Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

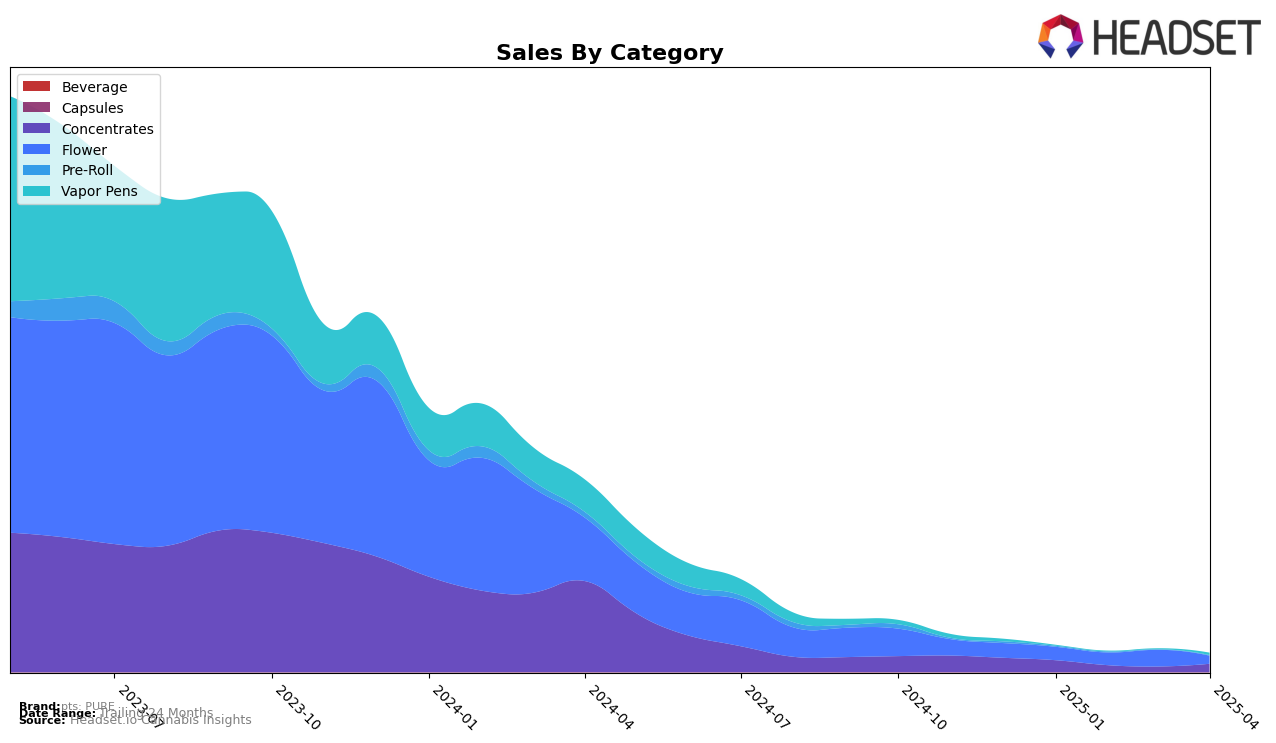

In the state of Illinois, pts: PURE has shown varied performance across different cannabis product categories. Within the concentrates category, the brand experienced notable fluctuations in its rankings over the first four months of 2025. Starting at the 25th position in January, pts: PURE saw a drop to 29th in February and even fell out of the top 30 in March, before bouncing back to 26th in April. This indicates a volatile presence in the concentrates market, with sales figures reflecting this instability; for instance, sales dropped significantly from January to February but then partially recovered by April. In contrast, the brand's presence in the vapor pens category is less prominent, as it did not appear in the top 30 rankings until April, where it entered at 75th. This suggests a weaker foothold in the vapor pens market, possibly indicating an area for potential growth or increased marketing efforts.

The flower category tells a slightly different story for pts: PURE in Illinois. The brand consistently hovered around the mid-50s in terms of rankings, starting at 55th in January and only slightly dropping to 59th by April. Despite these lower rankings, the sales figures in March indicated a peak, suggesting that while the brand isn't a top contender in terms of market position, it did experience a temporary surge in consumer demand. This peak in March could be attributed to seasonal trends, promotional efforts, or other market dynamics. Overall, while pts: PURE may not be leading the charts across these categories, its fluctuating performance highlights areas of both challenge and opportunity, particularly in stabilizing its presence in concentrates and exploring growth in vapor pens.

Competitive Landscape

In the Illinois concentrates market, pts: PURE has experienced notable fluctuations in its ranking over the first four months of 2025, reflecting a dynamic competitive landscape. Starting at 25th position in January, pts: PURE saw a dip to 29th in February and 31st in March, before rebounding to 26th in April. This recovery suggests a positive response to market conditions or strategic adjustments. In comparison, #Hash demonstrated a strong performance, climbing from 32nd in January to 17th in March, although it slightly declined to 25th in April. Meanwhile, Amber showed a downward trend, slipping from 24th in January to 29th in April. On The Rocks improved its position from 30th in January to 24th in April, indicating a steady upward trajectory. These movements highlight the competitive pressures pts: PURE faces, emphasizing the importance of strategic positioning and market adaptation to maintain and improve its standing in the Illinois concentrates category.

Notable Products

In April 2025, the top-performing product from pts: PURE is Champion City Chocolate (3.5g) in the Flower category, maintaining its consistent first-place ranking throughout the year with an impressive sales figure of 2152. The Great Ha'Tuh (3.5g), also in the Flower category, climbed to the second position from third in March, showcasing a positive trend. The Antidote - Papaya x Gelato RSO Syringe (0.5g) made its debut in the rankings at third place in the Concentrates category, indicating strong market entry. Papaya x Gelato Wax (1g) followed closely in fourth place among Concentrates, showing a slight dip from its previous position. Lastly, Champion City Chocolate Crumble Wax (1g) rounded out the top five, dropping from its previous fourth place, suggesting a shift in consumer preference within Concentrates.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.