Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

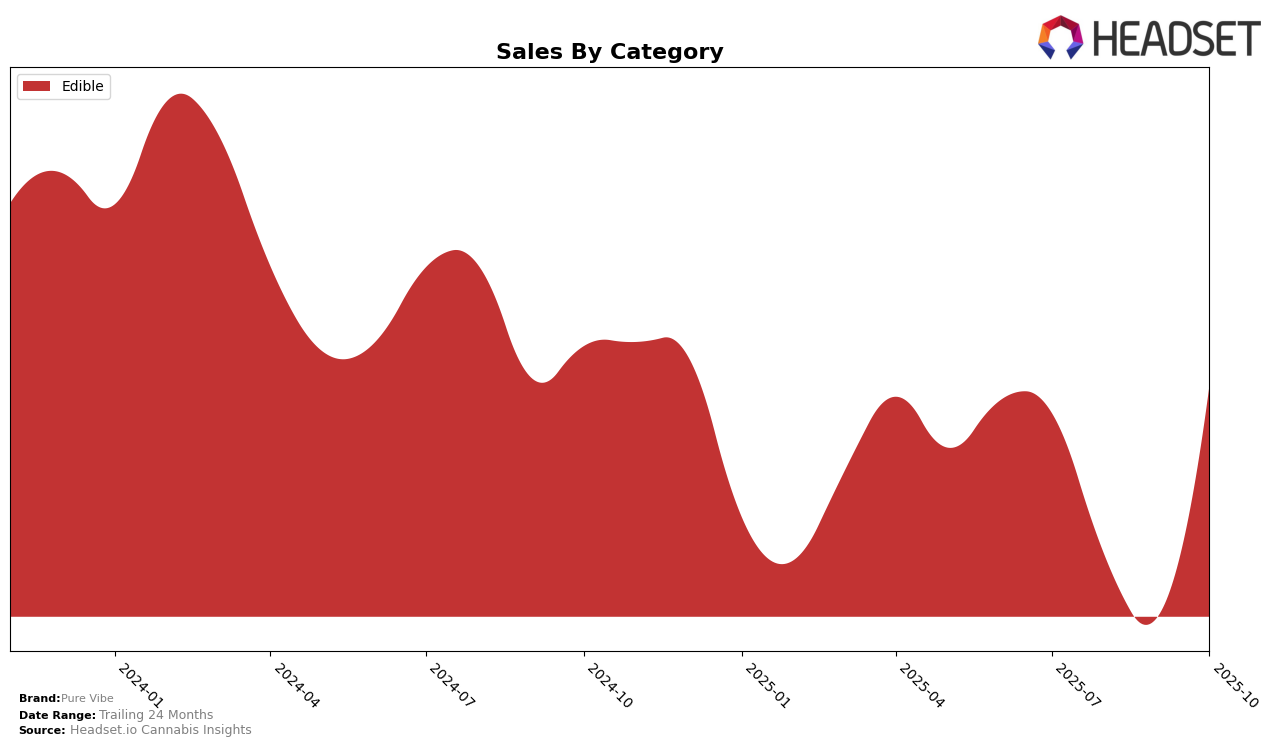

In the state of New York, Pure Vibe has shown a noteworthy performance in the Edible category over the past few months. Starting from a rank of 35 in July 2025, Pure Vibe experienced a dip in the following months, dropping to 43 in August and 44 in September. However, the brand made a significant comeback in October, climbing back into the top 30. This upward movement in October is particularly impressive given the competitive nature of the Edible category in New York. The sales trend also reflects a similar pattern, with a decline from July to September followed by a strong rebound in October, suggesting a successful strategy or product launch that month.

Despite the fluctuations in rankings, Pure Vibe's ability to re-enter the top 30 in New York's Edible category indicates resilience and potential for growth. The brand's journey through the rankings highlights the challenges faced in maintaining a strong market position, especially in a diverse and dynamic market like New York. The absence of Pure Vibe in the top rankings during August and September may have been a cause for concern, but the recovery in October demonstrates their capability to adapt and regain momentum. This could be an interesting point for further exploration to understand what factors contributed to the brand's resurgence in October.

Competitive Landscape

In the competitive landscape of the Edible category in New York, Pure Vibe has shown a notable fluctuation in its ranking over recent months, reflecting its dynamic positioning in the market. Starting from a rank of 35 in July 2025, Pure Vibe experienced a decline, reaching a low of 44 in September, before making a significant comeback to rank 30 in October. This resurgence suggests a positive trend in consumer preference or strategic adjustments by Pure Vibe that have bolstered its market position. In contrast, competitors like Kiva Chocolate and Gezoont have maintained relatively stable rankings, consistently staying within the top 30, which indicates a steady consumer base and possibly more consistent sales performance. Meanwhile, Nyce has shown an upward trajectory, improving from rank 48 in July to 32 in October, suggesting a growing market presence. Spacebuds Moonrocks has remained fairly stable, with minor fluctuations around the mid-30s rank. These insights highlight the competitive pressures and opportunities Pure Vibe faces as it seeks to enhance its market share and sales in the New York Edible market.

Notable Products

In October 2025, Pure Vibe's top-performing product was Rainbow Pack Gummies 10-Pack (100mg) in the Edible category, which climbed to the number one spot with impressive sales of 942 units. Chill'n Blue Raspberry Gummies 10-Pack (100mg), which had consistently held the top rank in previous months, fell to second place. Magic Mango Gummies 10-Pack (100mg) showed a significant rise, securing the third position from fourth in September. Cherry Mango Bliss Gummies 10-Pack (100mg) maintained a steady performance, ranking fourth. Cherry Rush Gummies 10-Pack (100mg) continued to hold the fifth spot, consistent with its September ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.