Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

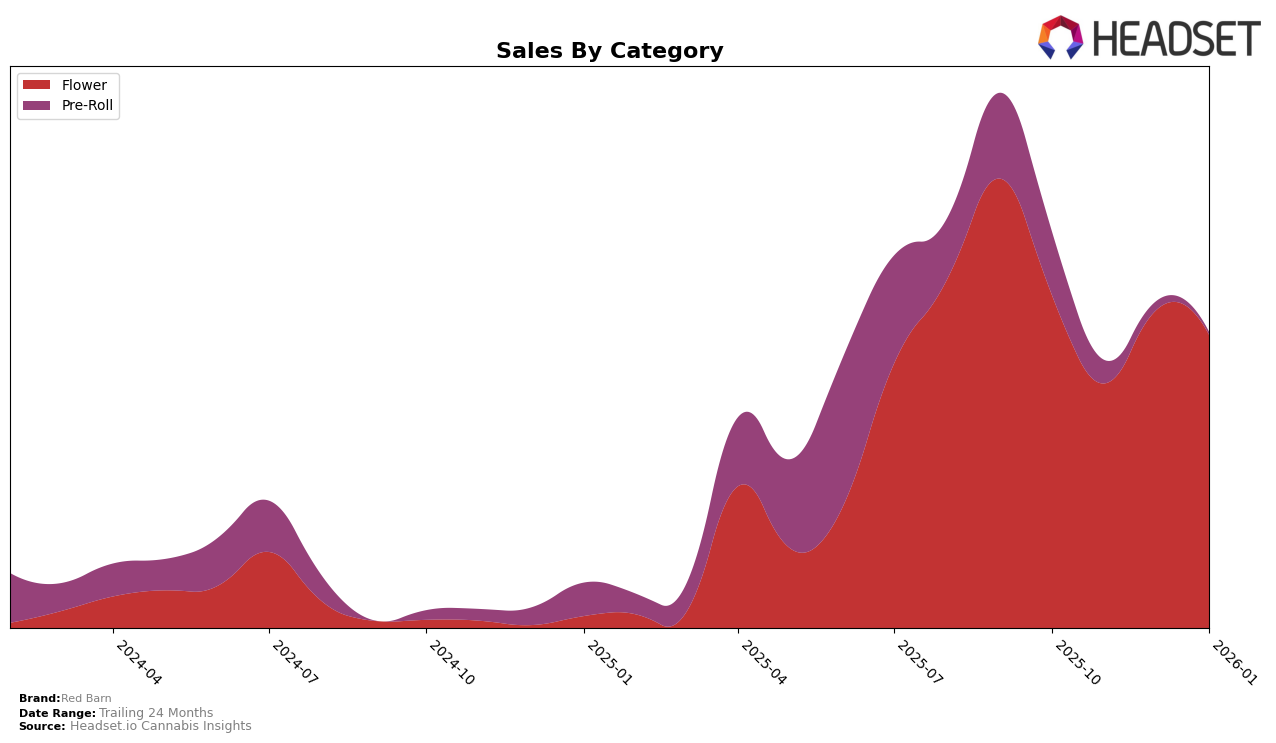

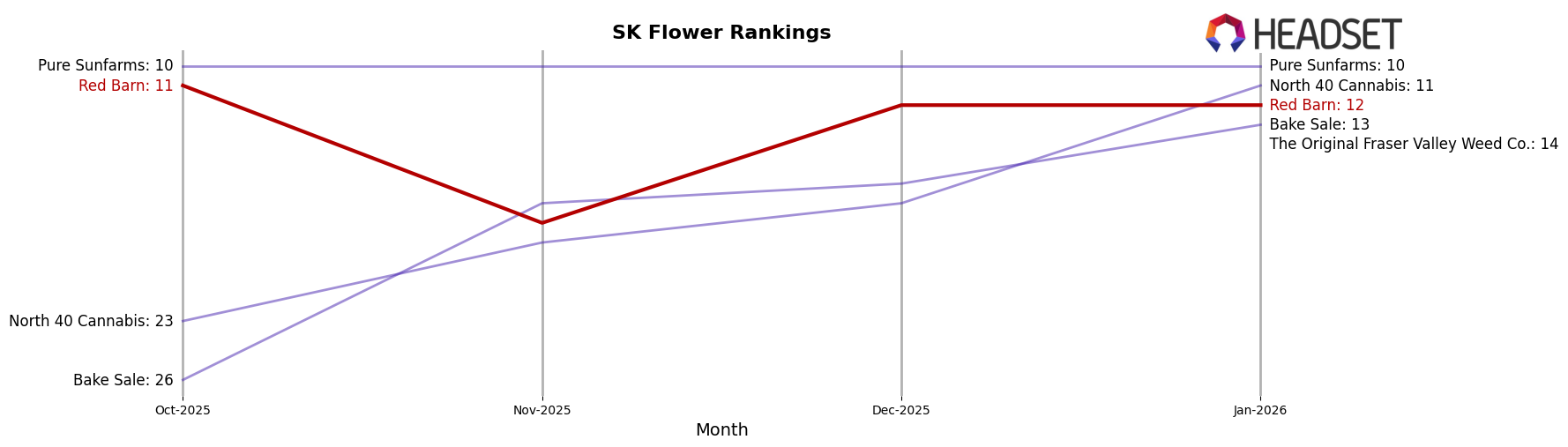

Red Barn's performance in the Saskatchewan market shows varied results across different product categories. In the Flower category, Red Barn maintained a relatively stable position, ranking 11th in October 2025, dipping to 18th in November, and then recovering to 12th in both December 2025 and January 2026. This fluctuation suggests a resilient market presence despite some volatility. Notably, the sales figures highlight a significant drop in November, which could indicate seasonal factors or increased competition. The consistency in rankings at the end of the year and the start of the next year might suggest a stabilization or strategic adjustment by the brand.

In contrast, Red Barn's standing in the Pre-Roll category in Saskatchewan paints a different picture. The brand was ranked 35th in October 2025 and fell to 66th in November, after which it did not make it into the top 30 rankings in December or January. This decline could be seen as a challenge for Red Barn, indicating potential issues in market penetration or consumer preference in this category. The absence from the top 30 in subsequent months may point to either a strategic shift away from Pre-Rolls or a need for a stronger market strategy to regain its position. This contrast between categories underscores the importance of targeted strategies for different product lines within the same market.