Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

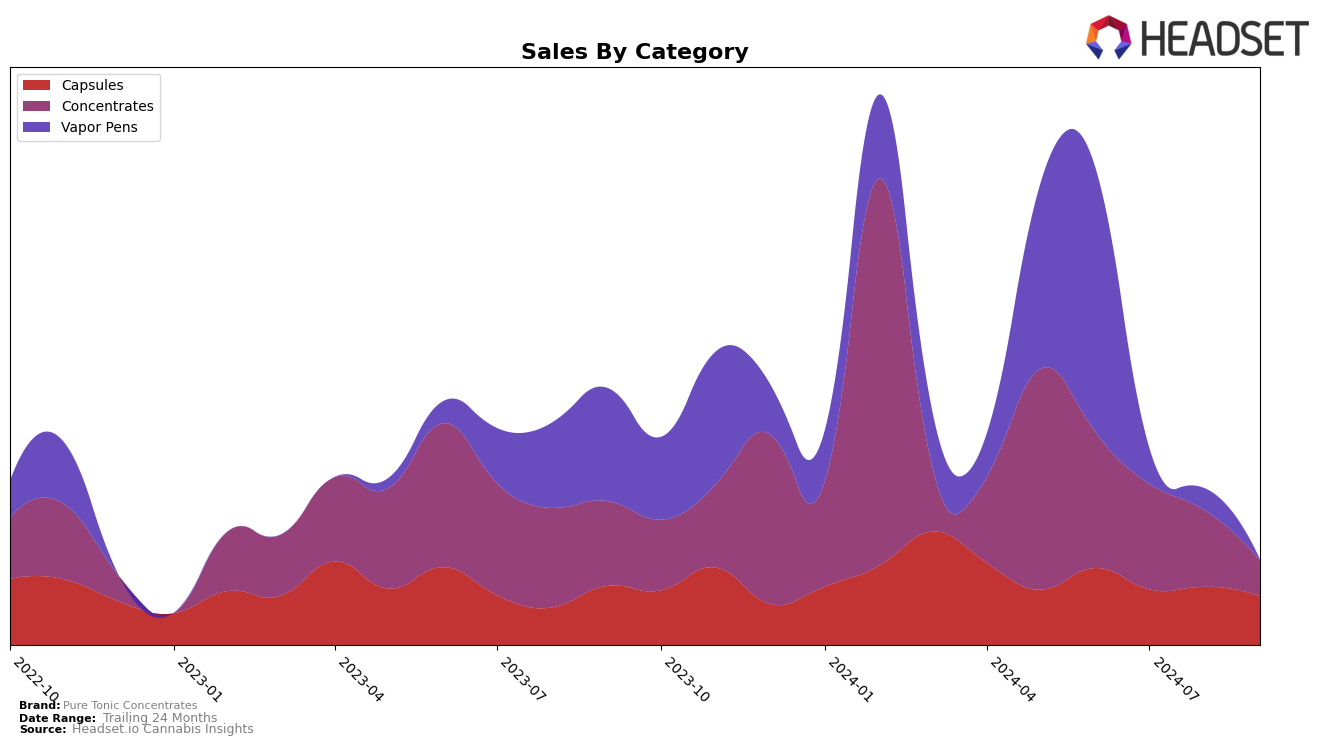

Pure Tonic Concentrates has shown varied performance across different categories and states, with some notable trends. In the state of Nevada, the brand made a significant impact in the Concentrates category in June 2024, achieving a rank of 31. However, it did not maintain this momentum in the subsequent months, as it did not appear in the top 30 rankings from July to September 2024. This absence indicates a potential decline in market presence or increased competition within the category. Such fluctuations highlight the challenges faced by brands in maintaining consistent performance in a competitive market.

In addition to Concentrates, Pure Tonic Concentrates also ventured into the Vapor Pens category in Nevada, where it was ranked 46th in June 2024. Similar to the Concentrates category, the brand did not secure a position in the top 30 in the following months. This suggests that while the brand had a presence initially, sustaining a competitive edge proved to be challenging. The lack of appearance in the top 30 rankings in both categories after June might indicate a need for strategic adjustments to enhance market penetration and brand visibility in Nevada.

Competitive Landscape

In the Nevada concentrates market, Pure Tonic Concentrates has faced significant competition, particularly from brands like Cannavative and Spiked Flamingo. Pure Tonic Concentrates did not rank in the top 20 from July to September 2024, indicating a challenging period for the brand. In contrast, Cannavative maintained a presence in the rankings, achieving a notable 21st position in August 2024. Spiked Flamingo, despite a drop to 31st in September, showed strong performance earlier in the summer, peaking at 10th in July. Meanwhile, Tsunami appeared in the rankings only in July and September, suggesting fluctuating market dynamics. The competitive landscape highlights the need for Pure Tonic Concentrates to strategize effectively to regain its footing and improve its market position amidst these dynamic shifts.

Notable Products

In September 2024, Pure Tonic Concentrates saw the CBD/THC 1:1 CanTabs Tablets 20-Pack maintain its top position in the Capsules category, with notable sales of 103 units. Indica CanTabs 20-Pack followed closely, securing the second spot, consistent with its August ranking. Sativa CanTabs 20-Pack experienced a slight drop, moving from the first position in August to third in September. Garlic Banana Sugar Wax showed stable performance, ranking fourth in Concentrates, maintaining its position from August. Cerebellum Terp Sugar made its entry into the rankings at fifth place in September, marking a new presence in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.