Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

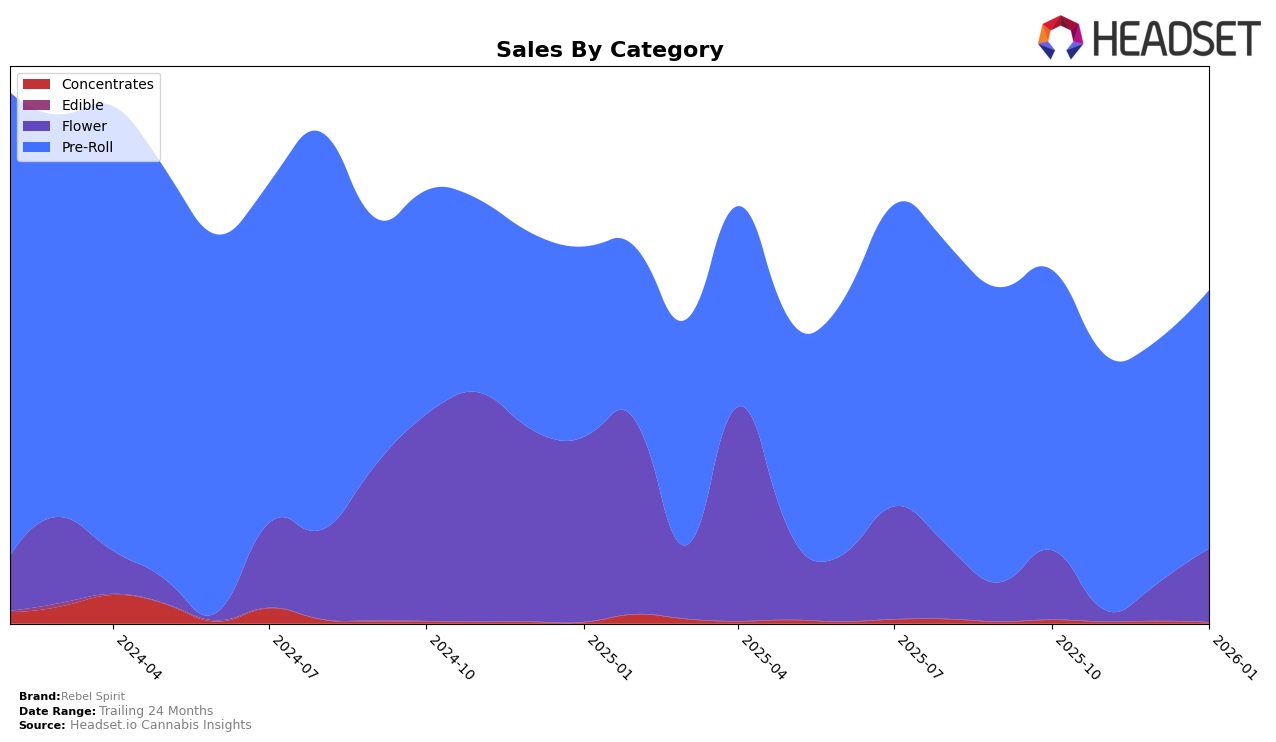

Rebel Spirit has shown a consistent presence in the Oregon market, particularly in the Pre-Roll category. Over the four-month period from October 2025 to January 2026, the brand maintained its position within the top 30, with rankings fluctuating slightly. Starting at 20th place in October, Rebel Spirit experienced a minor dip to 23rd in December but rebounded to 19th by January. This indicates a resilient performance despite the competitive nature of the market. The sales figures reflect this trend, with a noticeable dip in November, but a recovery by January, suggesting effective strategies to regain market share.

The absence of Rebel Spirit from the top 30 in other states and categories highlights both opportunities and challenges. While their presence in Oregon is commendable, expanding their reach to other states could be beneficial for growth. The brand's ability to maintain a steady position within the Oregon Pre-Roll category suggests a strong local customer base and effective product offerings. However, the lack of representation in other regions underscores the need for strategic expansion and diversification. This focused presence in Oregon could serve as a foundation for broader market penetration if leveraged effectively.

Competitive Landscape

In the Oregon Pre-Roll category, Rebel Spirit experienced a dynamic shift in its competitive positioning from October 2025 to January 2026. Initially ranked 20th in October, Rebel Spirit maintained its position in November but slipped to 23rd in December before rebounding to 19th in January. This fluctuation in rank reflects a competitive landscape where brands like Feel Goods consistently performed well, maintaining a rank between 16th and 19th, and Drewby Doobie / Epic Flower showed strong upward momentum, climbing from 24th in October to 17th by December and maintaining that position in January. Meanwhile, Grown Rogue demonstrated a steady improvement, moving from outside the top 20 to 20th by January. Despite the competitive pressure, Rebel Spirit's sales in January 2026 showed a positive trend, surpassing its December figures, indicating resilience and potential for growth in a highly competitive market.

Notable Products

In January 2026, Rebel Spirit's top-performing product was Rebel Pre-Roll 10-Pack (5g) in the Pre-Roll category, maintaining its number one rank consistently since October 2025 with sales of 2727 units. The Apples & Bananas x Lemonicious Pre-Roll 10-Pack (5g) emerged as the second-best selling product, a newcomer to the rankings. Light Speed x Sapphire Blush Pre-Roll 10-Pack (5g) secured the third position, also debuting in the top ranks for January. The Apples & Bananas (3.5g) in the Flower category held steady at fourth place since December 2025. White Hybrid Pre-Roll 12-Pack (8.4g) rounded out the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.