Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

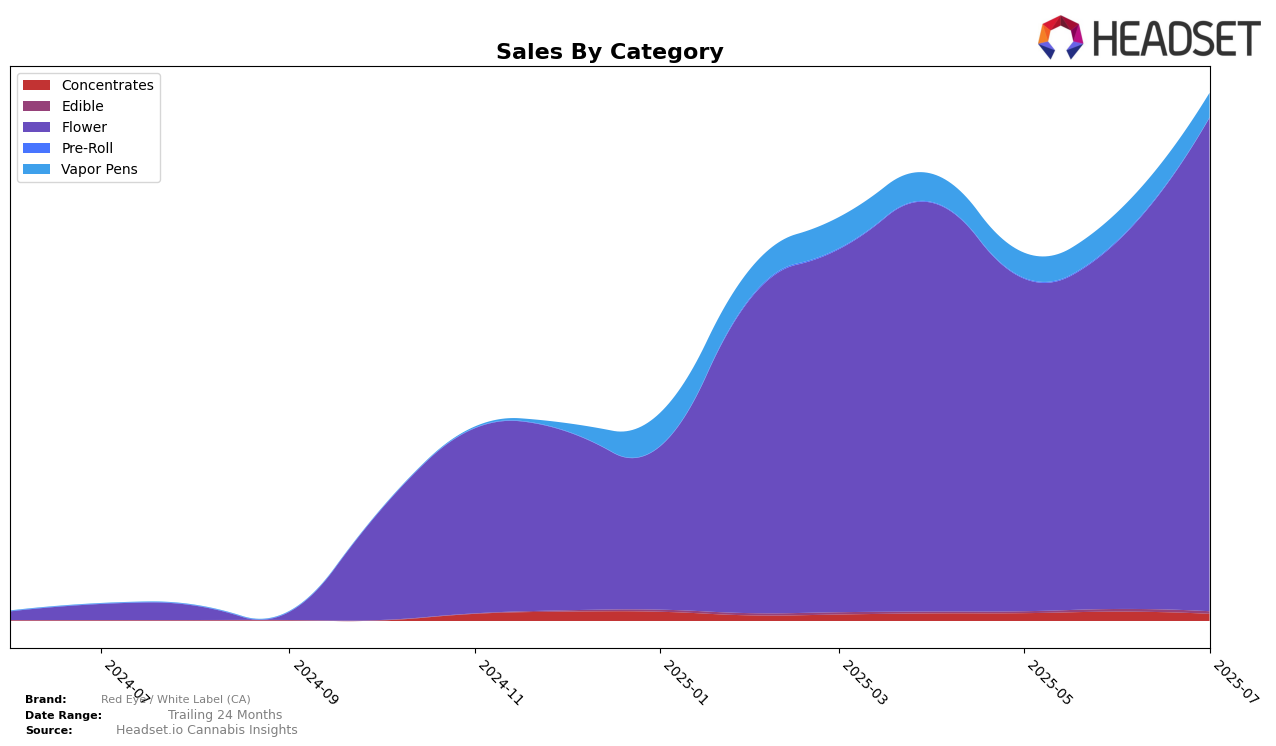

Red Eye / White Label (CA) has shown notable fluctuations in its performance across various categories and states. In California, the brand has demonstrated a significant upward trend in the Flower category. Starting from a rank of 38 in April 2025, it experienced a dip in May, moving to the 50th position. However, the brand rebounded strongly in the following months, climbing to the 28th position by July. This recovery is underscored by a substantial increase in sales, which peaked in July, indicating a successful strategic adjustment or market response. The absence from the top 30 in May highlights a challenging period, but the subsequent improvement suggests resilience and effective brand management.

While the Flower category in California has seen a positive trajectory, it's important to note that Red Eye / White Label (CA) did not make it to the top 30 rankings in other states or categories during this period. This could suggest a focus or specialization in the California Flower market, or potentially untapped opportunities in other regions and categories. The brand's ability to capitalize on its strengths in California might serve as a blueprint for expansion strategies elsewhere. Observing these patterns can provide valuable insights into the brand's operational focus and market penetration strategies, indicating areas of success and potential growth opportunities.

Competitive Landscape

In the competitive landscape of the California flower category, Red Eye / White Label (CA) has demonstrated notable fluctuations in its market position from April to July 2025. Initially ranked 38th in April, the brand experienced a dip to 50th in May, indicating a potential challenge in maintaining consistent consumer interest or market penetration. However, by July, Red Eye / White Label (CA) rebounded significantly to 28th place, suggesting a successful strategic adjustment or marketing initiative that resonated with consumers. In contrast, competitors like Jungle Boys saw a decline from 16th to 27th place over the same period, possibly due to a decrease in sales momentum. Meanwhile, Maven Genetics maintained a relatively stable position, hovering around the mid-20s, which might indicate a steady consumer base. The upward trajectory of Red Eye / White Label (CA) in July positions it favorably against brands like 3C Farms / Craft Cannabis Cultivation and Team Elite Genetics, both of which showed less dramatic changes in rank, highlighting Red Eye / White Label (CA)'s potential for growth and increased market share in the coming months.

Notable Products

In July 2025, Red Eye / White Label (CA) saw Jokerz (28g) leading the sales as the top-performing product with notable sales of 2878 units. Following closely, Blue Cheese (28g) secured the second position, while Tropicana Cookies (3.5g) maintained a strong presence in third place. Jokerz (3.5g) and Gelato 33 (3.5g) rounded out the top five, ranking fourth and fifth, respectively. This marks a significant rise for Jokerz (28g) and Blue Cheese (28g) as they were not in the top five in previous months, suggesting a strong increase in popularity. Tropicana Cookies (3.5g) and Jokerz (3.5g) also improved their rankings, indicating growing consumer preference for these products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.