Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

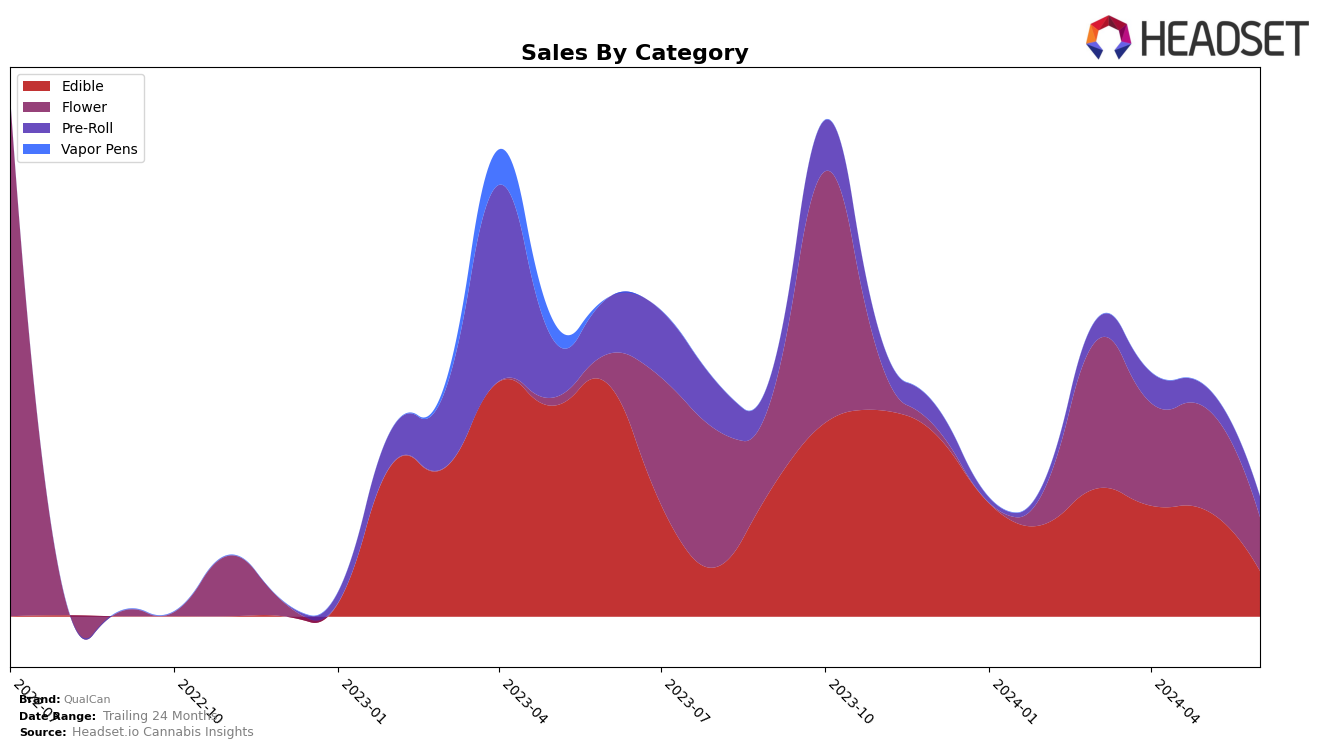

QualCan's performance in the Nevada market has shown a mixed trend across different product categories. In the Edible category, QualCan has maintained a presence in the top 30 brands, although its ranking has seen a gradual decline from March to June 2024, moving from 25th to 30th position. This downward trend is mirrored in their sales figures, which have decreased significantly over the same period. The drop in sales from March to June suggests that while QualCan is still a recognizable name in the Edible category, it is facing stiff competition and possibly losing market share to other brands.

Turning to the Flower category in Nevada, QualCan's performance appears more volatile. The brand did not make it into the top 30 rankings consistently, with its position fluctuating and eventually dropping out of the top 90 by June 2024. This inconsistency in ranking is accompanied by a notable decline in sales figures, which more than halved from March to June. Such a pattern indicates challenges in maintaining a stable foothold in the Flower category, possibly due to market dynamics or shifts in consumer preferences. These insights highlight the need for QualCan to reassess its strategies to improve its standing and performance in these competitive segments.

Competitive Landscape

In the competitive landscape of the Nevada Flower category, QualCan has experienced notable fluctuations in its rank and sales over recent months. QualCan's rank dipped from 88th in March 2024 to 99th in June 2024, indicating a downward trend. In contrast, Roots showed a more stable performance, with ranks varying between 91st and 97th, except for May 2024 when it was not in the top 20. Dadirri also displayed a consistent, albeit lower, ranking, fluctuating between 96th and 100th. Meanwhile, Sauced demonstrated a stronger performance, maintaining a rank between 84th and 93rd. Notably, Black Label Brand entered the top 20 in May 2024 at 81st, suggesting a significant rise. These shifts highlight the competitive pressures on QualCan, emphasizing the need for strategic adjustments to regain market share and improve sales performance in the Nevada Flower category.

Notable Products

In June 2024, the top-performing product for QualCan was Rice Crispy Bites (100mg) in the Edible category, maintaining its consistent high ranking from previous months and securing the number one spot with sales of 217 units. Don Mega Pre-Roll (1g) in the Pre-Roll category rose to the second position, showing an increase from its fourth-place ranking in April 2024. Don Mega (3.5g) in the Flower category remained steady at third place since May 2024. Honey Sticks 10-Pack (100mg) also held its position at fourth place for two consecutive months. Peanut Butter Cookies (100mg), another product in the Edible category, entered the rankings for the first time in June 2024 at fifth place with notable initial sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.