased competition or shifting consumer preferences.

In contrast, the Illinois market also saw PTS not making it into the top 30 in the Flower category from August to October 2025, similar to Arizona. In July 2025, they were ranked 69th, which was a lower starting point compared to Arizona, possibly indicating a more challenging market environment or different consumer dynamics. Despite this, the sales figures from July suggest that there is still a base level of demand for their products, which could be leveraged for future growth if strategic adjustments are made. The absence from the top 30 in consecutive months in both states calls for a closer look at market strategies and consumer engagement efforts.

Competitive Landscape

In the competitive landscape of the Arizona flower category, PTS (Progressive Treatment Solutions) has experienced fluctuating dynamics that highlight its challenges and opportunities. As of July 2025, PTS was ranked 54th, but it did not maintain a top 20 position in subsequent months, indicating a need for strategic adjustments to regain visibility and market share. In contrast, iLava showed a steady presence, improving its rank from 59th in July to 55th by October, despite a decline in sales during the summer months. Meanwhile, Hi-Klas demonstrated upward momentum, climbing from 66th in August to 58th in October, suggesting a growing consumer preference. House Exotics also showed potential with a notable rank of 52nd in September, although it did not sustain its position in the top 20 for other months. For PTS, these insights underscore the importance of strategic marketing and product differentiation to enhance its competitive edge in the Arizona flower market.

Notable Products

In October 2025, the top-performing product for PTS (Progressive Treatment Solutions) was GG4 (3.5g) in the Flower category, which climbed to the number one rank from second place in September, achieving sales of $79. Papaya x Gelato (3.5g), also in the Flower category, ranked second, having been the top product in September. Champion City Chocolate (3.5g) maintained a consistent performance, ranking third, though it has seen a decline from its peak position in July. The Antidote - Macnanna RSO Syringe (0.5g) held steady at fourth place across the last three months. Lime Light (14g) saw its ranking drop to fifth place, reflecting a decrease in sales from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.