Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

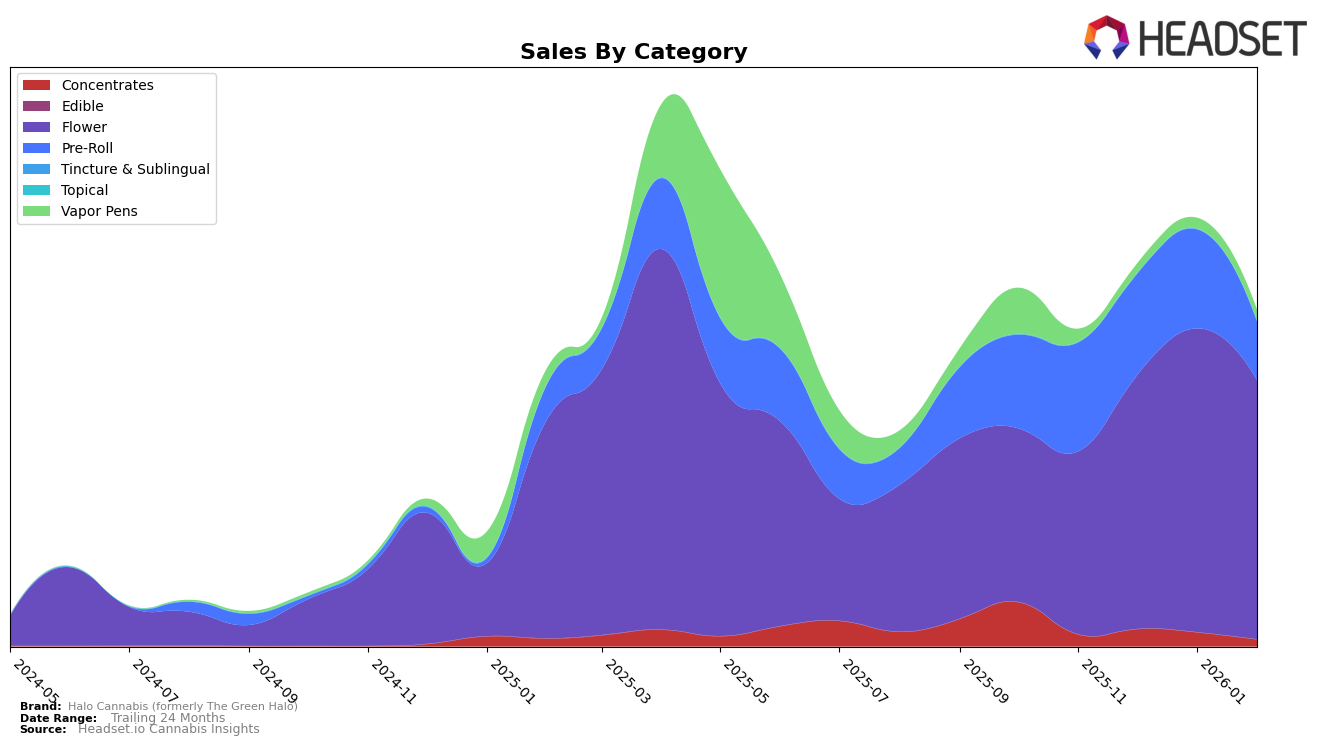

Halo Cannabis, formerly known as The Green Halo, has shown varying performance across different product categories in Arizona. In the Concentrates category, the brand's rank fluctuated around the 30s, peaking at 36th position in December 2025 but falling out of the top 30 by February 2026. This suggests a volatile presence in the Concentrates market, with a need for strategic adjustments to regain a competitive edge. Conversely, the Flower category has been a stronghold for Halo Cannabis, maintaining a consistent upward trajectory from 33rd position in November 2025 to a stable 27th position by February 2026, indicating robust consumer demand and effective market penetration.

The Pre-Roll category, however, presents a mixed picture. Halo Cannabis experienced a decline from 28th position in November 2025 to 34th by February 2026, signaling potential challenges in maintaining consumer interest or facing increased competition. In the Vapor Pens category, the brand showed some positive momentum, improving from 62nd in January 2026 to 55th in February 2026, despite not being ranked in December 2025. This upward trend could be indicative of successful marketing efforts or product innovations capturing consumer interest. Overall, while Halo Cannabis shows promising growth in certain categories, there remain areas that require targeted improvement to enhance its market position across Arizona.

Competitive Landscape

In the competitive landscape of the flower category in Arizona, Halo Cannabis (formerly The Green Halo) has shown a steady improvement in its rankings from November 2025 to February 2026, moving from 33rd to 27th place. This upward trend is indicative of a strategic shift that has positively impacted their sales, which saw a notable increase from November to January before stabilizing in February. In contrast, DTF - Downtown Flower experienced a decline, dropping out of the top 20 by December and continuing to fall to 28th place by February. Meanwhile, Roll One / R.O. has been climbing the ranks, closing in on Halo Cannabis by February. Brands like Earthgrow and FENO have maintained stronger positions within the top 20, suggesting that while Halo Cannabis is gaining momentum, it still faces significant competition from these established players. This competitive environment underscores the importance for Halo Cannabis to continue its growth trajectory to secure a more dominant position in the Arizona flower market.

Notable Products

In February 2026, the top-performing product for Halo Cannabis (formerly The Green Halo) was L.A. Baker (3.5g) in the Flower category, which climbed from fifth place in November 2025 to secure the top rank, with sales reaching 2868 units. Orange Eruption (3.5g) also made a strong debut in the Flower category, securing the second position with notable sales. OG Kush (3.5g) followed closely, ranking third in the same category. Pineapple Burst Pre-Roll (1g), previously ranked second in November 2025, dropped to fourth place. Finally, Gelato Crush Pre-Roll (1g) entered the rankings at fifth in February 2026, showing a competitive performance in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.