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, Red Barn experienced notable fluctuations in its rankings from October 2025 to January 2026. Initially ranked 11th in October, Red Barn saw a dip to 18th in November before recovering to 12th in December and maintaining that position in January. This volatility contrasts with the consistent performance of Pure Sunfarms, which held steady at the 10th rank throughout the same period. Meanwhile, North 40 Cannabis and Bake Sale showed upward momentum, with North 40 Cannabis climbing from 23rd to 11th and Bake Sale improving from 26th to 13th. The entry of The Original Fraser Valley Weed Co. into the rankings in January at 14th further intensified competition. These dynamics suggest that while Red Barn has maintained a competitive position, it faces increasing pressure from both established and emerging brands, indicating a need for strategic adjustments to sustain and improve its market share.

Notable Products

In January 2026, Strawberry Sour Diesel (3.5g) emerged as the top-performing product for Red Barn, ascending to the first rank with notable sales of 476 units. 91 Royale Diesel (3.5g) followed closely in second place, maintaining a consistent presence in the top three since October 2025. Cream Of The Cosmos (3.5g) dropped to third place after leading in December 2025, indicating a shift in consumer preference. The newly ranked Strawberry Sour Diesel (7g) made its debut at fourth place, showcasing its growing popularity. MK Kush (28g) secured the fifth spot, rounding out the top-performing products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.