Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

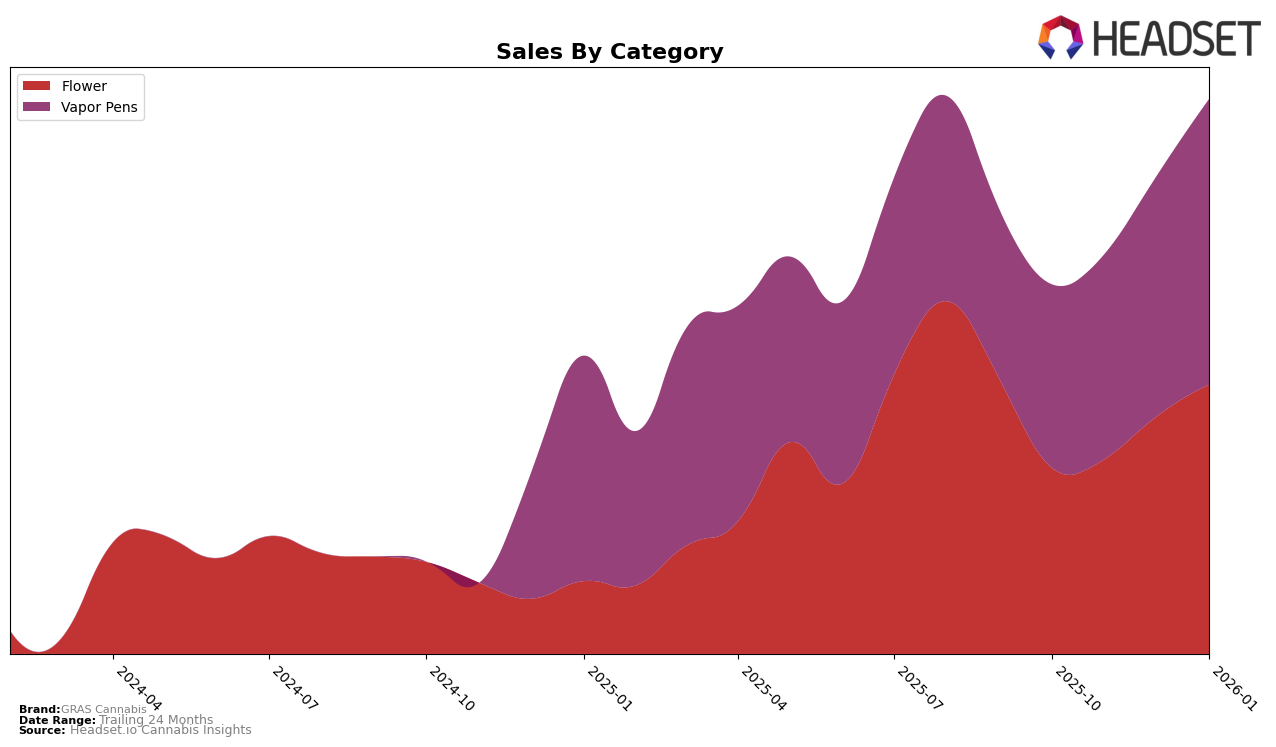

GRAS Cannabis has shown notable improvement in its performance across various categories in Arizona. In the Flower category, the brand has steadily climbed the ranks from 27th position in October 2025 to 21st by January 2026. This upward trajectory is indicative of a consistent increase in sales, with January's figures reaching $450,486. The movement suggests a strengthening presence in the Flower market, which could be attributed to strategic initiatives or product enhancements. However, the brand's absence from the top 30 in other states or provinces could indicate areas for potential growth or market entry strategies.

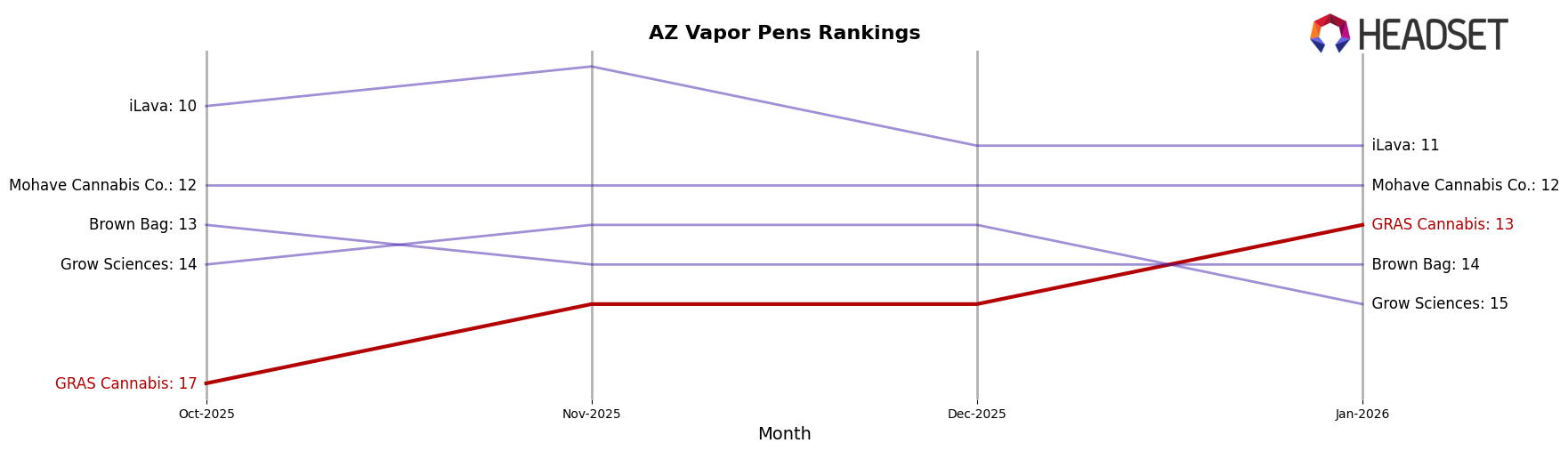

In the Vapor Pens category, GRAS Cannabis has also demonstrated positive momentum, advancing from the 17th position in October to 13th position by January in Arizona. This progression aligns with a notable increase in sales, reflecting a growing consumer preference or successful marketing tactics. Despite these gains, the brand did not appear in the top 30 rankings in other states or provinces for this category, suggesting that while they are gaining traction in Arizona, there remains untapped potential in other regions. This information could be pivotal for stakeholders looking to capitalize on emerging trends or for competitors aiming to benchmark their performance.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, GRAS Cannabis has shown a notable upward trajectory in rankings and sales over the past few months. Starting from the 17th position in October 2025, GRAS Cannabis climbed to 13th by January 2026, indicating a positive trend in market presence. This improvement is particularly significant given that competitors like iLava and Mohave Cannabis Co. have maintained relatively stable positions, with iLava consistently ranking within the top 11 and Mohave Cannabis Co. holding steady at 12th. Meanwhile, Grow Sciences and Brown Bag have experienced fluctuations, with Grow Sciences dropping to 15th in January 2026. GRAS Cannabis's sales have also seen a significant increase, closing the gap with higher-ranked brands, which suggests a growing consumer preference and effective market strategies. This momentum positions GRAS Cannabis as a rising contender in the Arizona vapor pen market, potentially challenging the established dominance of its competitors.

Notable Products

In January 2026, the top-performing product for GRAS Cannabis was Blue Widow Distillate Disposable (1g) in the Vapor Pens category, maintaining its first-place rank with impressive sales of 6808. Strawberry Mo'nana (3.5g) from the Flower category secured the second position, while Hibiscuits (3.5g) followed closely at third, both making strong entries into the rankings. The 24K Gold Punch Distillate Disposable (1g) improved its standing to fourth place, rising from fifth in December 2025. Golden Pineapple Distillate Disposable (1g) saw a slight drop, moving from fourth to fifth place. Overall, the Vapor Pens category continued to dominate, with Blue Widow Distillate Disposable consistently leading the sales charts over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.